How to calculate returns from a SIP (Systematic Investment Plan)

Post on: 12 Август, 2015 No Comment

by Manshu on May 15, 2011

About a week ago I exchanged comments with a reader who was comparing returns from a lump-sum investment in a mutual fund with a SIP (Systematic Investment Plan) in the same fund.

Basically, seeing whether Rs. 36,000 invested 3 years ago, amounted to higher or lower than Rs. 1,000 invested every month for 3 years in the same fund.

This is not an accurate way of comparing the two returns because in one case you have this massive capital that compounds for you for 3 years, whereas in the second case, you just have Rs. 1,000 that gets invested for the whole 3 years.

In my opinion, this is like comparing a fixed deposit to a recurring deposit. If you invest Rs. 36,000 in a fixed deposit for 3 years at 10% then at the end of 3 years you will get an amount of Rs. 47,916.

However, Â a recurring deposit for Rs. 1,000 for 3 years at 10% will only give you Rs. 41,841.

Use IRR to calculate returns from a SIP

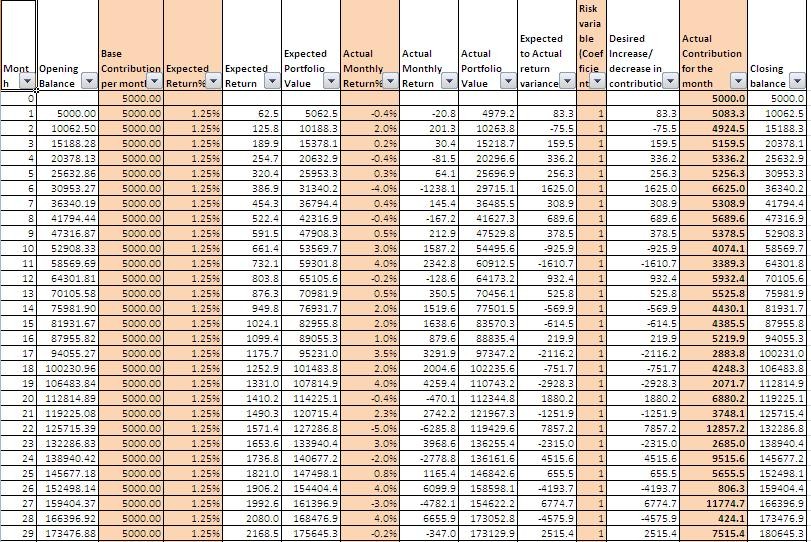

Since returns from a SIP involve outflow of cash at different time periods, and then a large inflow of cash at the end you can use IRR to calculate the returns percentage from a SIP.

I have a very detailed post on IRR. so you can read that post to understand the intricacies of IRR, and then come back to read the rest of this post.

How to calculate returns from a SIP?

Lets say I made a SIP in Canara Robeco which features as one of the funds in my post on the best balanced mutual funds .

Suppose I invested Rs. 1,000 every month for the last 3 years  Moneysights has this calculator that shows me that this investment resulted in Rs. 47,927.79.

I use Excel and type in -1,000 in 36 rows followed by 47,927.79. Then I select this range and use the IRR formula to find the IRR value which I have to multiply by 12 to annualize this number.

This value comes out to be 17.93%.

To cross check this number I go back to the recurring deposit calculator and enter Rs. 1,000 per month enter the interest rate of 17.93% compounded monthly to get a value of Rs. 47,930.

This confirms that my calculation is accurate.

Just for reference Rs. 36,000 invested in this fund 3 years ago will give you Rs. 48,171.60 today.

This is very close in absolute terms, but if you look at the CAGR then this fund only returned 10.19%.

As a side note Ive seen several websites use these type of calculations to tout the benefit of SIP, but they fail to mention that theyre working with the benefit of hindsight.

In general, Id say SIPs will work better than lump-sum investment for most people but this is not the way to prove it.

Conclusion

Let me conclude by saying that this is a post about what I feel is the right way to calculate returns from a SIP, and not that a SIP is always better than a lump sum investment. Thats a whole different discussion altogether, and it simply happened that the fund and time period I chose returned a higher rate of return by the SIP mode than the lump sum mode.