How to Calculate Return on Equity (ROE) (4 Steps)

Post on: 16 Март, 2015 No Comment

Instructions

Locate the Balance Sheet or Statement of Shareholders’ Equity. After you have done so, identify the common shareholders’ equity for the current year (lets call it CSE1) and the common shareholders’ equity for the previous year (CSE2).

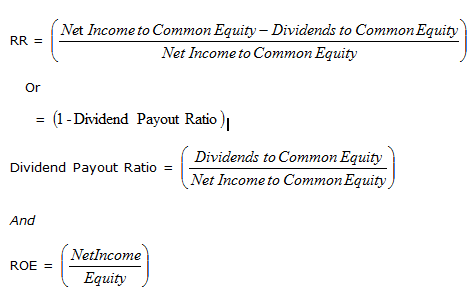

Locate the net income (NI) for the year in which you want to calculate ROE. This can be found near the bottom of the income statement for the most recent year.

Tips & Warnings

More Like This

How to Calculate Return on Equity

How to Calculate Return on Assets

How to Calculate Return on Equity

You May Also Like

Return on Equity is a measure of how much money a company is earning in regards to the amount of equity its.

ROE stands for return on equity ratio and is sometimes called the return on net worth ratio. To calculate the ROE, divide.

Investors can use return on equity (ROE) to help calculate the weighted average cost of capital (WACC) of a company. WACC shows.

The rate of return on tangible equity measures how well a company is producing profit with the equity invested in the company.

ROE stands for return on equity, which measures your gains or losses as a portion of your total portfolio. When calculating the.

Return on equity shows how much income can be distributed to the total shareholders' equity. Shareholders' equity is the amount of ownership.

A required return on equity is a figure used by financial analysts to determine whether or not a firm is using its.

A company's balance sheet reflects its financial position for a specific accounting period and itemizes its assets and liabilities, as well as.

Comments You May Also Like. How to Calculate Return on Equity (ROE) When analyzing a stock, one of the key measures of.

Return on equity is calculated by taking the net income and dividing it by the shareholder's equity, or the total amount of.

The return on equity ratio is a common formula used by many investors of the stock market. This formula represents a company's.

Traditional balance sheets equate assets with liabilities plus owner's equity. Owner's equity applies to businesses that operate as sole proprietorship or.

Return on Equity (ROE) is a calculation that determines the profitability of a company based on return of revenue. Used as a.

Return on equity, or ROE, is one of the most important financial metrics to consider when evaluating a business for possible investment.

These ratios rely on information that is found in a company's financial statements. How to Calculate Return on Equity (ROE) When.