How to Buy a Target Date Fund

Post on: 16 Март, 2015 No Comment

Investors come in all sorts of shapes, sizes and disciplines. We have different goals and aspirations. We also have unique forms of human capital. Human capital is often expressed as being similar to a bond. Upon retirement, the moment we stop working, the bond is hypothetically paid. Target date funds (TDFs), a mutual fund that lumps similarly aged cohorts into an age-based investment do not, or better cannot account for that uniqueness, the difference between our human capital. So how do you buy a TDF suited to your interests, goals, and age?

What are target date funds?

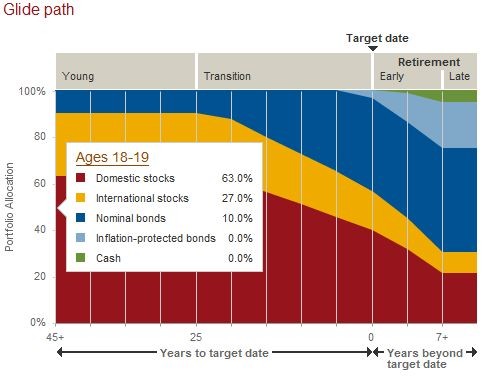

Most investors will encounter their first target date fund through auto-enrollment into their new company’s 401(k) plan. If for example, you are 25 years old, the target date fund you will be automatically enrolled in will reflect a retirement age forty years in the future. Make no mistake, these are actively managed mutual funds, comprised of other types of mutual funds that are professionally managed with a single goal: invest aggressively (with a large percentage of equities) in the earliest years of ownership moving gradually to more conservative approach (with a larger percentage in fixed income investments) as we approach the target.

What’s wrong with that plan?

The plan, at least on paper seems prudent. We generally do a poor job with asset allocation, the manual adjustment of your risk over time. Investors in these types of retirement plans may not invest at all without auto-enrollment and because of the fiduciary responsibility of the plan provider (your company), target date funds were a good place to get you started on your journey. The problem rests in our different human capital contributions. Someone at the lowest level of the company will be much more dependent on the income this fund promises to provide in retirement than someone working in the upper tiers of the company.

How do you know which TDF will help your situation?

This is a behavioral concern. Workers with different trajectories but of the same age will have the same fund available in most of these plans. These differences cannot be split with a single fund. The lower tier worker will obviously need every cent they save in order to not outlive their money.An upper teir worker may have numerous other investments to hedge the probelm of having enough in retirement.

Are earnings (human capital) the only consideration?

Not at all. Even high level workers can succumb to job changes, health issues and even changes in risk tolerance. Some have suggested that TDFs be redesigned to accommodate these worker differences and abandon an homogenized approach that may not suit these differences. Some others have suggested that TDFs change their approach completely, adjusting for risks in the marketplace over time instead of simply moving gradually from one type of investment to another. Suppose bonds were at risk due to economic changes. An investor might find their investment involved in securities like these at higher-than-assumed risk so close to retirement.