How To Build A Low Cost ETF Portfolio

Post on: 21 Октябрь, 2015 No Comment

The quest for ETF providers to offer the lowest fees and total expenses is without a doubt beneficial for index investors. Generally this involves dropping the expense ratios on competing ETFs to rock bottom levels in order to attract assets and attention to their funds.

On another front, Vanguard recently announced that they will be doing a reverse 2:1 share split on their widely held Vanguard S&P 500 ETF (NYSEARCA:VOO ). This will essentially double the price of the fund on October 24th from its current level of $77 per share. The reason cited was to lower transaction costs for investors buying and selling VOO.

So what does this share split mean to you, the retail investor?

Virtually nothing. VOO is already a very heavily traded ETF with a tight bid/ask spread and economical expense ratio of just 0.05% annually. This change will likely only benefit institutional investors who are trading thousands of shares and millions of dollars daily. In addition, it will bring the price of VOO closer in line with its competitors in the SPDR S&P 500 ETF (NYSEARCA:SPY ) and the iShares S&P 500 ETF (NYSEARCA:IVV ) which both have slightly higher net expense ratios.

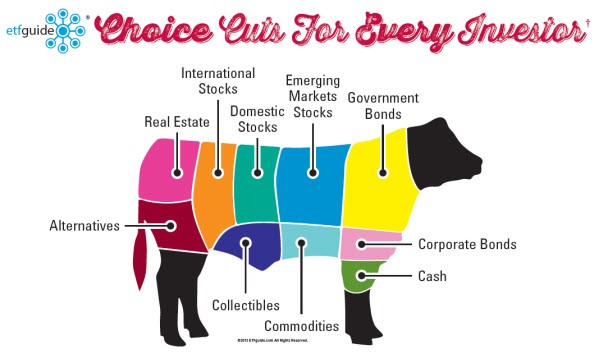

For the majority of investors, these are the most important characteristics to consider when constructing a low cost ETF portfolio.

1. Expense Ratio — ETF expenses can vary widely between competing providers and often times doing a little bit of homework can save you a boatload of money. One example of a significant fee disparity for a comparable ETF is the iShares Dow Jones US Real Estate ETF (NYSEARCA:IYR ) vs. the Vanguard REIT ETF (NYSEARCA:VNQ ). While the underlying holdings are quite similar, VNQ has the advantage of a miniscule 0.10% expense ratio as compared to 0.46% for IYR. Vanguard and Charles Schwab are leading the pack with the lowest cost ETFs in the industry.

2. Trading Fees — More and more brokerage companies are offering access to commission free ETF trades which can be a significant advantage in your total investment expenses. This is especially true for smaller accounts, where a trading fee as low as $8 to buy or sell can be cost prohibitive. Another advantage for commission free ETFs is that you can trade as often as you like and in whatever quantity you desire. This will allow you to scale in and out of positions with multiple orders or set stop losses and not worry about the impact of trading costs on smaller sized holdings.

3. Liquidity — I consider liquidity to be a stealth cost on an investment portfolio because it is easy to overlook. Often times ETFs that are thinly traded or have underlying holdings with low volume are at risk for scalping your hard earned money. This can occur when the bid/ask spread widens to abnormal levels or the market maker takes advantage of a drought in liquidity.

One way to avoid getting a bad fill on entering or exiting an ETF is to use limit orders to ensure that your trades are executed at the price that you desire. If your trade is not filled at a reasonable price, then you can adjust your limit order or walk away knowing that you dodged a bullet.

The Final Word

By analyzing these factors and comparing ETF products, you will be better equipped to find the lowest cost investments to access the sector or asset class that you desire. Index Universe has an excellent tool that allows you to screen ETFs in a specific category and then compare some of these important attributes.

However, remember that fees aren’t everything. Often times you will only have one or two ETF choices for a particular segment of the market that you want to get exposure too. An example of a unique fund with no competition in its asset class is the MarketVectors Gaming ETF (NYSEARCA:BJK ) which has gained over 30% so far this year. In that case, it may be more important to set fees aside and forge ahead with an opportunity or dislocation in the market that will give you the best chance for big gains.

Disclosure: I am long IYR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: David Fabian, Fabian Capital Management, and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.