How The Retail Investor Profits From High Frequency Trading

Post on: 21 Май, 2015 No Comment

Are most of us prejudiced about High Frequency Trading (HFT)? Perhaps the answer is yes, and it’s not without reason. It was the Flash Crash that took place in May 2010 in the U.S. equity markets which brought HFT under the microscope.

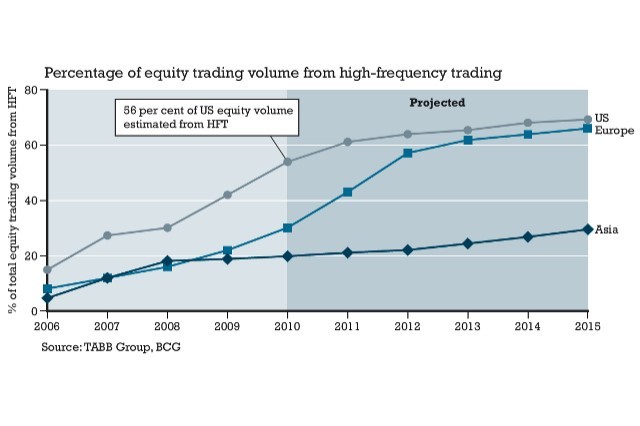

HFT continues to be a controversial issue, with some event or other making it resurface in the news, and often in an unflattering way. But the fact is that HFT is not a new thing in the stock markets and has been around for a decade. In fact, there is a very high likelihood that your investments involve HFT in some way, whether you know it or not. HFT is popular with traditional market making firms, propriety firms, professional traders which include investment banks and funds.

The Securities and Exchanges Commission (SEC ) has no formal definition of HFT but attributes it with certain features listed below:

- Use of extraordinarily high speed and sophisticated programs for generating, routing, and executing orders.

- Use of co-location services and individual data feeds offered by exchanges and others to minimize network and other latencies.

- Very short time-frames for establishing and liquidating positions.

- Submission of numerous orders that are canceled shortly after submission.

- Ending the trading day in as close to a flat position as possible (that is, not carrying significant, un-hedged positions overnight). (See: You’d Better Know Your High-Frequency Trading Terminology )

What does HFT do? Does it strengthen the market or rig it against the individual investor? The answer here is both. Let’s first explore the positive effects HFT has on the stock market.

- There is increase in liquidity in the markets as the HFT traders typically enter a high number of trades. This results in enhanced order flow and hence greater liquidity.

- The bid-ask spread tends to narrow down with HFT. This is because HFT uses algorithms and advanced computers which are capable of updating the stock prices more frequently and accurately. This further helps to reduce the trading costs.

- HFT supports the idea of market efficiency where the prices quickly and accurately reflect all relevant and available market information. Prices are updated at a much smaller interval with HFT, which further helps in execution of trade.

HFT has done some good but a lot of damage as well. leaving less room for some people to acknowledge the positives. Stock markets are supposed to be fair and a level playing ground, which HFT arguably disrupts. It creates discrimination by the use of technology which can be used for abusive ultra-short term strategies. HFT preys on any imbalance between demand-supply, using arbitrage and speed to its advantage. The moves by high frequency traders are not based on fundamental research about the company or its growth prospects but on “opportunities” to strike. Though HFT doesn’t target anyone in particular, they cause collateral damage to retail as well as institutional investors. Thus, HFT is an irritant even for institutional investors like mutual funds who buy and sell in bulk and not just individual investors. (See Investopedia’s exciting piece on How IEX is Combating Certain Types of High-Frequency Traders .)

High Frequency Trading v/s Retail Investors

Having posited that HFT is more bad than good, is there a solution? The ideal situation would be for the market regulators to restrict abusive trading while retaining the positives it has on the stock market — this seems to be an impossible task. So how can retail investors beat the complex system behind HFT? It’s difficult to stay ahead of them but few simple tips can help you sail through.

- Don’t play the same game as they do. It’s difficult for speculators and day traders to race ahead of these ultra-fast servers and connections that the high frequency traders use. Don’t cause self inflicted injury.

- The strategy of buy and hold works well here, by not indulging in frequent trades; this way, you give high frequency traders less opportunity to jump in front of your orders and make money from you.

- It’s advisable to buy funds that have a smaller portfolio turnover ratio. An average large-cap mutual fund has a turnover ratio of around 60%; in such a scenario if you opt for a fund with a lower turnover; it will limit the HFT impact on your portfolio (like Vanguard 500 Index Fund (VFINX ) with a turnover rate of just 3.4%).

- HFT’s impact on the portfolios of long term investors is argued to be inconsequential. Investing for a long time frame helps to reap the benefits of long term investing. Buy fundamentally strong stocks aiming at capital appreciation.

- The high frequency traders do not target all stocks. Low price and high volume make a stock apt for HFT. This is because of the fact that rebates are done on a per-share basis rather than a percentage-of-price basis, making low prices more profitable for HFT. Citigroup (C ) been the favorite of high frequency traders in the past. Retail investors can avoid stocks with these features and stay somewhat shielded from HFT. (See: Top Stocks High-Frequency Traders (HFTs) Pick )

- If you are an alert investor, sudden dips caused by HFT can be an opportunity to pick more shares to sell later once the prices are restored and move higher.

HFT has been around for many years now, jumping the queue to grab a bite from others’ orders. There are mixed views about HFT and the debate about it is likely to continue in the absence of concrete steps taken by the market regulators. With the right regulations in place there could be more transparency and less volatility. HFT affects short-term investors along with professional traders the most. For investors, who indulge in low-frequency trades, the worries are much diminished. As an individual investor, rather than waiting for the regulators to bring about radical changes with regards to HFT, just try and make the best of the mess.

Disclosure: The author did not hold shares in any of the companies mentioned at the time of writing.