How the IMF Growth Forecast Impacts Investors

Post on: 30 Май, 2015 No Comment

Global Growth Shakes up Investors

Global growth just ain’t what it used to be.

At least that’s the latest read from the International Monetary Fund (IMF). On Tuesday, the IMF lowered its global growth forecast for 2015, while also issuing a warning about the risks posed by increasing geopolitical tensions, as well as by an equity market trading at what it described as “frothy” levels.

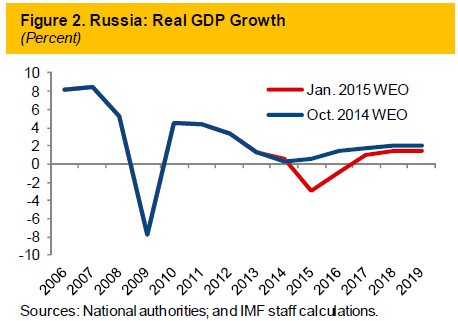

The IMF now indicates the global economy will grow at a 3.8% pace next year, which is a downgrade from the July forecast for 4% growth. The bright spot in the global growth picture actually is U.S. economic growth, which the IMF added is helping lead a worldwide acceleration, albeit one that is expected to be slightly weaker than what was anticipated in July. The IMF said weakness in the euro zone, Brazil, Japan and Russia all are pulling down overall economic growth.

The announcement of a slowdown in global growth shouldn’t have come as a surprise to most, but traders used the announcement as a catalyst for some pretty aggressive selling. During the past several weeks, sellers have been in control, especially when it comes to emerging market and international equities.

The aggregate decline in the global equity market can be seen via a chart of the Vanguard Total World Stock ETF (VT).

Although the fund remains positive year to date by about 4.5%, VT shares are down more than 4% during the past month. The price action in September pushed VT down below its 50-day moving average, and last week the shares broke key support at the 200-day moving average.

The decline in global markets is something we’ve been tracking in my Successful ETF Investing newsletter. Over the past month, subscribers have been instructed to reduce exposure to international equities, and we’ve exited several positions for gains before any real downside damage took place.

If you’d like to know how to protect your assets against more angst in the global equity market, then I urge you to check out Successful ETF Investing today.

ETF Talk: Low-Cost Vanguard Attracts Billions in Assets

Vanguard, one of the world’s largest mutual fund companies, also has carved out a strong niche as a provider of exchange-traded funds (ETFs) that fit the investment firm’s focus on keeping its management expenses low.

In 2013, Vanguard’s funds incurred an average expense ratio of 0.19%, compared to the industry average expense ratio of 1.08%, according to Lipper, which provides fund information and analysis. A low expense ratio has been a hallmark of Vanguard funds since the company’s launch in 1975.

Vanguard’s ETFs actually are regarded within the investment company as a share class of its mutual funds. Those ETFs combine the benefits of low cost and diversification provided by investing in indexes, along with the opportunity to know the share price at a given moment before selling shares. In contrast, a mutual fund prices its shares at the end of the trading day, and an investor is forced to accept that sale price without knowing it when the sell order is placed.

In addition, the expense ratios of Vanguard’s ETF shares align with the expense ratios of the company’s lowest-cost mutual funds. Vanguard’s lowest-cost mutual fund class consists of “admiral” shares, which require a minimum $10,000 investment to buy most of its index-based mutual funds. In contrast, Vanguard’s ETFs that are tied to the same indexes only require a minimum investment of $1,000.

Based on the advantages that ETFs offer, you can understand why I am such an avowed proponent of these investments, compared to mutual funds. I clearly am not alone, since Vanguard has seven of the world’s top 20 ETFs, based on the amount of assets that they hold. Below is a table that shows Vanguard’s 10 largest ETFs, based on asset size.