How Mutual Fund Trading Costs Hurt Your Bottom Line US News

Post on: 27 Июль, 2015 No Comment

Study measures the impact of invisible fees.

When investors are shopping around for mutual funds, they have a wealth of data at their fingertips. They know, for instance, how much a given fund charges in management and operational fees (its expense ratio). They also know how a particular fund has performed over various time periods and what type of investments management held as of the most recent reporting date.

But what they don’t know is how a fund spends on trading costs. These trading expenditures, which come out of investors’ pockets much the same way that management and operational expenses do, are one of the invisible fees associated with mutual fund investing. And, according to new research, they can have a significant effect on investor returns.

In a new study, published in the Financial Analysts Journal. Roger Edelen, Richard Evans, and Gregory Kadlec—of the University of California, the University of Virginia, and Virginia Tech, respectively—conclude that high trading costs put a significant damper on the returns investors take home.

The Securities and Exchange Commission (SEC) does not require mutual funds to make their trading costs—the costs associated with buying and selling securities—known to investors. Mutual funds do publish turnover ratios, which give investors a rough sense of how much trading activity is going on in a particular portfolio. Specifically, a turnover ratio measures the percentage of a portfolio that is replaced by new holdings over a set time period. But Edelen, Evans, and Kadlec maintain that such disclosures do not provide investors with adequate information. To fill in the gaps, they looked at 1,758 domestic equity funds and analyzed available information to estimate trading costs, which can come in the form of everything from brokerage fees to bid-ask spreads.

Their results are telling: Investors pay an average of 1.44 percent per year in trading costs. In many cases, that’s more than they pay in management and operational fees. Moreover, for certain types of funds, trading can be particularly expensive, according to the study. For instance, the researchers found that investors in small-cap growth funds pay an average of 3.17 percent per year in trading costs. For large-cap value funds, that number is only 0.84 percent.

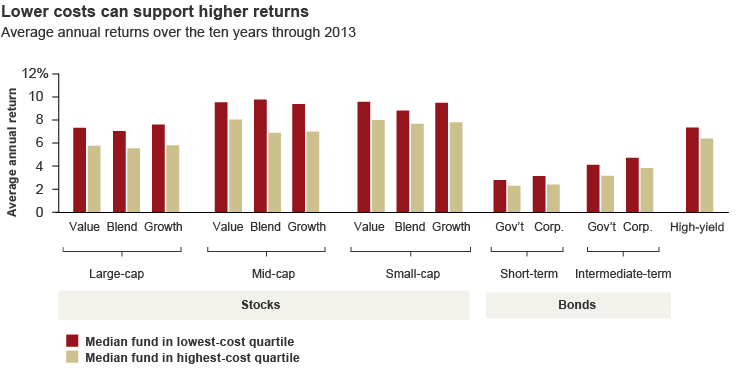

Although active managers tend to justify their trading costs by maintaining that the returns they earn from their active trading outweigh the costs, the researchers have concluded that, at least for the average fund, that’s not the case. Instead, they have found a strong negative relation between aggregate trading cost and fund return performance. Specifically, the funds in the highest quintile for trading costs (the funds that had the most significant costs) underperformed those in the lowest quintile by an average of 1.78 percentage points per year.

Russel Kinnel, Morningstar’s director of mutual fund research, says that because funds don’t publicize their trading costs, it’s difficult for investors to take them into account when deciding which funds to purchase. Since trading costs aren’t reported, it’s fairly hard for them to do it, he says.

One option would be for the SEC to require funds to disclose trading costs. However, it would be difficult to find a uniform definition of how to measure these costs, which are often harder to pin down than, say, management fees. The catch is it’s not something like expense ratios than can be precisely measured, Kinnel says. It’s a little more subjective, kind of the way value is subjective. You can measure a stock a number of different ways.

Even though such costs can be hard to quantify, what’s clear is that if the researchers are correct, the effects of trading costs are more than theoretical. [O]ur results suggest that invisible trading costs have a detrimental effect on fund performance that is at least as material as that of the (visible) expense ratio, they note.