How mutual fund fees can hurt your returns

Post on: 22 Июнь, 2015 No Comment

Canadian equity funds can cost much more to hold than an index fund that tracks the same companies.

Canadians have more than one trillion dollars invested in mutual funds, according to the Investment Funds Institute of Canada. The lobby group for the mutual fund industry praises Canadian investors for adopting regular savings habits and trusting mutual funds to help their savings grow.

But those savings come at a cost. Numerous studies, most notably from research firm Morningstar, have shown that on average, Canadian mutual fund fees are the highest in the world. Morningstar went as far as to give Canada an F for fees and expenses in its latest report.

Equity mutual funds, the type sold by banks and investment firms, were the biggest offenders. According to the study, published in May 2013, average management expense ratios (MER) of equity funds sold in Canada came in at 2.42 per cent. Conversely, investors south of the border pay a relatively inexpensive 0.82 per cent, on average, for a similar fund.

This means that $100,000 invested in an equity mutual fund in Canada might cost around $2,420 per year in fees. You dont see it because the fees are whisked away to pay your adviser and fund manager whether the fund makes money or not.

Mutual funds come in a variety of flavours. Index funds, which can be mutual funds or exchange-traded funds (ETFs), are growing in popularity, and for good reason. These funds are designed to track an index like the TSX in Canada or the Dow Jones industrial average in the U.S. and give investors exposure to all the large established companies in that market for a relatively small fee.

Banks and investment firms sell both types of funds, so an investor might wonder what the difference is besides the fees. The answer is, not much.

The main objective for Canadian equity funds is to achieve long-term growth by investing primarily in major companies in Canada. Canadian index funds have a similar objective achieve long-term growth by tracking the performance of the various indexes that make up the TSX.

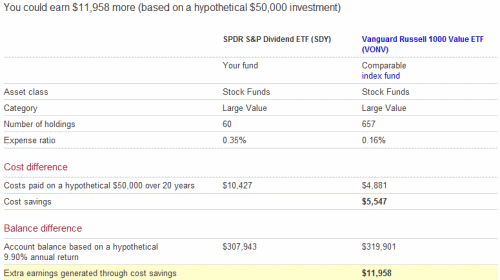

So while the objectives are the same and the holdings similar, an investor would pay anywhere between 1.19 and 1.85 per cent more to hold a Canadian equity fund at one of the big banks versus one of its cheaper index fund cousins.

Mutual fund representatives are required to offer products that are suitable to your risk tolerance, but suitable may not mean the best choice for you.

An example might be a Canadian equity mutual fund with an MER of 2.18 per cent versus a Canadian index fund with an MER of just 0.33 per cent. Both have similar objectives, yet one fund will cost the investor more than six times as much as the other. Both funds would be considered suitable for a growth-oriented investor.

New disclosure rules mean investors are getting more information to help decipher their investment statements and fees. For example, you might see a new statement saying something along these lines:

Higher commissions can influence representatives to recommend one investment over another. Ask about other funds and investments that may be suitable for you at a lower cost.

John Bogle is the founder of U.S. investment firm Vanguard and is known as the father of index investing. In a PBS documentary, Bogle said if you invest in a mutual fund that earns 7 per cent a year on average, but you pay 2 per cent a year in fees, the costs will erode two-thirds of your gains over a 50-year period.

What happens in the fund business is the magic of compound returns is overwhelmed by the tyranny of compounding costs. Its a mathematical fact, said Bogle.

Mutual funds are still a great place to start building a portfolio, but Canadian investors must do a better job understanding the fees and expenses associated with their investments.

Ask your adviser for alternatives to expensive equity mutual funds, read the fund facts information sheets before you invest, and dont let your investment portfolio get eaten up by unnecessary fees.