How Much Does an Investment Advisor Cost

Post on: 25 Июнь, 2015 No Comment

How much does an investment advisor cost? Thats a pretty good question, and one that we hear often at Mullooly Asset Management. Many people see it as some sort of a big secret. You have probably felt that feeling of intimidation before when shopping for car, buying insurance, or maybe working with somebody who manages your money. The intimidation comes from not knowing how much these things should cost. Tom thinks it is critical that investors understand the different fees and costs that come from various sectors of investment management industry. Thats why our weekly podcast focuses on answering the question, How much does an investment advisor cost?. The first thing that investors need to know is whether they are working with a brokerage firm, financial planner, or a fee-only investment advisor. Tom and Brendan get into the vast differences between these three investment managers in the podcast. The financial industry has done their best to blur the distinction between these roles, and Tom will do his best to redraw the lines for you.

When your investment manager is a broker it means that they are part of the sales force at a brokerage firm. Youll be paying a commission to this broker whenever he or she makes adjustments to your portfolio. Different names for these commissions exist, such as a wrap fee. Just be aware that these are fees in lieu-of commissions. There will always be a fee associated with having an account at a brokerage firm. Whether they are commissions, wrap fees . or brokerage firm fees youll be paying them.

If you go to a financial planner for your investment advice you will likely end up paying fees and commissions. Financial planners charge a financial planning fee for when you meet with them and come up with a gameplan. Youll also have to pay a commission when they implement their investment strategy. Whether they want you to invest in annuities, mutual funds, or whatever else, there will be a cost involved.

If you choose to invest your money with the help of a fee-only investment advisor (like Mullooly Asset Management) there will be a quarterly feeand thats pretty much it. Fee-only investment advisors normally team up with discount broker to make their transactions. This means they will have little to no costs when making adjustments to your portfolio. A lot of investors believe that working with an investment advisor means that you need to have a lot of money, but that simply isnt true. Tom breaks down how a quarterly fee would be determined by most investment advisors. The thing to keep in mind with fee-only investment advisors is that they are on your side. They charge a fixed rate, not a fixed fee. Meaning that if a clients account loses money, their fees go down. The main focus tends to be on growing the clients assets, while also avoiding any big risks.

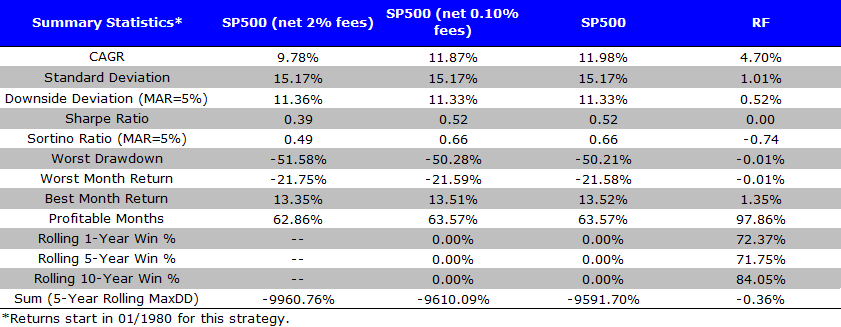

Most fee-only investment advisors charge a fee around 2% per year. Here at Mullooly Asset Management the most you will ever be charged is 1% per year. Our rates go down from 1% based on the value of the account.

So how much does an investment advisor cost? As you can see that is a pretty complicated question. Many people dont understand the differences between brokers, financial planners, and fee-only investment advisors. Hopefully this weeks Mullooly Asset Management podcast cleared up some of the questions you may have had. If you are still wondering, How much does an investment advisor cost?, dont hesitate to contact us at Mullooly Asset Management with any questions.

Get financial planning tips, 401k guidance and investment management delivered straight to your inbox.