How Much are the Costs and Fees for Mutual Fund Investments

Post on: 9 Август, 2015 No Comment

Two of the most highly-recommended investment vehicles for individual investors are exchange traded funds or ETFs and mutual funds. Because mutual funds are business endeavors, it is only natural that the companies incur costs in the course of their operations. Some of these costs are related to the transactions that investors make. Other costs are categorized as part of the fund’s operating costs.

As a wise investor, you should get to know what these related expenses are because if you don’t, you may just be eroding the earnings of your investments by paying more than you need to. The reason why you should be extra vigilant is that the Securities and Exchange Commission generally does not put certain limits on how much fees the mutual fund charges. It does, however, cap redemption fees at 2 percent in most instances. Some fees also have limits as per the regulations of the Financial Industry Regulatory Authority or FINRA. But as an investor, it is your responsibility to get to know what these expenses are so you can choose the mutual fund that only charges reasonable fees.

Shareholder fees or those that investors have to pay for when they transact with the fund generally include sales loads, redemption fee, exchange fee, account fee and purchase fee. Operating expenses of the fund which are generally paid using fund assets include management fees, distribution fees, other expenses and total annual fund operating expenses. Let’s discuss these fees in more detail in the next sections.

Sales Load

Also called a sales charge, a sales load can be likened to a commission that you pay to a broker when you buy any type of security from them. This is because funds have to pay the brokers who sell their shares. Generally, the FINRA limits mutual fund sales loads to no more than 8.5 percent but mutual funds generally don’t impose the maximum limits.

Sales loads are categorized as front-end sales loads and back-end sales load. Front-end loads are paid the moment an investor buys shares from the fund while back-end loads are paid when an investor redeems his shares.

Front-end sales loads basically reduce the amount of money you have to purchase fund shares. This means that if you have $5,000 to invest and the fund charges a front end load of 3 percent then the sales load of $150 will reduce your total investment amount to $4,850.

Back-end sales load, also called deferred sales charge, is collected when the investor sells his share back to the fund. There are funds that don’t impose front-end loads but back-end loads. In this arrangement, the entire investment amount is used to buy shares. The back-end load is only deducted when the investor redeems his shares. Thus, if the investor had $5,000 to invest in a mutual fund that charges back-end load of 3 percent, the entire amount will be used to purchase shares. When the investor sells his shares, the $150 will be charged as the deferred load.

It’s very important that you know how the fund computes the collection of the back-end load. In most cases, the basis for the back-end load is the lesser of the value of the initial investment. Thus, in the event that the $5,000 investment has appreciated to $8,000 the 3 percent deferred load will be based on the initial $5,000 used to buy the shares and not its current value. Note that this is only a general observation—other funds might not use this calculation so it’s very important that you read your fund’s prospectus thoroughly.

Contingent deferred sales load or CDSC or CDSL is a common kind of back-end sales load. In this kind of arrangement, the amount of the sales load will be reduced the longer you keep your investment in the fund. If you keep your investment long enough, the sales load will eventually become zero. The specifics of the arrangement are found in the prospectus. Take note, however, that a CDSC or CDSL may charge a 12b-1 fee each year.

Can you avoid sales load? Yes. In fact, you may be better off looking for no-load funds. No-load mutual funds don’t charge front-end or back-end sales loads, allowing you to maximize your earnings. Now some might say that funds with loads provide better returns but no evidence proves that this is true. Take note, however, that no-load mutual funds may still charge the other fees that we will be discussing below.

Redemption Fee

A redemption fee is charged to the shareholder whenever he redeems his shares from the fund. Although it may sound like a back-end sales load, the redemption fee is not paid to the broker but to the fund to help defray the costs incurred by the fund by the shareholder redeeming his shares. The SEC has ruled that funds cannot charge more than 2 percent to shareholders for the redemption fee.

Generally speaking, a redemption fee is charged to shareholders who sell their shares too soon—usually within five years from the date of purchase. It is also worth noting that not all funds impose redemption fees so it’s well-worth researching as to what these funds are.

Purchase Fee

This is a fee paid directly to the fund when an investor buys shares. This is the reason why a purchase fee is not a front-end load. It is imposed to defray the cost of the fund associated with the buying of the shares and not paid to the broker.

Other Shareholder Fees

A fee may be slapped on some investors in order to maintain their accounts. For example, if your account goes below a specified dollar amount, the mutual fund firm may collect an account fee. Another fee is the exchange fee which is imposed on shareholders who transfer to another fund in the same group.

Management Fees

Fees that are paid to the investment adviser of the fund are called management fees. They are taken from the fund’s assets. They generally vary from one fund to the next. Actively-managed funds tend to charge higher management fees because the fund manager tries to beat the market. Index funds are passively-managed funds and as such, don’t charge a lot in terms of management fees.

Distribution Fees

Also called 12b-1 fees, distribution expenses include those fees for marketing and selling the shares of the fund. This includes the compensation paid to brokers as well as for the advertising, printing and mailing of prospectuses and sales literature to clients.

Other Expenses

This includes legal expenses, accounting expenses, custodial expenses, transfer agent expenses, administrative expenses and shareholder service expenses which are not part of the distribution fees category.

Conclusion

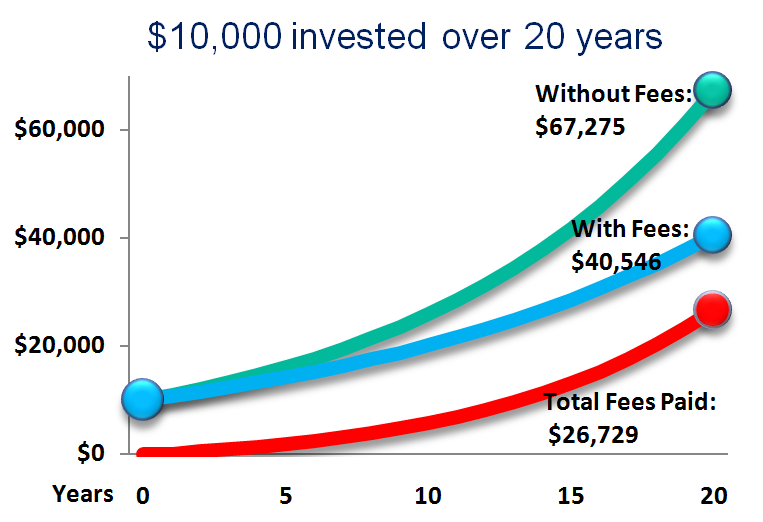

The importance of knowing what the fees charged by the mutual fund are cannot be underestimated because the gains you make over time could get eroded by all these fees if you are not careful. Even those seemingly inconsequential differences of 0.5 percent or 1 percent can mean a substantial difference in your earnings over the course of a decade or two.

A fund that has consistently beaten the market with its track record may impose higher costs. However, you have to remember that no one can predict with accuracy that the mutual fund will perform well this year. Past performance is never a reliable predictor of how the fund will perform in the future. While it’s true that mutual funds and ETFs are quite diversified and won’t be as prone to fluctuations in the market, nothing is ever certain. The fund may have had a good run in the past but you can never tell if it will do well this year.

One important way to protect yourself against these downturns which you have no control over is to focus on the fees. Try looking for funds that don’t really charge very high costs so you can make the most of your investments. A fund that won’t impose very high fees will always be better than one that does because even if it will only make modest returns, the fees won’t eat up a lot of your earnings. Do away with loads as much as possible and go for no-load mutual funds. Don’t forget to read the fine print so that you know how the fees are structured. You’ll find this information in the fund’s prospectus so always take the time to read through this document. If you don’t you could potentially put yourself in a situation where you don’t have any idea why you are being asked to pay for various fees that you are totally clueless about. If there are provisions in the document that you are unsure of, take the time to ask.

So choose funds wisely. There are a lot of mutual funds to select from so don’t rush. Do an apples-to-apples comparison of the funds you are thinking of buying shares from before finally making your decision. There are mutual fund cost calculators that help you crunch the numbers so you can choose the best mutual fund to invest in. Take advantage of them.