How is a Mutual Fund s Share Price (NAV) Determined

Post on: 9 Июнь, 2015 No Comment

How is a Mutual Funds Share Price Determined?

During a lunch recently, Matt, a colleague, and I were discussing investments and the topic turned to mutual funds. I proceeded to tell him a few funds that I had in mind and why I liked them. The conversation then turned to how I choose mutual funds. primarily how to choose a good mutual fund manager whose strategy matches your goals. When it comes to this topic, there are a few mutual fund managers that I hold in high esteem and I began to talk about them. Matt then asked the question, well if everyone else thinks that this mutual fund manager is great, then wont the mutual fund price become inflated?.

For those with a strong background in mutual fund investing, this misconception is one that is easy to overlook when talking to others about mutual funds. Many investors assume that because mutual funds have a price per share, then their value is determined on the open market by investors who buy and sell shares. In the case of a certain type of mutual fund, this is the case.

However, in most cases, investors need not worry that the price of a mutual fund they are buying has been pumped. Ive openly promoted certain mutual funds on this site, but in every case theyve been open ended funds (well discuss later). My promotion of these funds has no effect on the share prices of these funds. Lets take a look at why this may be.

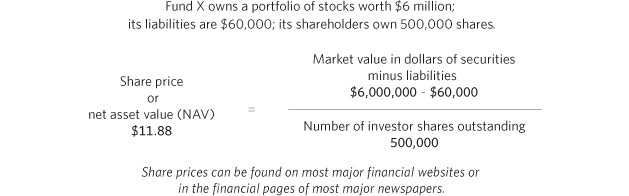

How Net Asset Value (NAV) Determines a Mutual Funds Share Price

Net Asset Value (NAV) is the total value of all of a funds assets minus its liabilities divided by the number of outstanding shares for that fund. For instance, if a mutual fund has $100 million in assets and $10 million in liabilities, its net assets are $90 million. If this same mutual fund happens to have issued 9 million outstanding shares to investors, then its price per share (or NAV) is $10. Heres the formula:

NAV = (assets liabilities)/shares outstanding

The Difference Between Mutual Fund and Stock Share Prices

Stock share prices

Stock share prices are determined on the open market based on investors perceptions of the value of a share. Often times, these perceptions are based on a number of factors including the stocks current earnings per share, and expected future earnings per share. A number of macro and micro economic factors are taken into consideration, but the important thing to know is that a stocks share price is fluid and based on perceived value. If more people want to buy the stock than sell it, the share price trends upward. If more people want to sell the stock than buy it, it will trend downwards.

Mutual fund share prices

Mutual fund prices are based on the funds holdings rather than a perceived value of that fund. For instance, lets assume that a mutual fund owns a total of 10 different stocks, which wrapped up a trading session at $20 per share. For simplicity, lets say that this fund has zero liabilities and owns 2 shares of each stock. Meanwhile, the fund has sold a total of 10 shares. This fund would have a NAV of $40, heres how: NAV = ($20 x 10 stocks x 2 shares $0 liabilities)/10 shares = $40. The price of a share is not at all based on demand for that share.

Fund Share Prices: The Law of Supply and Demand at Work

The main reason why a stock share price can be influenced by outside factors and a mutual funds price cannot comes down to the law of supply and demand. At any given time, a company only has a certain limited number of shares available that are trading on the market. These shares are released during an initial public offering (IPO). Companies can later release more shares (secondary offerings), if theyd like, but it often has a large devaluing effect on the already existing shares.

At the same time, mutual funds create as many shares as there are demand for, and sell and buy them back from you at the NAV price. They do not trade on the open markets, as stocks do. You typically get the price of the fund at the end of that trading session if you purchased before the closing bell, or at the end of the next trading session if you purchased after hours. In the case of mutual funds, unlimited supply equals an asset with a value that is not influenced by outside demand (or lack of).

The Exception: Closed End Funds Prices

There is one exception to everything weve discussed thus far, closed end funds. Everything mentioned in this article prior was in reference to open ended mutual funds, which make up the vast majority of mutual funds out there. In contrast, a closed end fund is a certain type of mutual fund that has a limited number of shares that trade on the open market, much like a stock.

Often times, these funds will trade at a discount to their NAV and investors will purchase them hoping to make a gain if the fund starts trading closer to its NAV. You may find it hard to believe that a closed end fund would trade at a discount to its NAV, but it does happen on a regular basis. In general, if you dont understand the reasons why these funds would sell at a discount to their NAV, youre probably better off steering clear of them and sticking with open ended funds.