How Interest Rates Affect The Stock Market

Post on: 16 Март, 2015 No Comment

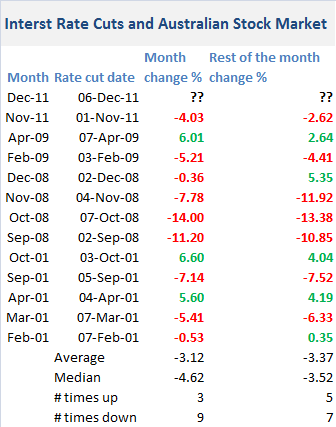

It is a common understanding that federal interest rates affect the market. Higher rates will slow down the market and lower rates will drive it up.

If this is so, we can combine this concept with other factors that are forming the investment strategy to achieve better forecasting accuracy.

This example demonstrates how much, in percents per year, a strategy performance will improve by taking into the account the values of the federal funds interest rates.

It also gives the answer, in numbers, how the economy is affected by the interest rate and its changes.

Market Model

In this example, the investment strategy consists of a single market model that uses the interest rate history to forecast changes in stock prices.

A generic formula that follows this concept will be:

PriceChange = F( R )

where PriceChange is the stock expected price change, R is the interest rate history and the F is a function that we should find to be able to calculate the price changes for any interest rate history combinations.

Interest Rate Approximation

Lets say the function F uses past 12 months of interest rate history to calculate forecasts. Because interest rate changes relatively slow, rather than using all 250 daily values that were recorded over the past year, we can approximate it with a set of only say 2 real numbers:

- R1 — the average interest rate over the past year,

- R2 — the average change rate of the interest rate over the past year.

Values for R1 and R2 are changing with the time as the history of interest rates is different at each moment.

Now our generic formula will become a function of two real numbers:

PriceChange = F( R1. R2 )

Forecasting Function Approximation

The function F itself can be approximated using Tailor polynomial, up to linear terms:

where C0. C1 and C2 are constant numbers that define our approximated forecasting function.

Finding Forecasting Formula

The formula above for PriceChange can be entered into the One Investment Way system and used as a stock price forecasting model in the investment strategy.

The system then will find the best values for the C0. C1 and C2 constants that most accurately describe market reaction on the interest rate changes. It will also find the expected performance of such model.

Results Interpretation

The coefficients C0. C1 and C2 found by the system can be viewed as the quantitative answer on the question How interest rates affect the stock market :

- The value of the C0 can be viewed as the average economy growth that is not affected by the interest rates.

- The value of the C1 is the effect of the interest rate on the economy in general: high negative values (about -1 and below) will mean that economy is significantly affected by the interest rates: higher interest rates will cause the market declines. Values around zero (-0.2. +0.2) will mean that there is no significant effect of interest rate on the economy.

- The value of the C2 means how the market reacts on the changes in the interest rates:

- positive numbers will mean the market will go up if rates are increasing and decline when rates are decreasing (Fed is anticipating market changes),

- negative numbers will mean the market will start declining if rates are increasing (Fed is controlling the market direction).

How to View or Modify This Example

To run this example, you would need to:

- Install One Investment Way system,

- From File menu, click Examples sub-menu to start examples wizard,

- From examples wizard select Economic Data category,

- Select Interest Rate and click Finish to create a new project,

- To see the value for C0. C1 and C2 coefficients, open Model1 / Variables tab.

- To see how including interest rates model improves strategy performance, open Strategy / Performance tab.

How to Include This Example into Your Strategy

If you already have a strategy formalized as the One Investment Way project, simply copy and paste the Model1 node into your Strategy folder.

After re-optimization, if your strategy did not include the effects of the interest rates before, you should see the improvements in the expected performance for your strategy.

If your strategy already took into the account the effects of the interest rates somewhere in other models, there will be no changes in the expected strategy performance.