How Compound Returns Favor the Young

Post on: 16 Март, 2015 No Comment

Published on May 23rd, 2006

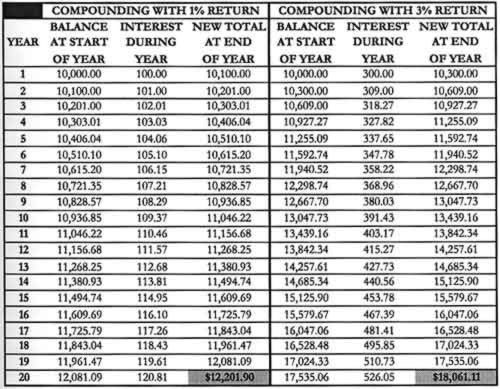

In an earlier entry about the cost of waiting one year to begin investing for retirement, I posted a chart from AllFinancialMatters that demonstrated the power of compound returns. Vintek posted a math exercise related to the subject.

I got this from a book called The Random Walk Guide to Investing by Burton Malkiel. It’s a book I recommend, and I’ll eventually talk about it in the forum. Here’s the exercise:

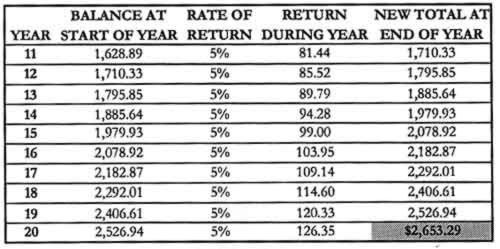

William and James are twin brothers who are 65 years old. 45 years ago (at the end of the year when he reached 20), William started an IRA and put $2K in the account at the end of each year. After 20 years of contributions, William stopped making new deposits but left the accumulated contributions in the IRA fund. The fund produced returns of 10% per year tax-free. James started his own IRA when he reached the age of 40 (just after William quit) and contributed $2K per year for 25 years, making his last contribution today. James invested 25% more money in total than William. James also earned 10% on his investments tax-free. What are the values of William’s and James’s IRA funds today?

Vintek sent along the answer in a spreadsheet. Its eye-opening.

William has $1,365,227. James has $218,364. James invested 25% more than William, but through the magic of compounded returns, Williams IRA fund is worth more than six times as much! For some real fun, download the spreadsheet and plug in your own numbers. Im having to contribute $5,000/year because I didnt start in time. How about you?

(Note that the 10% assumption used in the charts and in the spreadsheet is arbitrary and for illustrative purposes only. An 8% return-on-investment is more realistic over the long term, and interest rates on CDs are half that. Still, the same principle applies regardless the rate, as long as the rates are consistent between sample cases.)

You twenty-somethings: I know that retirement seems a long way off, and you probably wish I would write about how to save money on mortgages or how to use coupons at the grocery store. But this is important. Force yourself to save for retirement. It may hurt, but its not going to hurt for long. And when youre old like I am, youll be glad you made the decision. If you will just invest $2000/year for twenty years starting at age 20, youll set yourself up for life!

Don’t ever try to convince yourself that you can make up for not saving for a few years by saving later. It will snowball. You’ll establish a lifestyle that depends on too much of your income to ever make up for lost time. But if you didn’t save enough last year, resolve to find the extra money somewhere this year to make up for the lost time. When you are in your 40s like me and looking back, you won’t have regrets about your retirement savings.

Amen.

GRS is committed to helping our readers save and achieve their financial goals. Savings interest rates may be low, but that is all the more reason to shop for the best rate. Find the highest savings interest rates and CD rates from Synchrony Bank. Ally Bank. GE Capital Bank. and more.