How can one predict the stock market s performance using artificial neural networks

Post on: 16 Март, 2015 No Comment

Related Topics

Before I begin, I currently run a company that started off as an attempt to do just this!

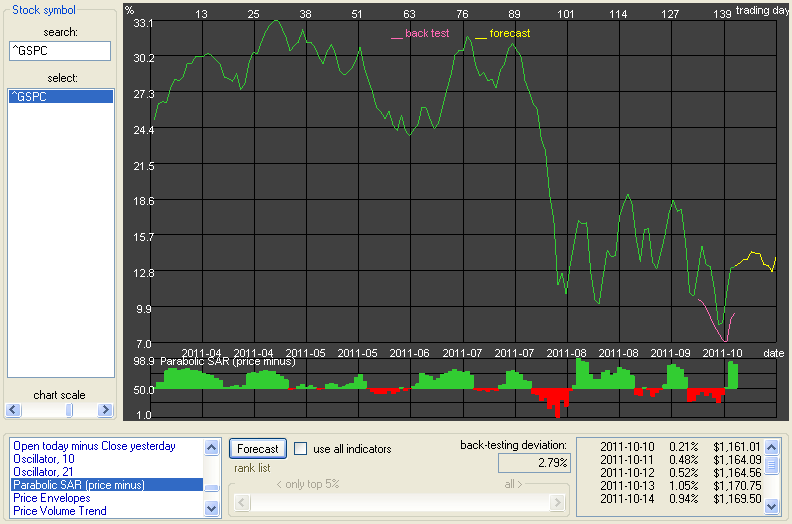

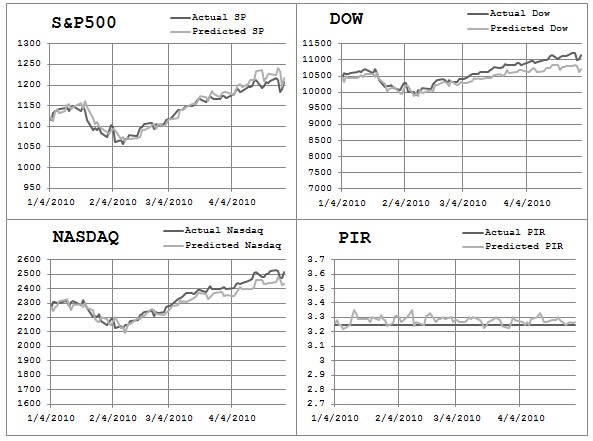

While predicting stock markets, ANNs play the primary role of a pattern recognition / function fitting tool. So basically if you choose a right mix of parameters that have been shown to govern the system that is a stock market and present them to a (well-designed) ANN, it would give you a 'prediction' of what the market would do at a later time. As easy as giving the ANN a set of readings for various weather-related parameters and then asking it for a weather forecast.

So why are people not making fortunes out of this?

1. So basically if you choose a right mix of parameters that have been shown to govern the system that is a stock market

Stock markets parameters are too intricately correlated and too localized for a general neural network to accurately 'get the hang of'. Also you would need sufficient knowledge about the stock markets to not present misleading/ uncorrelated parameters to the network. The Curse of Dimensionality would, well, curse you here too.

2. and present them to a (well-designed ) ANN

There is very little hope of finding a 'general' network design that will work for any generic stock market, or even the same index for an extended period of time. You would need to spend a lot of time accounting for the variablity of your data; most researchers just do a rather long-winded trial and error routine. Most times it leads to a network that ends up fitting well to their data; it is fallacious to assume this network will continue to be a good judge of even the same market at a later stage (for example, stock markets in India react to festivals. How would you ask your network to predict that? ![]() (It's not impossible, for the record. Just requires huge amounts of specialized training data. Which is pain to get.))

(It's not impossible, for the record. Just requires huge amounts of specialized training data. Which is pain to get.))

3. The Efficient Market Hypothesis

Google this!

So, to summarize — it is possible to have a nice, localized ANN that would do a decent job of giving you an indication of the stock market's performance in the near future. Anything more would need the kind of data that simply isn't available.

You could turn to Markov chains, HMMs, SVMs and a lot of other more sophisticated algorithms that deal much better with limited/ high-dimensional data that is erratic. Again, though, there is no magic code that is going to help you beat the stock markets forever!