How Anyone Can Invest Like Hedge Funds Only With Lower Fees And Risk

Post on: 26 Май, 2015 No Comment

Share | Subscribe

Rich guys have all the fun, said my friend after reading severalhedge fund prospectuses.

He added that he would love to diversify hisstock portfolio with alternativeinvestments. but the best hedge funds typically require a million-dollarminimum investment and the investor to be accredited.

It’s just not my friend. Even most accredited investors can’t afford to plunge a million or more into a hedge fund and hope for the best. Most individual hedge fund investors are in the ultra-highnet worth class. For them, a million dollars in a hedge fund merely represents thediversification of a portfolio rather than the majority of its investable assets.

What Are Hedge Funds?

Hedge funds are loosely regulated privateinvestment partnerships that invest in a wide variety of strategies. These strategies can includederivatives. long and short positions, commodities, currencies and just about any other investment strategy that can be imagined.

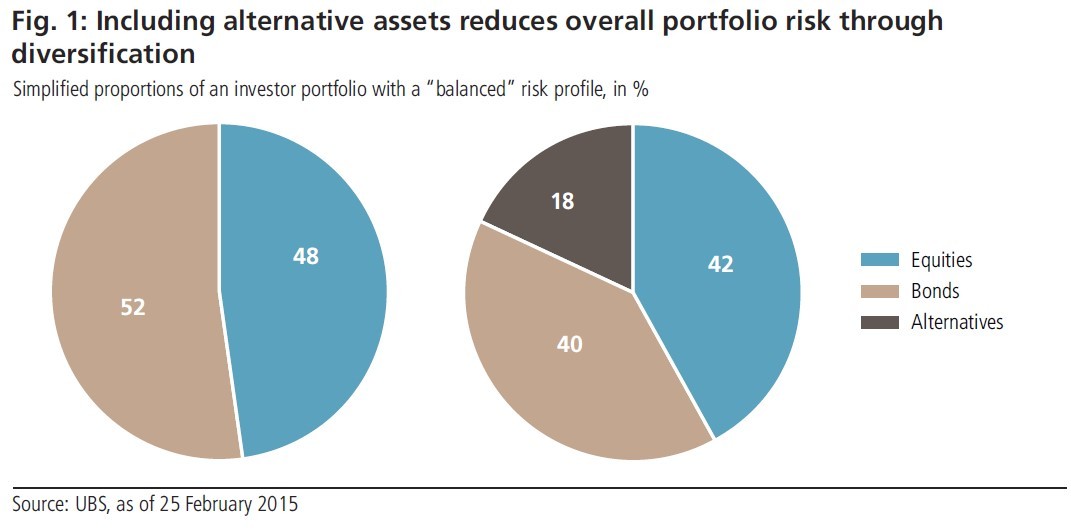

This wide diversification choice is what gives hedge funds their edge over more traditional investments. In addition, because they’re subject to less regulation and oversight than other forms offunds permits hedge funds can quickly alter course in search of profits. Furthermore, their ability to useleverage and invest in exotic products increases their appeal among ultra high net worth investors.

However, it’s critical to remember that leverage, managerial freedom and exotic products can work against you as easily as for you. Just because it’s a hedge fund, the profits are no way guaranteed.

As an example, my old firm was invested in five different hedge fund partnerships. Out of the five, three lostmoney over theyear. one broke even, and one made hugegains. saving the firm and its investors. Had we not been invested in the one large winner, it would have been a financial disaster.

In my mind, this experience solidified the need for diversification, regardless of one’s confidence in a particular investment or manager.

Play In The Hedge Fund’s Exclusive Sandbox

I explained to my friend that there is a solution to his dilemma. Now every investor can take advantage of hedge fund tactics and profits.

Known as alternative mutual funds, these funds attempt to mimic hedge fund strategies — only without the very high fees and often lofty structural risk that are part and parcel with private hedge funds. These alternative mutual funds invest andhedge with derivatives, shorts, exchange-traded funds ( ETFs ) and nearly anything else a hedge fund would be interested in.

Investors do not need to be accredited and may invest far less money. These alternative mutual funds also do not charge the standard yearly fees (2% on assets and 20% on performance) of their hedge fund brethren.

There are limits on leverage that can be employed by alternative mutual funds, but this can be a good thing, should a drawdown occur.

The alternativemutual fund space has been exploding in popularity. In 2007, there were just 112 alternative mutual funds. Today, there are 357 — more than three times as many. I think this is just the start of the growth in alternative mutual funds.

Offering most of the benefits of hedge funds, but with a much lower entry price level, radically lower costs, and just enough regulatory oversight to increase the safetyfactor. alternative mutual funds may one day take the spotlight from the traditional hedge fundmarket .

In fact,multiple large hedge funds have launched or are considering launching alternative mutual fund products. It is truly a niche that should be on your investment radar.

My Favorite Alternative Mutual Funds

Bridgeway Managed Volatility Fund ( BRBPX ). Thisfund has produced more than 6% returns in the past year with 4% of that in 2013.

It seeks to provide high returns with short-term risk less than or equal to 40% of the stock market. About 75% of the fund’s assets are invested incommon stocks and options on companies that trade on regulated national exchanges.

Fees are low with anexpense ratio of 0.94, and Morningstar lists risk at below average when compared with other funds in the same category.

Dreyfus GlobalAlpha Fund ( AVGAX ). The word alpha in the hedge fund world means performance above the norm, and this alternative mutual fund fits the name.

The fund seeks total return byinvesting in the globalequity ,currency ,bond and fixedincome securities. It primarily usesfutures. options andforward contracts that allow the fund’s managers to make fast decisions. The fund has earned investors more than 8% in the past year and just under 5% in 2013.

Global Alpha has an expense ratio of 1.85%, which is above average, according to Morningstar, which also rates the fund as high risk compared with similar funds.

Risks to Consider: Alternative mutual funds should be used as a way of diversification and not a primary investment. The strategies employed often contain more risk than traditional mutual funds. This risk can beoffset by higher rewards. Always use stops and position size properly in your portfolio.

Action to Take —> I like both of these alternative mutual funds as a means to diversify a stock portfolio — and hopefully capture profits.