How a Mutual Fund Is Structured

Post on: 17 Июль, 2015 No Comment

An Explanation of What You are Buying When You Invest In a Mutual Fund

Many of you know that I am seriously considering launching a mutual fund this year as part of a restructuring of my businesses. As I’ve been meeting with fund companies and banks, I’ve learned a tremendous amount about how mutual funds are structured, including the arrangements that make funds work on a day-to-day basis. I thought it would be a great opportunity to share this knowledge with you so you can actually look at the man behind the curtain and see how your money moves once you’ve put it into a mutual fund. By better understanding it, I hope that the idea of investing in mutual funds won’t be so daunting for you as a new investor.

The Background on Mutual Funds

As I explained in Mutual Funds 101. which is part of our Complete Beginner’s Guide to Investing in Mutual Funds. mutual funds are the most popular investment in the United States because they provide a way for every day people to buy a broadly diversified portfolio of stocks. bonds. or other securities. There are mutual funds to match virtually any need, from finding a place to store your temporary cash savings to earning dividends and capital gains on long-term global stocks. This convenience has lead to explosive growth in the mutual fund industry. Money market funds had nearly $3.3 trillion dollars in assets in them as of the end of fiscal 2009. As of the end of November, 2009, long-term mutual funds had just shy of $11 trillion in assets. This is a massive industry, and one which is important to you regardless of if you invest through a 401(k). 403(b). Roth IRA. Traditional IRA. SEP-IRA. Simple IRA. or brokerage account. According to some estimates, 1 out of every 2 American households owns mutual funds.

The Mutual Fund Company

A mutual fund is organized as a regular corporation or a trust, depending upon which method the founders prefer. If the fund agrees to pay out all of its dividend, interest, and capital gains profits to shareholders, the IRS won’t make it pay corporate taxes (this is called pass-through taxation and helps you avoid the double layer of taxation that is ordinarily present when buying shares of stock).

The mutual fund itself consists of only a few things:

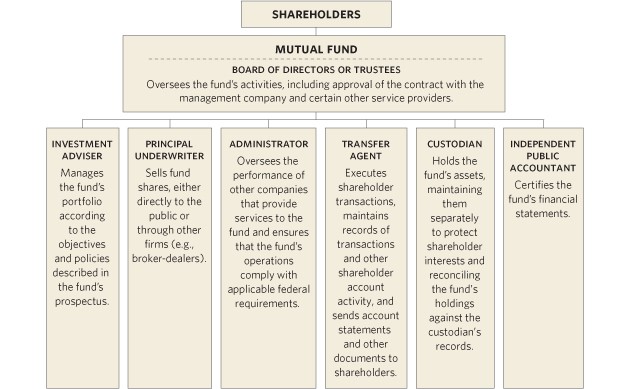

- A Board of Directors or Board of Trustees. If the company is a corporation, the people who watch over it for the shareholders are known as directors and serve on a Board of Directors. If it is a trust, they are known as trustees and serve on a Board of Trustees. For all intents and purposes, there is no difference between the two roles. According to rules set by law, at least 75% of the directors must be disinterested, meaning they have no relationship to the person or firm that will actually manage the money. The directors will be paid for their service. At major, multi-billion dollar mutual funds, they may receive as much as $250,000 a year!

How the Mutual Fund Process Works

Let’s say you have $10,000 you want to invest in XYZ Fund. You download a new account application from the mutual fund’s website, fill it out, and mail it in along with a check. A few days later, your account is open.

Here’s a simplified explanation of what will happen:

- Your check was mailed to the transfer agent. It was deposited into a bank or custody account. They will make sure you are issued shares of the mutual fund based on the value of the fund when your check was deposited.

- The cash will show up in the account, and will be visible to the portfolio manager that represents the adviser company. They will get a report telling them how much money is available to invest in additional stocks, bonds, or other securities based on the net money coming into or out of the fund.

- When the portfolio manager is ready to buy shares of a stock such as Coca-Cola, he will tell his trading department to make sure the order gets filled. They will work with stock brokers. investment banks. clearing networks, and other sources of liquidity to find the stock and get their hands on it at the lowest possible price.

- When the trade is agreed upon, a few days will pass until the settlement date. On this date, the mutual fund will have the money taken out of its bank account and give it to the person or institution that sold the shares of Coke to them in exchange for the Coke stock certificates, making them the new owner. These shares are stored either physically or electronically with the custodian.

- When Coca-Cola pays a dividend, it will send the money to the custodian, who will make sure it is credited to the mutual fund’s account.

- The mutual fund will likely hold the money in cash so it can pay them out to you as a dividend at the end of the year.