House Your Retirement With SelfDirected Real Estate IRAs

Post on: 17 Май, 2015 No Comment

Direct real estate investing is becoming an increasing option for investors eying retirement and who want to take advantage of real estate’s return potential and its abilities as a portfolio diversifier and inflation hedge. For the most part, real estate is not frequently invested in for retirement-account purposes, and with the exception of real estate-related funds, there are few options for investors to use direct real estate investments for retirement accounts. Although less than 2% of retirement accounts are invested in real estate, the emergence of IRAs for which the primary — and possibly only — investments are real estate products is beginning to change the situation.

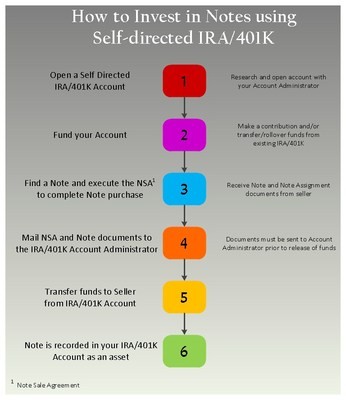

In the form of a self-directed IRA, investors are now able to invest directly in real property, mortgages, private placements and other non-traditional assets. In some cases, IRA owners are given checkbook access to their IRA balances. With such structures, investors can achieve significant flexibility in investing options, greater control over their retirement assets and the investment potential provided by direct real estate investments. (For those interested in buying property directly, Investing In Real Estate provides some helpful advice.)

Self-Directed IRAs

A self-directed IRA is one that allows the account owner to make investment decisions and choose investments. For instance, the IRA owner can choose to invest in stocks, bonds and non-traditional investments instead of having the investment decisions made by the financial institution.

In order to invest using a self-directed IRA, the IRA must be held with a qualified trustee or custodian. Generally these trustees provide administrative services, such as maintaining records of contributions and other activity, filing required IRS reports, issuing client statements and providing information pertaining to the rules and regulations that govern IRAs (for example, the contribution limits and deductibility rules, the rules for distributions and the penalties for early distributions).

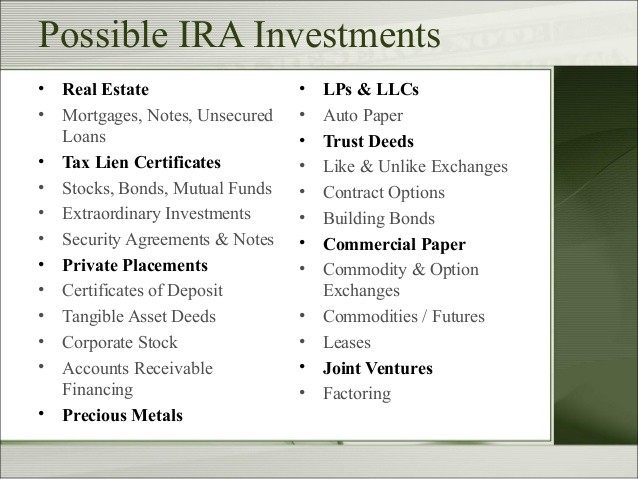

Investment Options For Self-Directed IRAs

The investment options for self-directed IRAs are not usually limited to traditional asset types, but allow all of the IRS-permitted investment types. This creates a higher diversification potential than IRAs, where investments are limited to mutual funds or certificates of deposits (CDs). However, although all investment types are allowed under federal regulations, not all custodians provide for all asset classes. such as real estate or mortgages. Therefore, IRA owners should check with the custodian to determine which investment options they offer before establishing the IRA. (Read about the advantages of CDs in Are CDs Good Protection For The Bear Market? )

Non-Permissible Investments

These IRAs cannot invest in IRS-prohibited assets, such as life insurance and collectibles, and must follow the same IRS rules and regulations covering regular IRAs. (Read more about collectibles in Contemplating Collectible Investments .)

Although the IRA is a non-discretionary account. the regulations make the IRA owner responsible for compliance with all regulatory requirements. Since the custodian usually does not determine whether the investment is in compliance with regulatory requirements or provide legal/tax advice, investors interested in self-directed IRAs should seek advice from an independent tax or legal advisor.

Investment Options

The investment options available for self-directed IRAs extend beyond stocks and bonds and can include the following:

- Limited liability companies (LLC)

- Private limited partnerships

- Secured and unsecured notes (mortgages and deeds of trust)

- Partnerships and joint ventures

- Private stock

- Publicly traded stocks, bonds and mutual funds

- Other investments

- Judgments /structured settlements

- Tax sale certificates

- Car paper

- Factoring

- Accounts receivable

- Commercial paper

- Equipment leasing

It is important to find a custodian that is experienced with handling these investments, as special tax reporting rules and operational procedures apply.

Self-Dealing Prohibited

You can purchase land or property (residential and commercial) in your IRA as long as it does not result in self-dealing. This means you cannot purchase a home or building in which you will reside or do in business in your IRA. Your IRA also cannot purchase any property owned by you or a business in which you or certain members of your family have a specified percentage of ownership. The IRA is also prohibited from selling any property to you or any of the aforementioned parties.

Operational Procedures And Taxes

Once you’ve provided the documentation and proper instructions for purchasing the property, your IRA custodian will initiate the purchase for your IRA. The title of the property will reflect the name of your IRA custodian. All property-management and property-specific expenses must be made through the IRA, so the IRA must have sufficient cash to pay these amounts. Having to rely on outside capital to fund management expenses can lead to the loss of tax benefits or the incurrence of penalties.

If the property is debt-financed, it can create what is known as unrelated business income tax (UBIT) or unrelated business taxable income (UBTI), which is taxable under the IRS code. This is unlike other earnings, which are tax-deferred until withdrawn from the IRA. Investors wishing to invest in debt-financed assets should contact their tax advisor to investigate the tax implications. (Learn to use debt ratios to gauge a company’s financial health in Debt Reckoning .)

Checkbook Control

For investors wanting greater influence over their investments, checkbook control is another option. Self-directed IRAs that offer checkbook control allow the IRA owner to make purchases by writing checks on behalf of the IRA. The transactions are facilitated through an LLC that is owned by the IRA. Other legal structures, such as S corporations. are usually not available, since they do not allow IRAs as investors. Creating an LLC to do one’s IRA investing can give an investor even greater control over their assets and reduce certain custodial fees. (Learn more about the advantages of LLCs and S corporations in Should You Incorporate Your Business? )

Typically, the IRA owner has the option of performing certain management functions, such as advertising, collecting and depositing rent checks and paying related bills. This puts the investor at a great advantage, especially when purchasing real estate foreclosures. which is usually a time-sensitive proposition requiring the ability to write checks at the courthouse steps. (Read more about foreclosure investing in Foreclosure Opens Windows For Investors and Foreclosure Investing Not A Get-Rich-Quick Venture .)

Retirement Implications

Direct real estate investing has historically given rise to significant wealth for investors that understand the risk-return tradeoff of this asset class. Even though many retail investors buy, manage and rent taxable properties, less than 2% of retirement accounts include real estate of any kind. The use of self-directed IRAs gives investors the ability to directly invest in property and other real estate-related assets while providing the tax-deferment abilities of Traditional IRAs. (Read more about the regulations affecting Traditional IRAs in Traditional IRA Deductibility Limits .)

Real estate investment by retail investors is on the rise, but for the most part it has been limited to real estate investment trusts (REITs) and real estate mutual funds. Section 408 of the Internal Revenue Code allows for the purchase of property with funds held in many common forms of IRAs, including a Traditional IRA, a Roth IRA and a simplified employee pension (SEP) IRA. Self-directed IRAs allow investors the same discretion as they typically have over their taxable investments, but allow for the tax-deferred growth of earnings. Individuals who want to hold real estate in their IRAs should consult a tax professional and/or ERISA attorney who is experienced in this area.