High Yield Municipal Bond Funds What You Need to Know

Post on: 21 Апрель, 2015 No Comment

High yield municipal bond funds invest in municipal bonds that are rated BB+ or below for both S&P and Fitch, and below Ba1 for Moody’s. (not familiar with credit ratings? go here )

Unlike the corporate bond market where the majority of issues are below investment grade, the majority of municipal bond issuers have investment grade ratings. This fact contributes to the very small municipal bond default rate of less than ½ of 1% of all municipal bonds.

There are high yield municipal bonds as well however, which are primarily focused among revenue bonds. Although these bonds are riskier than their investment grade counterparts, the historical default rate for high yield municipal bonds is in the 1% per year range. This compares to an average historical default rate of around 4% per year for high yield corporate bonds. So even when comparing high yield corporate bonds to high yield municipal bonds, high yield municipal bonds have considerably less credit risk. You can learn more about this in our article “Municipal Bond Defaults, Safety, and Credit Ratings ”.

High Yield Municipal Bond Funds and Non Rated Municipal Bonds

Municipal bonds with below investment grade credit ratings are not the only type of bonds that high yield municipal bond funds invest in. They also specialize in non-rated municipal bonds, which may or may not have a high risk of default. If a municipal bond issuer wants to have their bonds rated they must pay the ratings agencies to rate their bonds. On the low end of the range this costs over $40,000 per agency. As many municipalities like small cities and towns issue municipal bonds in denominations of as little as a few million dollars (a relatively small amount in a $3 Trillion plus market) it is not cost effective for them to pay for ratings. Since their bonds are unrated, they will have to pay a higher yield to attract buyers, but the extra cost they incur paying the higher yield, is still lower than the cost of having their bonds rated.

Since non-rated issues are normally small, they do not trade very actively. This can be an advantage for high yield municipal bond funds because it may be easier to find bonds that are yielding significantly more than a rated bond of a similar credit quality and maturity. As most municipal bond funds have their own in house research teams for credit analysis, they do not rely heavily on the rating given by the rating agencies anyway. This can also be a disadvantage however, as there is not an active market for these bonds. If the fund wants to sell the bonds, they are likely to have sell them below their “fair” value in order to attract a buyer, and may not be able to sell them at all.

Why do people invest in High Yield Municipal Bond Funds?

There are two primary reasons:

The first is to earn a yield that can be significantly higher than what they will receive on an investment grade municipal bond fund. Historically high yield municipal bonds have yielded around 3% more per year on average than their investment grade counterparts. In June 2012 when this article was published, the average yield of the 5 largest high yield municipal bond funds was was 5.76%. This compares to an average yield of the 5 largest national intermediate term municipal bond funds of 3.2%. That is a difference of 2.76%, and would give the investor in the high yield municipal bond fund 44% more income than the investor in the investment grade fund. As with all municipal bond funds, this is income that is also free of federal taxes, making the after tax yield even higher.

The second reason people invest in high yield municipal bond funds it to get access to the relatively high yields that these bonds pay, with the reduced risk that the diversification investing in these bonds through a bond mutual fund offers. Most bond mutual funds, including high yield municipal bond funds, do not hold more than 2% of the money in the fund in any one issue. This means that even if there is a default on one of the bonds that the fund holds, it is not likely to be a catastrophic event for the fund.

What are the Dangers of High Yield Municipal Bond Funds?

Although most bond fund investors focus on yield, its really total return that matters most. As bond prices change based on interest rates and other economic factors, so do the value of the shares that the mutual fund investor holds. Ultimately, if a high yield municipal bond fund gives you a great yield, but loses you money over all, then that’s not a good thing.

Whether the state of the economy is good or bad, as well as other factors like how people view municipal bonds in general, will have an effect on all municipal bonds. In these times of shifting economic conditions and investor sentiment, the more credit risk a bond fund has, the worse its performance will be.

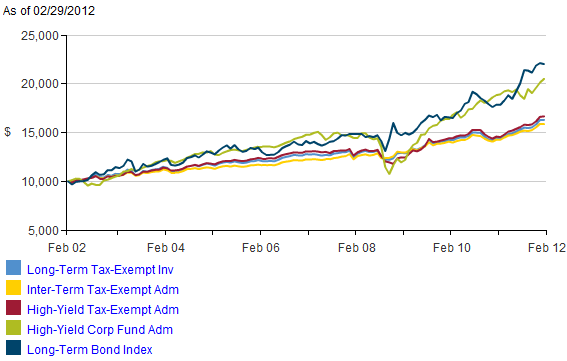

To demonstrate this point lets take a look at a chart of the The Vanguard Long Term Tax Exempt Fund VWLTX (Blue Line) and the average return of all funds in the High Yield Municipal Bond Funds Category Average (Orange Line) going back the last 10 years.

As you can see up until the financial crisis in 2008 when the economy was doing well and investors were in a risk taking mood, the average high yield municipal bond fund would have given you a nice boost in returns vs. their investment grade counterparts. As the financial crisis progressed in 2008 however, the average high yield muni fund took a very large dive in value. While investment grade municipal bond funds fell as well, the fall was no where near as drastic as with their high yield counterparts.

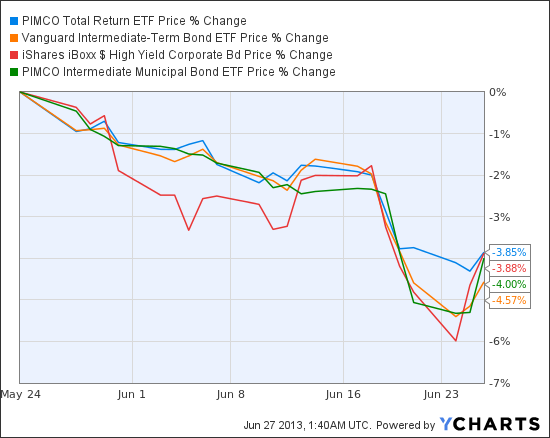

The volatility of returns is also higher with high yield municipal bond funds because it can be difficult to sell high yield municipal bonds. Liquidity, or being able to enter and exit a position when needed without having to accept a significant discount in the price of the bond, is an issue for many municipal bonds. However, it is especially an issue in high yield and small non-rated municipal bonds. This means that High Yield Municipal Bond funds are also more vulnerable to negative shifts in investor sentiment. If investor sentiment shifts and many investors decide they want out of their high yield municipal bond funds, this can force the fund to sell their illiquid assets at fire sale prices in order to meet their investor redemption requests.

What’s the Bottom Line?

The mistake that many investors in high yield municipal bond funds make, is that they focus only on the higher yields that these funds provide. When considering investing in high yield municipal bond funds the first question that investors should ask is not how much more do they yield, but how much riskier the fund is and how much more volatile their returns in the fund will be?

Only after an investor is comfortable that they understand all the risks, should they consider whether or not the potential for a higher yield and total return is worth the risk to them.

Want help choosing a high yield bond fund? Visit the LB Ratings section here at Learn Bonds .