High Yield Led Bond Funds In February

Post on: 19 Апрель, 2015 No Comment

F ebruary’s bond market action reflected the mirror image of January’s performance. More than half of fixed-income categories underperformed, with high-yield and a few specialty bond mutual funds going against the grain with gains.

While January’s bond mutual funds rallied in a strong flight-to-quality move, last month saw a pullback as a number of solid economic indicators showed the U.S. economy is improving, thereby increasing the probability of future Federal Reserve rate hikes.

General U.S. Treasury funds gave back 2.96%, while short and intermediate U.S. investment grade funds retreated 0.20%, according to preliminary data from Lipper, Inc.

January was kind of a risk-off month, with the curve flattening a lot and (bonds) rallying in general, said Chuck Burge, senior portfolio manager with Invesco Fixed Income. And I think we’ve had a reversal of that in February, where it’s been more of a risk-on: spread sectors have outperformed and the yield curve has steepened.

Strengthening Economy

The U.S. Bureau of Labor Statistics reported in early February that total nonfarm payroll employment rose by 257,000 in January, with the largest gains occurring in retail, construction, health care, financial services and manufacturing. The unemployment rate had remained unchanged since October at 5.7%.

However, an even more significant effect on the markets was the upward revision of prior estimates, indicating that an additional 147,000 jobs were created in November and December. This gave the equity markets a real boost, with the S&P 500 surging 5% in February, scoring the biggest monthly gain in more than three years.

The time frame of the Fed funds increase came into spotlight and moved from being maybe a late 2015, maybe even 2016 time frame to something more in line to what the Fed had been communicating, which may be the May-June (2015) time frame, said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management .

We’re in the camp that they’re going to react sooner rather than later, he added. When you look at the jobless claims numbers, all in all, we’re continuing to see very good traction in the labor markets. We really don’t see that changing much, even despite perhaps some headwinds from layoffs in the energy space.

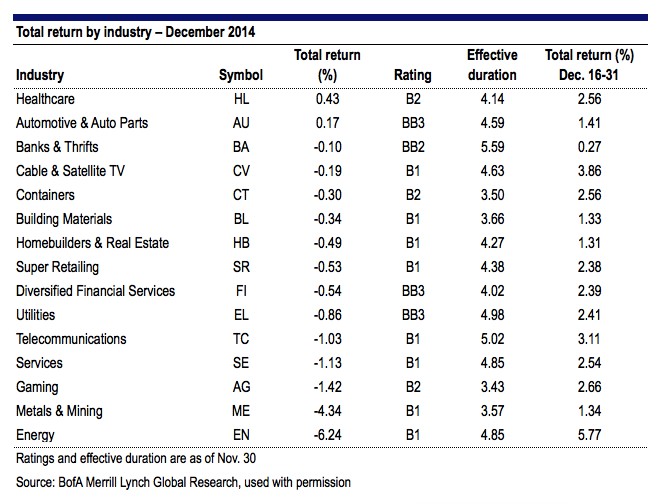

Oil prices recovered somewhat, reversing their downward slide. This helped the high-yield funds, which soared 2.25% in February and laid claim to the top-performing bond fund category. Nevertheless, investment-grade corporate debt continued to suffer, with A-rated funds declining 1.04% and BBB-rated ones giving up 0.82%.