Hedge world 4 Alternatives To Traditional Mutual Funds

Post on: 30 Март, 2015 No Comment

4 Alternatives To Traditional Mutual Funds

The first generation of mutual funds began to impress their existence

upon the public consciousness in the early 1970s. These open-ended

vehicles became widely used by both individual and institutional

investors to fund retirement plans, provide current income and

diversify small portfolios. But the 1990s saw the advent of several

new types of funds that were more streamlined, liquid and efficient

than traditional open-ended funds. This article explores several

reasons why the traditional open-ended mutual fund may be losing its

relevance. (For related reading, also check out _How To Pick A Good

Mutual Fund_.)

*TUTORIAL:* Mutual Fund Basics

*Cost Disadvantages*Although the first generation of mutual funds has

helped millions of Americans achieve their financial goals, they also

have several substantial disadvantages, such as high costs and

illiquidity. Many A-share mutual funds carry initial sales charges as

high as 5.75% and charge annual 12b-1 fees as high as 1%. B-shares

can have back-end sales charge schedules that gradually decline the

longer you hold your shares and C shares typically do not have initial

sales charges but can charge a back-end load if the shares are sold

within a short time frame. The latter two share classes also typically

have higher annual expenses than A shares. Obviously, this

substantially reduces the return on capital to the investor, both in

the short and the long term.

_Example_

John invests $100,000 in the A-share class of a growth fund. He pays

an initial sales charge of 4.75%, thus reducing his initial principal

to $95,250. The 12b-1 fees also reduce his average annual return of 8%

per year to 7.25%. If John leaves his money in the fund for 20 years,

the initial charge and lower annual return will reduce his overall

savings by nearly $80,000.

*Liquidity Disadvantages*Owners of open-ended mutual funds must also

wait until the settlement date to get their money out of the fund. An

investor who sells shares of a fund on Monday will not be able to take

constructive receipt of the sale proceeds until Thursday of the same

week, at the earliest. For investors who need to access their money

quickly for any reason, this can be a real problem.

*Forward Pricing*Mutual fund prices also lag the markets on a daily

basis. Because the portfolio managers trade securities within the

portfolio on a daily basis, it is impossible for open-ended funds to

post an intraday share price. They must instead use forward pricing,

which is based on the daily closing prices of all of the securities

within the portfolio.

*Performance Disadvantages*This is perhaps the greatest disadvantage

posed by open-ended funds. Although many funds have posted impressive

returns over five- and 10-year periods, the average annual returns of

virtually all stock funds have lagged those of the market itself over

longer periods of time. As of 2010, only one mutual fund that has

existed since 1970 has beaten the 10-year rolling return of the S&P

500 Index every single year. The rest have underperformed the markets

as a whole, which has led to the popularity of index funds that simply

invest directly in the S&P 500 or other index.

*Taxation Disadvantages*Although taxation of any type of investment

that is not housed inside a Roth IRA is inevitable, the taxation of

open-ended mutual funds is especially inevitable. Open-ended mutual

funds almost always pass on a pro-rata share of capital gains (and

losses) distributions to shareholders once each year, typically in

November. This means that any shareholder who owns shares in a taxable

account will have gains or losses to report every year. These gains or

losses may adversely affect the amount of income that the investor had

planned on reporting that year.

*Alternatives to Open-Ended Funds*Over the past 20 years, a plethora

of alternatives to open-ended funds have arisen. Although some of

these vehicles have become more popular than others, they all offer

diversification and some degree of professional management without

many of the shortcomings of open-ended funds. A list of these

includes:

*Unit Investment Trusts* *(UITs)*These instruments resemble mutual

funds in that each unit of the trust represents a portion of each

security that is held within the portfolio. However, they are more

tax-efficient than actively managed funds, although they may post

substantial gains or losses when the trust matures.

*Variable Annuity Subaccounts *These are essentially clones of

taxable retail funds, but must be treated and reported as separate

securities for regulatory reasons. Variable subaccounts have most

of the same disadvantages as open-ended funds except that they do

not post capital gains distributions.

*Closed-End Mutual Funds*

These funds have a limited number of shares than can be issued to

investors. Once all of the shares are sold, the fund is closed to new

investors and the shares begin trading in the secondary market.

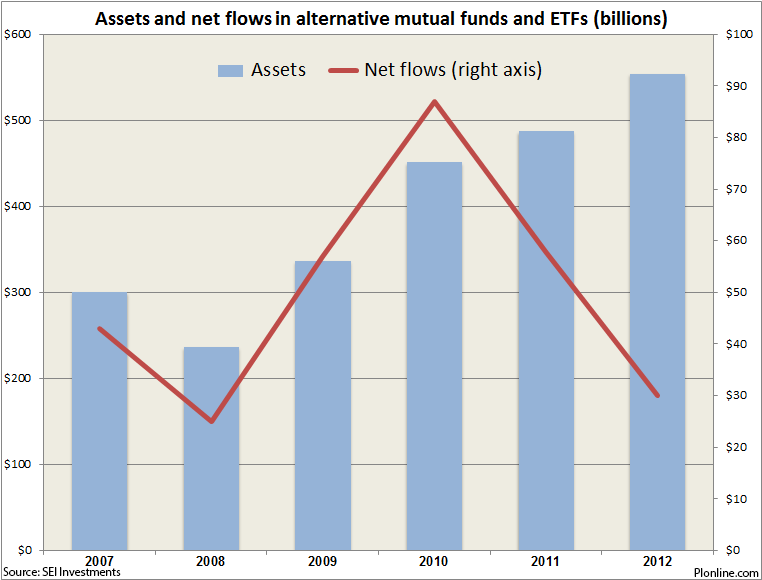

* *Exchange-Traded Funds* *(ETFs)*Although this class of fund is

still the new kid on the block, ETFs have quickly become very

popular with serious investors for a number of reasons. As their

name implies, these funds trade like stocks on the major exchanges

and can be sold like any other security while the markets are

open. They provide liquidity, diversity and some degree of

professional management as well as tax efficiency in most cases.

They can be ideal instruments for tax-loss harvesting.

*Bottom Line*Although there is still a huge market for open-ended

mutual funds, their relative illiquidity, tax inefficiencies and

subpar performance compared to their benchmark indexes over time

have led to the creation of several more-efficient alternatives.

Instruments such as ETFs and UITs are rapidly increasing in

popularity and may eventually supplant their more traditional

cousins.

*by Mark P. Cussen*,CFP, CMFC

Mark P. Cussen has more than 15 years of experience in the financial

industry, which includes working with investments, insurance,