Hedge Funds Just High Fees or Higher Returns

Post on: 16 Май, 2015 No Comment

Hedge Funds Just High Fees or Higher Returns

Different to mutual funds, hedge fund managers play a role in the management of investment portfolios with an objective of achieving total returns regardless overall index or market movement. Hedge fund managers also execute their trading strategies with more freedom than mutual funds; however they are not always registered with Securities & Commissions commission or other regulatory body. Richard Cayne Meyer Asset Management Ltd Tokyo is a specialized hedge fund consultant, and will give advice on all matters relating to hedge funds.

The major reasons for investing in hedge funds are: seeking higher returns, and or diversification. To determine how good hedge funds are will largely depend on your fund manager, and the advice you get. Richard Cayne Meyer Asset Management Ltd Japan is made up of highly skilled professionals consulting on hedge funds, and other financial matters.

Achieving higher returns is not a guarantee. Many hedge funds invest in the same securities available to individual investors and mutual funds. You can only achieve higher returns by picking a timely strategy or selecting a superior fund manager. With help from consultants like Richard Cayne Meyer Asset Management Ltd Tokyo that would be easier than going at it alone. Experts argue that choosing the right fund manager is what really matters, and you can greatly increase your chances of higher returns by selecting experienced and certified hedge fund managers with the assistance of Richard Cayne Meyer Asset Management Ltd Japan

Timely Strategy

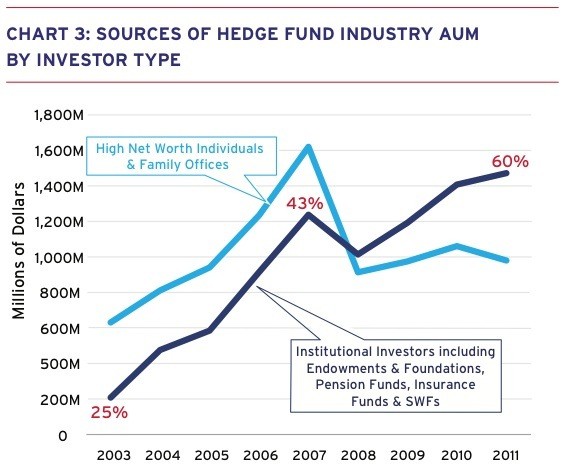

A timely strategy in hedge funds is critical. Cited statistics from CSFB/Tremont Index with regard to the performance of hedge funds in the 90s reveals so. Between January 1994 and September 2000, a rampant bull market according to definition, the S&P 500 Index outperformed all important hedge fund strategies by a staggering 6 percent annually. During the period, hedge fund strategies performed differently. For instance, dedicated short strategies fell badly while neutral market strategies surpassed the S&P 500 Index. If the overall market outlook seems bullish, you would need a specific reason to assume hedge funds to outperform the index. On the other hand, if the outlook seems bearish, hedge funds would make an attractive asset compared to mutual funds or buy-and-hold. To help you make an informed decision on hedge fund investment, Richard Cayne Meyer International Thailand has the expertise in consulting high net worth individuals and family offices.

Benefit of Diversification

Most institutions invest in hedge funds to enjoy the benefits of diversification. If you have investment portfolios, adding non-related, positive-returning assets will mitigate overall portfolio risk factors. Because hedge funds employ short sales, non-equity or derivative investments – they tend to be uncorrelated with wider stock market indexes. If you would like to know more about how to generate higher returns through diversification, the services of firms like International Thailand can help increase your portfolio.

www.isdx.com/Asia Wealth Group .