Hedge fund talent draw to hurt mutual funds

Post on: 13 Май, 2015 No Comment

NEW YORK (Reuters) — The best new talent for managing money no longer heads to mutual funds as better-paying hedge funds are luring the smartest business school graduates.

Hedge funds are grabbing the most promising candidates from such schools as Wharton, Stamford and Stern because they offer a greater intellectual challenge and potentially better pay, speakers at the Reuters Hedge Fund Summit said this week.

The brain drain has become so widespread that some say it could result in stodgy asset management performance, as seen in the insurance industry.

I think that the mutual funds, 20 years from now, might be viewed a bit like the way we view insurance companies today, said Robert Niehaus, chairman of Greenhill Capital Partners LLC, the private equity arm of investment bank Greenhill & Co.

Niehaus, speaking at the summit held at Reuters U.S. headquarters in New York, said that mutual funds will have to come up with better compensation packages to attract and retain the best talent available on the Street. For the very best, hedge funds now offer the greatest potential remuneration as they charge more for their services than mutual funds.

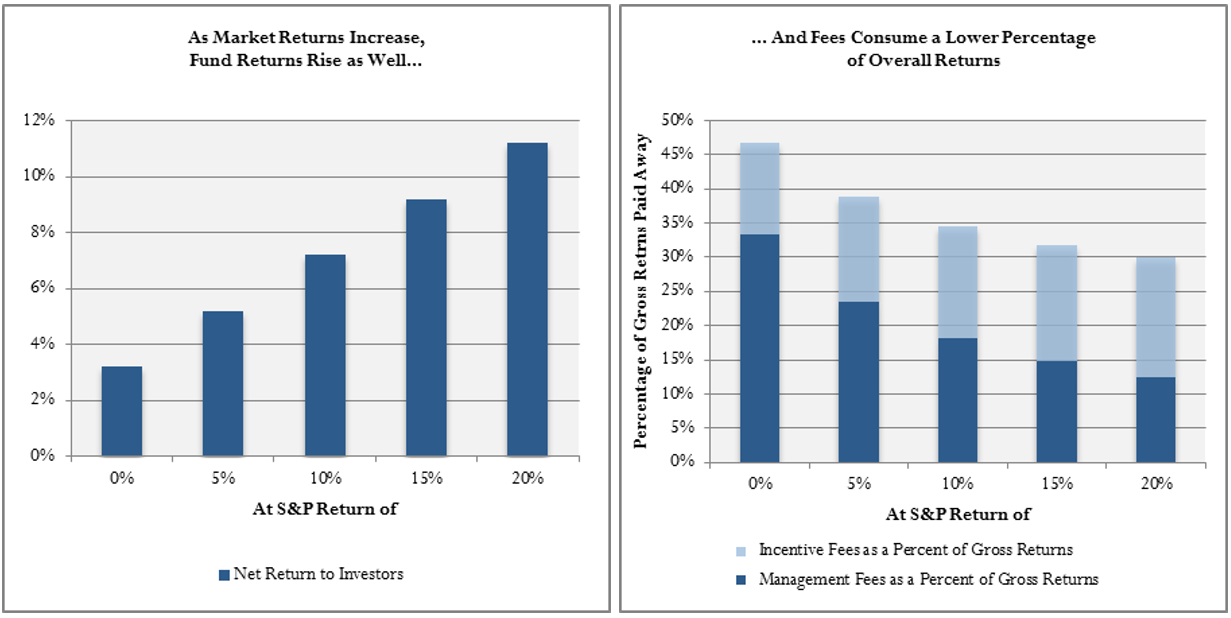

Hedge funds typically charge 2 percent of assets under management, and 20 percent of any profits they generate, way beyond the 1 percent or so of assets under management that mutual funds charge for managing institutional money.

While there are many well-respected money managers in the mutual fund industry who are committed to the companies they work for, the flow of talent to hedge funds implies in the long term the quality of people who work at mutual funds will slip.

The attraction of hedge funds has been a long process that started to pick up about 10 years ago, said Jane Buchan, chief executive of Pacific Alternative Asset Management Co.

The quality of the top quartile of hedge fund managers today are so much above the caliber of a decade ago, she said.

Her company recruits graduates from the top U.S. business schools, people who in the past would have gone to the best mutual fund companies, such as Fidelity Investments, she said.

Leonard Harlan, president of private equity firm Castle Harlan Inc. said the appeal of hedge funds is affecting the talent search in his industry.

Right now, the business du jour for folks getting out of business school are the hedge funds, he said. Young people see that some folks are making money very quickly. It’s going to be interesting to see how that works over the longer term.

Already hedge funds produce the best research, said Mario Gabelli, chairman of GAMCO Investors Inc. ( GBL.N ), an asset management company with $28 billion in assets under management and 24 analysts dedicated solely to research.

The hedge funds are doing better research when they’re stock specific than any other organization, said Gabelli. A hedge fund manager in theory has the smartest people. They’re very focused, highly incentivized.

Gabelli said that because of higher compensation in hedge funds, within three years the business school graduates he’s hired will have moved on. They are careful about going to a firm that is highly leveraged and know the hours in money management are long, but hedge funds can pay better, he said.

You can’t compete, he said.

Of course, there is always a two-way street in any industry, with many people who have gone to hedge funds seeking to go back or enter the mutual fund side of asset management. There is a mercurial side to hedge funds, and their life span is not always that long, perhaps just three years.

Still, the bottom line is you get what you pay for, said Mark Yusko, founder of Morgan Creek Capital Management. For mutual funds, that might not bode well.

All things aren’t equal, Yusko said. There are great managers, there are good managers and there are poor managers. If you pay low fees to get a poor manager, you lose.

(New York newsroom +1-646-223-6019)