Growth v Mutual Funds

Post on: 31 Май, 2015 No Comment

T he last article in this series covered the market cap of funds. asking whether size matters. Today we look at the difference between growth vs value mutual funds.

Value Funds. A value stock is one that is undervalued according to some measurement. It may be undervalued because its in an industry that is struggling. It may be undervalued because its not in one of the hot industries (think technology in the late 1990s). Whatever the reason, the company is trading at a price that may not reflect its actual value.

Growth Funds. A growth stock is one that the market expects to enjoy substantial growth in earnings. Often, growth stocks are expensive relative to their earnings because of the high expectation of future growth. Today, Google is a good example of a growth stock.

So how do we determine whether a stock is a value or growth stock? There are two measurements most often used to make this determination: Price-to-earnings ratio (P/E) and Price-to-book ratio (P/B).

The P/E Ratio

Price to earnings is simply the price of the stock divided by the earnings per share. The P/E ratio can be calculated using the past years earnings (called trailing twelve months, or ttm for short), or using projected earnings for the next year. Both ratios can be useful, but I usually rely on ttm to calculate P/E. I should add that there are many, many other ways to calculate P/E. Some take the average annual earnings of the past 3 or 5 years. The reason is to smooth out the earnings, which over the course of a single year may be skewed due to some extraordinary event at a company.

Morningstar uses projected earnings to calculate the P/E for its value vs growth determination. So what does the P/E tell you? It tells you how many years worth of current earnings it will take to earn back the cost of the stock. If a stock costs $10 and the company is earning $1 a share each year, the P/E ratio of 10 (10/1) tells you it will take 10 years of earnings to equal the cost of the share. So now how do you feel about buying a stock with a P/E of 50 or more?

The P/B Ratio

Unlike P/E, which is an income statement measure (remember, it uses earnings, which are disclosed on the income statement), P/B looks at a companys stock price in relation to its book value. Book value is simply a companys net worth (assets liabilities). As such, P/B is a balance sheet measurement. As with the P/E ratio, there is more than one way to calculate P/B. For example, some remove from the companys assets all intangible assets. A P/B of 4, for example, tells you that the price of a stock is 4 times its book, or net asset, value.

Using these and other ratios, stocks can be divided into value and growth. The stocks with the lowest P/E and P/B would be considered value stocks, and the shares with the highest P/E and P/B would be considered growth stocks. Now, there are many other ways to determine growth vs value. Morningstar, for example, takes a slightly more complex approach, using several additional ratios and giving each ratio a different weight in the final calculation. In addition, Morningstar divides stocks into three categories: value, blend and growth.

As with individual stocks, mutual funds are classified as either a value fund or a growth fund based on the stocks the fund owns. Funds can own stocks of hundreds of companies, so calculating whether a fund is value or growth can be a monumental task. The good news is, you dont have to do the calculations. The information is available on many websites for free, including Morningstar. Well be looking at how to use Morningstar to determine whether a fund or an entire portfolio is weighted toward value or growth (or blend, which is what they call a fund that is an equal mix of value and growth stocks) in the series on Making the Most of Morningstar.

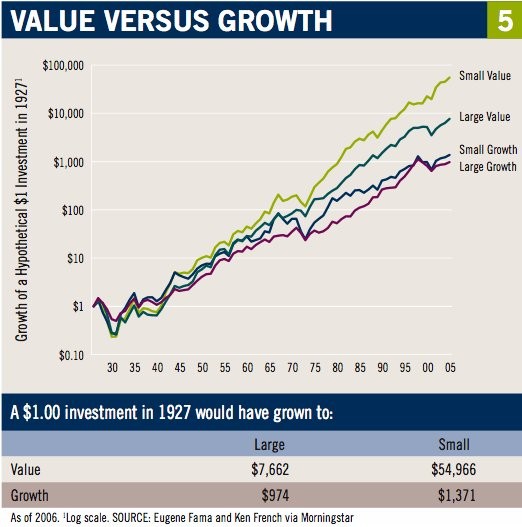

Returns of Value and Growth Stocks

Now to the so what question? Who cares whether a stock, fund or portfolio is value, growth or a blend? As always, we have to look to the past. History tells us that a value fund has greater risk, but with that risk, comes higher returns. One analysis shows that from 1979 to 2003, annualized returns for value stocks was 14.5%, compared to just 12.5% for growth. Because of this, some suggest that a portfolio designed for the long term, say at least 10 years and preferably 15 or 20, have more invested in value funds than growth funds. How much more? Well, theres no one answer to that question. Well look more closely at this question when we begin to build a portfolio later in this series.