Going Green With Exchange Traded Funds Yahoo She Philippines

Post on: 14 Май, 2015 No Comment

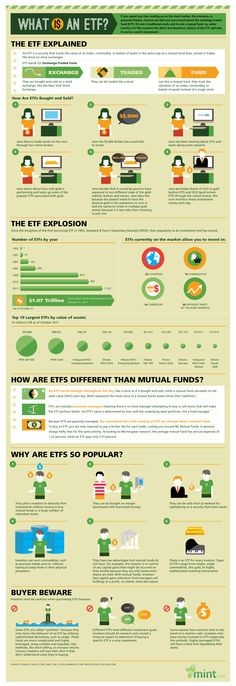

Exchange traded funds, or ETFs as they are commonly known, are investment funds that are traded on a stock exchange. Investors have a wide variety of ETFs from which to choose, from those that track a major market Index to ETFs that track a basket of foreign currencies. Another type of exchange traded funds are green ETFs, or those that focus on companies that support or are directly involved with environmentally responsible technologies, such as the development of alternative energy or the manufacturing of green technology equipment and devices. Todays investors have access to a growing number of green ETFs, allowing them to incorporate environmentally friendly strategies in their investment decisions.

What Is a Green Investment?

Green investing, whether it pertains to ETFs, mutual funds or individual stocks, refers to investment activity that focuses on companies whose business supports or promotes conservation efforts, alternative energy, clean air and water projects and other environmentally responsible business decisions. The majority of green ETFs focus on companies involved directly or indirectly with the research, development, production and providing of alternative energy. Companies may be distributors of alternative energy or may be manufacturers of parts and equipment needed to produce the energy, such as the photovoltaic cells necessary for creating solar panels. Each ETF has its own criteria for determining the eligibility requirements for assets.

Considerations in Defining Green

Many new businesses are able — with careful planning — to go green from the start. Established companies, however, with years or decades of bad habits have to work extremely hard to turn their routines into environmentally friendly practices. This can leave companies with one foot in the old school, environmentally irresponsible group, and the other foot in the modern, green movement. Automobile manufacturers are good examples: the same company that is making gas-guzzling SUVs might also be on the forefront of developing hybrid and electric cars.

So what makes a company or an ETF green? Currently there are no strict rules regarding which companies or investment instruments are officially green. Many of the considerations are a matter of opinion. For example, some people consider nuclear energy to be a clean and green energy choice, while others would argue that the toxic waste precludes it from being environmentally responsible. In general, it is up to each investor to decide if an investment instrument is green by his or her standards.

Green ETFs

Although each investor must decide if an investment is green, there are a growing number of ETFs that are based on companies that are actively engaged in the research and development of alternative energy sources; namely broad clean energy, wind, solar and nuclear:

Broad Clean Energy ETFs

Broad clean energy exchange traded funds are involved in the alternative, renewable and clean energy sectors. ETFs based on broad clean energy include:

- PowerShares WilderHill Clean Energy Portfolio (ARCA:PBW ): This fund is based on the WilderHill Clean Energy Index and selects companies focused on greener and renewable energy sources and technology that facilitates cleaner energy. The fund has a large focus on holding small cap firms and implements a growth strategy investment approach.

Wind Power ETFs

Wind power converts wind energy into other forms of useful energy. Wind turbines are used to generate electricity, wind mills create mechanical power and giant sails can be used to provide thrust for ships. Energy production of wind power has increased, and more than 80 countries are using wind power on a commercial basis. ETFs based on wind power include:

- PowerShares Global Wind Energy Portfolio (Nasdaq:PWND ): This ETF tracks the Nasdaq OMX Clean Edge Global Wind Energy Index. The Index includes numerous international companies that are manufacturers, developers, distributors, installers and/or users of wind-powered energy sources.

Solar Power ETFs

Solar power harnesses the suns energy and converts it into electricity, either directly using photovoltaic cells or indirectly using concentrated solar power (CSP). Germany, Canada and Spain are among the world leaders for solar innovation. The price drivers for solar ETFs include oil prices (which are generally positively correlated); government subsidies and incentives and technological developments. ETFs based on solar power include:

- Market Vectors Solar Energy ETF (ARCA:KWT ): This fund aims to replicate the yield performance of the capitalization weighted index Ardour Solar Energy Index. Domestic and international corporations are represented with significant investments in China, the United States and Germany.

Nuclear Energy ETFs

Nuclear power is the product of controlled nuclear reactions, and accounts for a rapidly growing percent of global electricity. Despite historical drawbacks such as Chernobyl and The Three Mile Island, utilities and miners have begun to focus their resources on uranium and nuclear energy. ETFs based on nuclear energy include:

- PowerShares Global Nuclear (ARCA:PKN ): This fund is based on the WNA Nuclear Energy Index. Represented are globally traded companies that are engaged across multiple areas of the nuclear energy industry in reactors, utilities, construction, technology, equipment, service providers and fuels. The funds holdings include those companies in the industrials, energy and utilities sectors.

The Bottom Line

This article highlights only eight of the many green ETFs that are available to todays investors. Others include (without descriptions):

- PowerShares Water Resources Portfolio (ARCA:PHO )

- PowerShares WilderHill Progressive Energy Portfolio (ARCA:PUW )

- PowerShares Global Clean Energy Portfolio (ARCA:PBD )

- PowerShares Global Water Portfolio (ARCA:PIO )

- PowerShares CleanTech Portfolio (ARCA:PZD )

- Market Vectors Global Alternative Energy ETF (ARCA:GEX )

- Market Vectors Environmental Services Index (ARCA:EVX )

- Market Vectors Nuclear Energy ETF (ARCA:NLR )

- First Trust ISE Water Index Fund (ARCA:FIW )

- First Trust Nasdaq Clean Edge Green Energy Index Fund (Nasdaq:QCLN )

- Claymore S&P Global Water Index ETF (ARCA:CGW )

Interested investors can further research green ETFs by speaking with a qualified financial consultant.

Many green investments involve newer and smaller companies, which often equates to greater volatility and/or weak performance. That said, as these companies gain traction and the need for alternative energy is further realized and regulated, green investing will likely become an increasingly stable platform for investors.

The exchange-traded funds included in this article are examples only and do not represent any actual positions held by the author. The intention of the article is to introduce readers to green ETFs and not to make any inferences or recommendations regarding specific investments.

More From Investopedia