GoalBased Investing A Strategy Everyone Should Know

Post on: 3 Сентябрь, 2015 No Comment

Goal-based investing seems like an obvious tactic. After all, don’t all investors have goals? But many investors have only a vague idea what their goals are, much less how to achieve them.

The Traditional Approach

The traditional approach toward investing, which is used by most 401(k) retirement plan investors, begins with your time horizon and risk tolerance. This is often evaluated by a short “risk quiz” that asks about your willingness to sustain a 10% loss, a 20% loss, etc. and how many years you have to reach your goal.

After answering a few questions, you are directed to choose investments from a list of mutual funds. From there, you deposit money into your 401(k) plan with each paycheck and hope that, over time, you will have enough money to support yourself when you retire.

For many investors, “target-date funds” are the vehicle of choice for retirement savings. You simply match the date of your retirement with the date on the fund and you’re done. Yet this traditional approach simply defines the goal as “retirement” while making little effort to identify how much money you’ll actually need once you get there. (For more, read: Investing With Purpose: Target Date Funds. )

A slightly more advanced tactic uses a back of the envelope estimate that you’ll need 70%-80% of your pre-retirement income to live on, which requires a nest egg of 10 times your final salary. While this is a slightly better approach, it still is rather imprecise when you consider the importance of the goal.

A Different Approach

Goals-based investing takes a much more specific approach. For example, rather than listing “retirement” as your objective, you might choose “retire at age 55” as your goal.

In evaluating that goal, you determine that your bills (home, utilities, healthcare, food, a nice vacation each year, a small cushion of savings each month) will come to $3,000 a month. You may live to 100, so you will need to generate that $3,000 a month for 45 years.

At age 67½. your income will be supplemented by Social Security and your health-care coverage will convert to Medicare. so you need that $3,000 for 12½ years (67 ½ minus 45). After that, your medical expenses should fall and your income should rise, helping to offset inflation, which you expect to run at about 2.5% per year.

Based on these projections, you determine that your income goal is adequate and that you have the option of moving to a smaller home in a less expensive city if money gets tight.

Now, the real planning begins. Looking at your current age and income, determine how much money you’ll need to save each month—and how big a return you’ll need on your investments—to produce the desired monthly income when you retire. This has almost nothing to do with your risk tolerance or your target date and more to do with the reality of your current income, the amount you can afford to invest and realistic expectations for market returns.

If you are risk averse and choose a conservative investment vehicle, your odds of achieving your goal may be zero. At the same time, if you take wild risks in the market with an aggressive investment plan, your odds may still be zero.

In that case, evaluating your current lifestyle, the lifestyle you want to have in retirement, your ability to save and the likely return on your investment, you may need to rethink your objective. This could involve delaying your retirement date, saving more, moving to smaller home immediately, cutting your expenses, continuing to work during retirement or a combination of these choices. (For more, read:Investing 101: A Tutorial For Beginner Investors . )

Other Goals Besides Retirement

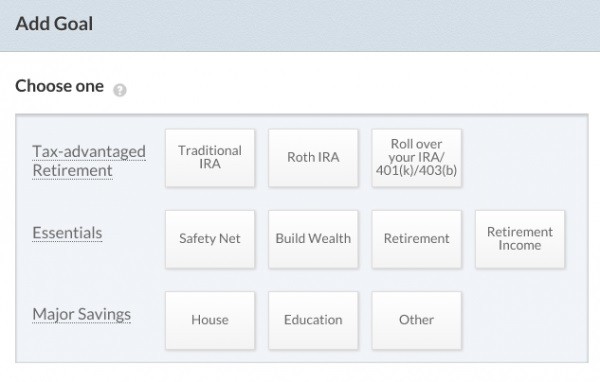

While retirement is a popular objective for investors, goal-based planning has other uses.

Most people have multiple objectives, and planning for all of them at the same time may be critical to your achieving them. Those goals may include saving to buy a second home, funding a child’s education or doing both while still saving for retirement.

Here again, the details are worth considering. Looking at college funding, for example, rather than setting your goal as “save $80,000 for college,” a goals-based approach would take a more granular look. The true objective may be to “fund eight semesters of tuition at $10,000 each beginning 20 years from today.”

Looked at in this manner, you don’t need $80,000 in cash 20 years from now. You actually have 24 years to complete the funding goal. The extra four years and partial funding spread across multiple years could change the way you pursue the objective. (For more, read: 6 Retirement Savings Tips For 45- To 54-Year-Olds. )

Different Measure of Success

The traditional method of gauging success is comparing your investment returns against a passive benchmark such as the Standard & Poor’s 500 index. If you beat the benchmark, you are judged successful.

Although this is useful when markets are rising, few investors find solace in the 1% “outperformance” of a portfolio that is “only” down 29% when the market falls 30%. Similarly, a portfolio that is up 2% when the market is up 1% isn’t really relevant if you don’t have enough money to fund your goals.

Using a goals-based metric, the real measure of success is whether you are on track to meet your funding goals. The risk is not that your investments are more aggressive than your comfort level but that you fail to save enough money to meet your needs.

The Bottom Line

Goal-based investing is more precise, detailed and nuanced than the more traditional “save as much as you can” approach. It requires some serious planning. But developing a true understanding of what you hope to achieve will allow you to make the necessary adjustments to reach your goal.