Getting In On An Initial Public Offering

Post on: 3 Апрель, 2015 No Comment

Highlights

- It’s easier to allocate many shares to one big investor than to many small ones.

- Brokers underwriting the deal tend to give their best customers first dibs.

- A few mutual funds that specialize in IPOs are accessible to all investors.

If the goal of investing is to buy low and sell high, then getting in on an initial public offering — more commonly called an IPO — must be the ticket to riches. Buy a hot new stock at a discount and then sell it for a huge profit just hours or days later, right? Seems like a sure thing.

But for most individual investors, that dream of getting in on the IPO action will never be realized. And that’s not necessarily a bad thing.

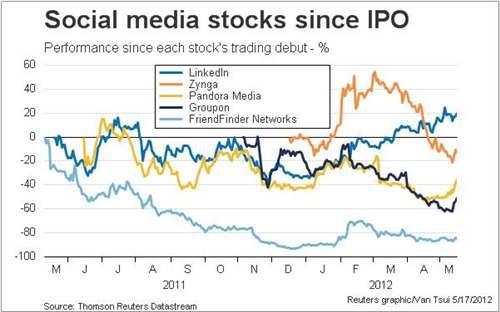

For every fairy-tale stock that takes off like a skyrocket following an IPO, there are cautionary tales of many more IPOs that post lackluster results. Some even crash and burn.

3 reasons you can’t join the IPO club

First, understand the process: When a company goes public and issues stock, it wants to raise capital and make shares available to the public. The IPO is underwritten by an investment bank, broker dealer or a group of broker-dealers. They buy the shares from the company and then distribute the shares to investors.

The brokers find a home for the largest pieces. If there is a lot of interest, the shares go very easily into the hands of institutional investors, says Rob Lutts, president and CIO of Cabot Money Management in Salem, Mass.

More On Investing In Stocks:

investing

Reason No. 1: Big buyers easier to find. Selling a million shares to an institutional investor is much more efficient than finding 1,000 individuals to purchase shares.

But even big institutions often don’t get as much of the action as they would like because the initial public offering may be quite limited.

Especially with a smaller IPO, nobody really gets 100 percent of their fill. In fact, no one gets more than 10 percent of their interest in the allocation, says Kathleen Shelton Smith, principal at Renaissance Capital, a global IPO investment adviser, research and management company.

Reason No. 2: One hand washes the other. Institutions that get to participate in the initial public offering often do a lot of business with the brokers underwriting the deal.

It’s stacked in favor of large asset managers, but it is a money game and everyone is in it to make a buck and that is where it goes — it goes to the best customers of those brokers, Lutts says.

Reason No. 3: Your broker perceives you as poor. Management, employees, friends and families of the company going public may be offered the chance to buy shares at the IPO price in addition to investment banks, hedge funds and institutions. High net worth clients may be rewarded with IPO shares from time to time as well.

If you have an account with the broker bringing the company public and happen to keep most of your vast fortune with that broker, you may be able to beg your way into a hot IPO.

That still doesn’t mean you’re going to get in. For LinkedIn’s (IPO), for instance, unless you were friends or family, you were probably out of luck, says Jeremy Carpenter, portfolio analyst with Investor Solutions in Miami.

Lutts agrees. I manage $500 million and I can’t get the really hot ones.

Lucky to lose out

Once the stock is trading on the exchange, small-fry investors and big-time professionals have plenty of opportunity to buy shares. In fact, waiting for this opportunity can be a smaller investor’s best strategy when it comes to new public companies.