Fund of Funds Advantages Disadvantages

Post on: 21 Июль, 2015 No Comment

Kotak Securities has explained the advantages & disadvantages of a Fund of Funds :

A Fund of Funds (FOF) is an investment strategy of holding a portfolio of other investment funds rather than investing directly in shares, bonds or other securities. This type of investing is often referred to as multi-manager investment.

There are different types of fund of funds, each investing in a different type of collective investment scheme, example mutual fund FoF, hedge fund FoF, private equity FoF or investment trust FoF.

Investing in a collective investment scheme may increase diversity compared to a small investor holding a smaller range of securities directly. Investing in a fund of funds may achieve greater diversification. According to modern portfolio theory, the benefit of diversification can be achieved by reduction in volatility while maintaining average returns. However, this is countered by the increased fees paid on both the FoF level, and of the underlying investment fund.

An investment manager may actively manage with a view to selecting the best securities. A FoF manager will try to select the best performing funds to invest in based upon the managers past performance and other factors. If the FoF manager is skilful, this additional level of selection can provide greater stability and take on some of the risk relating to the decisions of a single manager. As in all other areas of investing, there are no guarantees for regular returns. As a fund of funds invests in the scheme of other funds, it provides a greater degree of diversification. Instead of investing in different stocks of mutual funds and keeping records of all of them, it is much easier to invest and track only one fund which in turn invests in other mutual funds.

Management fees for Funds Of Funds are typically higher than those on traditional investment funds because they include the management fees charged by the underlying funds. As in the case of schemes of mutual funds, FOF schemes also work under the due diligence of a fund manager. This gives the scheme an additional expertise. It also helps to provide access to information which may be difficult to obtain information by an investor on a case by case basis. Every fund manager has a particular style of diversification. This diversification has a perfect correlation with the number of managers involved. Once a FOF reached a certain level of managers, adding more flattens return curve. Since a fund of funds buys many different funds which themselves invest in many different securities, it is possible for the fund of funds to own the same stock through several different funds and it can be difficult to keep track of the overall holdings.

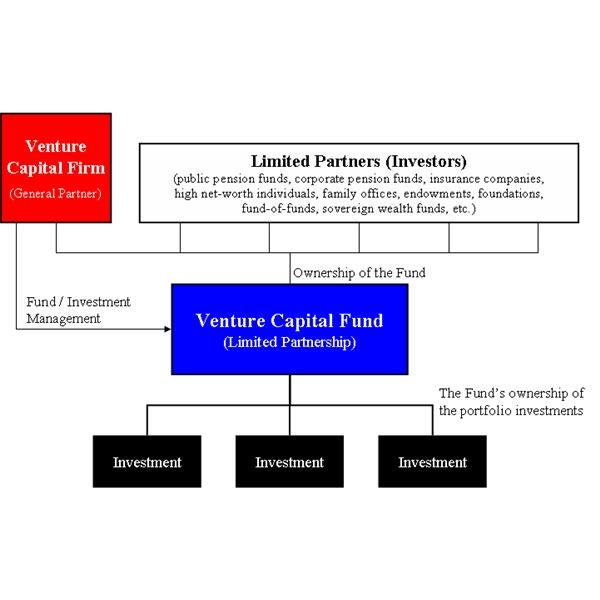

Funds of funds are often used when investing in hedge funds and private equity funds, as they typically have a high minimum investment level compared to traditional investment funds which precludes many from investing directly. In addition hedge fund and private equity investing is more complicated and higher risk than traditional collective investments. The lack of accessibility favors a FoF with a professional manager and built-in spread of risk.

Pension funds and other institutions often invest in funds of hedge funds for part or all of their alternative asset programs, i.e. investments other than traditional stock and bond holdings.

After allocation of the two levels of fees payable and taxation, returns on FoF investments will generally be lower than single-manager funds.

One can find that the Fund of Funds has various advantages and disadvantages. Some of the advantages and disadvantages are:

Advantages of Fund of Funds :

- Simplicity of the Fund of Funds: A person to achieve good results while can invest in one Fund of Funds rather than investing in several different funds. This helps the person to concentrate on only one thing and also helps the investor to take care of limited number of papers.

- Cheap For the New Investor: One finds it very difficult to diversify initially as he has minimum money. For this problem the Fund of Funds become more popular for the new investors as this would help them to diversify among thousands of funds through one vehicle.

- A mutual fundgenerally diversifies through a great number of stocks but a Fund of Funds goes through many different funds which provide the Fund of Funds double diversification.

- One can also have the institutional advantages as one can make investments in various funds which are in other ways off-limit for the retail investors. One also gets the advantages of load funds and for that one does not have to pay the load.

Disadvantages of Fund of Funds:

- Expense Ratios: Nearly all Fund of Funds carry an expense ratio that is on the higher side. These higher ratios can bring down the amount of returns one was scheduled to get.

- One also has to pay some extra charges for keeping the Fund of Funds in force and this can also curtail the amount of income one expected to get.

- It sometimes leads to over diversification.

More information is available at kotaksecurities.com