Fund Analyzer Methodology & Data Sources

Post on: 17 Июнь, 2015 No Comment

Methodology & Data Sources

Expense Analysis

The Fund Analyzer offers information on over 18,000 mutual funds, Exchange Traded Funds (ETFs), and Exchange Traded Notes (ETNs). Data is not currently available for closed-end funds or offshore funds. Please read our disclaimer .

How the Fund Analyzer Expense Analysis Works

The Fund Analyzer uses a rigorous calculation methodology to estimate the value of the funds and impact of fees and expenses on your investment.

Based on the funds you select and the investment amount you enter, the Fund Analyzer will assess a funds front-end load schedule and deduct the appropriate load from your investment. The Analyzer then calculates returns and deducts expenses on a daily basis through each holding period from one to twenty years. It calculates contingent deferred sales charges (CDSCs) automatically. It also handles convertible shares, such as Class B shares.

The Analyzer assumes that the funds are redeemed in full at the end of each year. The results are displayed on the Chart Details area of the tool. For example, the results calculated for year 7 assume that the fund was held through year 7 and then redeemed at the end of that year. The values displayed in the Report Summary and Chart Details portions of the Expense Analysis reflect the deduction of all fees and expenses.

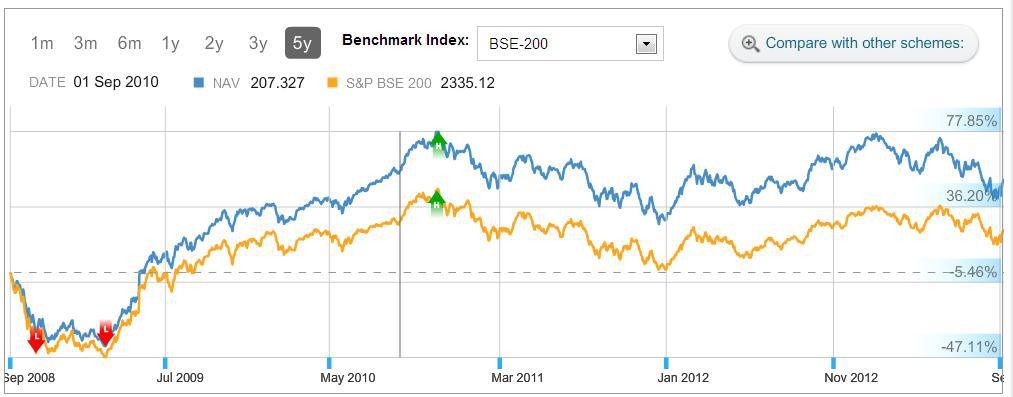

Verified Results

Broker Village is FINRA Investor Educations primary provider for online tool auditing services. Broker Village provides share class analytics and consulting services to fund firms, brokerage firms and regulators. They conducted an independent audit of this tool to refine and verify the calculation methodology and accuracy. The goal was to ensure that it applies appropriate industry practices, accounting standards and SEC requirements.

Fee & Discount Information

The information on the Fee/Discount Report on the Fund Analyzer is provided by the Mutual Fund Profile Service, a product of the National Securities Clearing Corporation (NSCC). NSCC is a subsidiary of the Deposit Trust & Clearing Corporatoin (DTCC). Information in the Mutual Fund Profile Service (MFPS) is entered and maintained by each mutual fund company. Because the MFPS does not necessarily contain the full text of the fund’s name or the fund’s symbol, FINRA has contracted with a third party data provider (Morningstar) to provide these additional pieces of information. All other information is displayed as entered by the fund’s adviser into MFPS.

Participating Funds

The MFPS is primarily designed for U.S. mutual funds sold to retail investors. As a result information on offshore mutual funds, certain mutual fund institutional share classes, ETFs, and ETNs may not be available through this service. Additionally not all fund families participate in this NSCC service. The Fund Analyzer will indicate when information has not been provided and users are encouraged to review the prospectus and/or contact the fund for information.

Obtaining Data Feeds from NSCC

Your comments and questions are welcome. We hope you find our Fund Analyzer helpful. If you have any questions or ideas about how we can improve this tool, please email us.