Frontier ETFs Have Liquidity Risk and Concentration Risk

Post on: 2 Май, 2015 No Comment

Frontier ETFs Have Liquidity Risk and Concentration Risk

Just about everyone is familiar with Jeremy Siegels book, Stocks For The Long Run . ETF investors are probably aware that the good professor is also a co-founder of fund provider, WisdomTree .

Yet, after the worst decade on record for the S&P 500, with a -1.2% annualized return for the 2000s (dividends included), its not too difficult to make a case for stocks going forward. In fact, in the decade following the -0.1% annualized return of the 1930s, stocks returned 9.2% and 19.4% compounded over the 40s and 50s respectively. After the turbulence and trauma of the 5.9% of the 70s, the S&P 500 annualized at 17.5% and 18% in the 80s and 90s.

Yes, Virginia stock assets tend to perform strongly in a decade that follows a lost one. (Note: Try to tell that to Japan, mired in 20+ years of underachievement.)

Of course, history is merely a guide not a guarantee. Thats why I have spent 20+ years speaking out against the silliness of buy-n-hold-n-hope .

Sensible investing is primarily about the management of downside risk and not just plain old market risk. There are a fair number of additional individual risk areas that can increase the likelihood of loss. In 2008, for instance, investors began to value liquidity; that is, if something barely trades on exceptionally thin volume (liquidity risk), youre going to have a tough time converting your money to a safer alternative like cash.

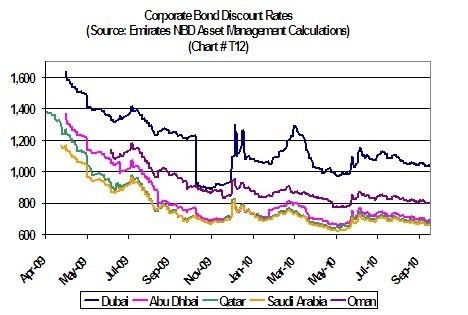

Thats why I find myself chuckling when a chief operating officer of an advisory firm called Frontier Strategy Group recently plied his public relations campaign in the media; more specifically, the advocate spoke glowingly about the prospects for tremendous financial rewards in frontier investments, even if they might represent illiquid, unstable and underdeveloped markets .

Its not that you shouldnt consider Frontier Market ETFs. Its not that you should avoid the prospects of Africa and/or the Middle East. Yet you should be concerned about how liquid your ETF choice is. Funds like PowerShares MENA (PMNA), Claymore Frontier Markets (FRN), Market Vectors Gulf States (MES) as well as Market Vectors Africa (AFK) may not have enough assets under management for those who do care about liquidity risk.

Another risk area that is woefully overlooked is concentration risk. For instance, the SPDR Emerging Middle East & Africa Fund (GAF) has 65% in South Africa. So what happened to Egypt, Morocco, Kenya, Angola, Tanzania? GAF also has another 25% in Israel. So what happened to the UAE, Qatar, Oman, Kuwait and Bahrain? In brief, GAF is concentrated in 2 countries that hardly represent their regions adequately.

The next decade, and the new year of 2010, are sure to bring plenty of surprises. There will be economic dangers, currency concerns, political shake-ups and more. Thats one of the reasons I will write even more about ETF risks in ETF Risk Alert industry, credit, currency, interest rate, liquidity, concentration, even systemic. Indeed, your investment success will depend heavily on your awareness of different types of risk and your plan to manage it.

If you’d like to learn more about ETF investing… then tune into “In the Money With Gary Gordon.” You can listen to the show “LIVE”, via podcast or on your iPod .

Disclosure Statement: ETF Expert is a web log (blog) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc. a Registered Investment Adviser with the SEC. The company and/or its clients may hold positions in the ETFs, mutual funds and/or index funds mentioned above. The company does not receive compensation from any of the fund providers covered in this feature. Moreover, the commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. Investors who are interested in money management services may visit the Pacific Park Financial, Inc. web site.

Share this post: