Frontier Bonds Are They Worth The Risk

Post on: 24 Июль, 2015 No Comment

Highlights

- Emerging-market countries such as Mexico and China have seen bond yields fall.

- Frontier bonds may offer higher yields, but they come with greater risks.

- Frontier-market countries have not built a lengthy track record of stability.

Low U.S. bond yields are pushing investors into riskier, more exotic territory.

And one of them is frontier bonds, which are issued by dozens of exotic locales such as Mongolia, Uganda, Sri Lanka and Nigeria. Investors are lured by high yields, strong gross domestic product growth and low country debt.

Frontier bonds are joining more indexes and getting more attention as global bond yields elsewhere slump, says Francesc Balcells, an executive vice president for investment firm Pimco’s Munich office. While they offer a potentially higher return, they also pose greater risks.

According to Ann C. Loque, author of Emerging Markets for Dummies, emerging markets are those countries that have growing economies and a growing middle class; frontier economies are very small nations at an early stage of economic development.

Big, well-known emerging-market countries, such as Mexico or China, already have seen their bond yields falling to near rock-bottom levels. For example, China’s 10-year bond yielded 3.61 percent in February — nearly as low as Australian bonds. Meanwhile, Nigerian bonds yielded a hefty 10.8 percent. That why so-called emerging-market bonds aren’t as attractive as they once were, Balcells says.

More On Investing:

investing

Search for higher yields

So investors are pushing further afield, pouring lots of money into bond investments in remote areas in Africa or central Asia to nab higher yields despite facing higher risks.

Frontier bonds have been popular to the point that indexes have popped up to track them. In 2011, JPMorgan Chase & Co. launched its Next Generation Markets Index, or NEXGEM, which tracks bonds issued by frontier countries in Asia, Africa, the Middle East, Central America and the Caribbean. The roster includes far-flung countries such as El Salvador, Senegal and Georgia — some with low credit ratings.

Yet NEXGEM has outperformed emerging and developed bond indexes. Last November, the NEXGEM average blended yield was 6.5 percent, compared to 5 percent for emerging-market bonds, according to Reuters.

Still, frontier bonds may offer higher yields, but they come with greater risks than bonds in developed markets, says Russell Wild, author of Bond Investing for Dummies. Higher returns come with greater volatility, running contrary to the main investment strategy for buying bonds — stability, he says.

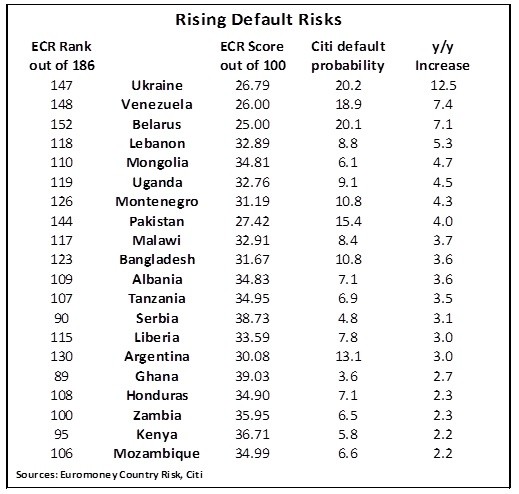

Many frontier-market countries also have political risks and have not built a lengthy track record of stability, Wild says. Yet you’re not being compensated enough for this default risk.

Here are some other frontier bond risks to note.

They’re riskier than most bonds. Frontier bonds are more akin to stocks than bonds, Wild says. Here’s why: Bondholders are typically higher in the payback hierarchy if a bond defaults. However, bondholder rights in frontier countries are harder to assess, since they don’t have a long legal history. So you may have a limited bond upside, but unlimited downside.

There’s limited bond liquidity. Frontier markets are called frontier for a reason. Their bond markets are small, so it’s hard for countries to buy and sell their bonds, Balcells says. This means that prices can be volatile and trading thin, making it hard for investors to sell a frontier bond once they own one.

When you enter these markets, you have to do your homework, he says.

Also, watch out if these narrowly traded frontier markets tumble, says Marc Prosser, co-founder and publisher of LearnBonds.com. There will be a tremendous difference between the bid and ask prices, translating into significant bond losses, he says.

Financial transparency may be lagging. There are lots of economic data on big emerging markets such as Brazil or Mexico, Balcells says. But frontier countries are young and still evolving. So bond data are erratic and harder to find. It takes additional research, and you must talk to issuers directly.

Given these high risks, don’t buy individual bonds, Wild says. Instead, invest via low-cost emerging-market mutual funds that can diversify risk and are increasingly including frontier bonds. For example, one fund invests some of its assets in bonds from countries such as Croatia and Lebanon; a second fund owns bonds from outlier countries such as Kazakhstan.

If you are squeamish about frontier bonds, you may find comfort in emerging-market bonds. Big emerging-market countries have billions of dollars of debt outstanding and there are lots of bond choices with credit quality, duration, yield and track record. What they lag in yield, they make up for in stability.

And, Balcells says, if you seek safety, you may want to stick with bonds from big emerging markets such as Mexico and Brazil. Those countries have more transparent governments, stable currencies and diverse economies.

If you take the plunge with frontier bonds, take it slowly. Balcells says many frontier-market countries are issuing debt for the first time. It’s good to start looking at frontier bonds, but don’t get carried away. In three to five years, frontier markets will be more developed and a better place to invest.