Free Household Budget Template

Post on: 30 Май, 2015 No Comment

Budgeting Tips on How to Use Our Free Budget Spreadsheet

Budgeting is hands down the most important way to understand and take control of your finances. To that end, we’ve created a free budget spreadsheet that you can use to help get your finances in order, along with some tips on how to create your own free household budget worksheet using our free budget template. Creating a budget can be a daunting task and it requires that you fully commit to tracking your expenses, creating your spreadsheet, analyzing the results, and then making improvements on a line item by line item basis. Here are some steps that can help guide you through the process.

Understand and track your spending

Track your monthly spending and try to account for every dollar spent. For the next month or two, think very closely about how your money is spent. Every time you buy something, pay a bill, or dispose of any of your money, make a strong mental note of what it is being spent on. Better yet, at the end of each day write down a list of each expenditure and what it was used for on a piece of paper or a spreadsheet. Try to think critically about each dollar spent and whether or not it was a required expense. Keep a spreadsheet or notebook with all of your expenditures for a month before you create your budget. While you are collecting the expense information, try to label each expense with the following attributes:

Assign each tracked expense to a specific category that will later be included in your main budget worksheet. For example, buying groceries would go under your grocery expenses. Use very specifc categories instead of broad category descriptions. For example, if you are buying groceries for a party, the expense category wouldn’t be food, or even groceries, but would better fit under entertaining. Instead of food expenses, be more specific and include categories for dining out, carry out, entertaining, food gifts, snacks, coffee breaks, impulse food buys and even holiday food purchases. When it comes time to analyze your budget, you can easily add up all these expenses to compute your total food costs.

Determine if the budget expense is discretionary

In addition to assigning each expense to a category, determine if each expense is discretionary or non-discretionary. Back to the food examples, a discretionary expense would be buying coffee, while a non-discretionary expense would be buying the groceries that feed your family. Discretionary expenses are items on your household budget that you do not require to live. They may not be expenses that you are willing to give up, but they are expenses such as entertainment, dining out, cable tv, non-essential clothing purchases, gifts, and any other expense that isn’t required for you to live. Non-discretionary expenses, on the other hand, include items like your mortgage payment, taxes, insurance and basic utilitites, food and clothing costs. Non-discretionary expenses are required for you to survive, but that doesn’t mean that they can’t be reduced. You’ll want to mark each budget item as discretionary or not so that when it comes time to analyze your household budget you’ll already have this step completed.

Create your household budget worksheet

After you’ve tracked all of your expenditures, it’s time to create your current family or household budget spreadsheet. To do this, you need to quantify and categorize all of the spending patterns you observed in the previous step. If you were already able to assign categories and tag each expense as discretionary or non-discretionary, then this step should be easy.

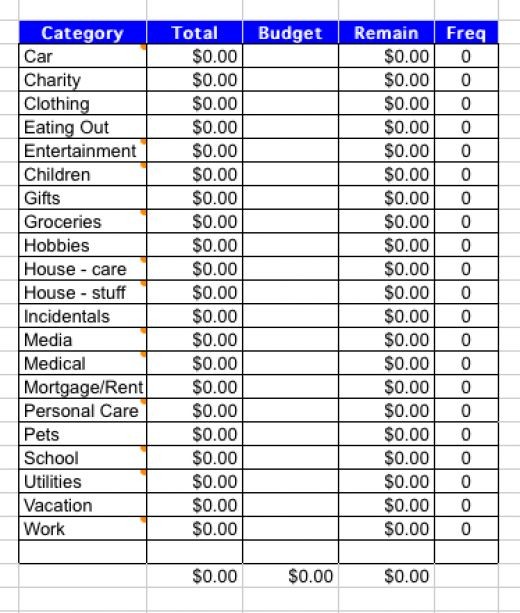

Download Our Free Budget Template

Start by downloading our rather detailed free Excel budget worksheet or go to our browser based online budget template (a very simplified budget form). Or, you can view and modify it using an online budget spreadsheet at Google docs. From there, you can make a copy or save the file in any format you desire (excel, openoffice, csv, xml, text or pdf). If you use the Excel spreadsheet you’ll have to know how to use Excel well enough to tweak the formulas yourself. If you don’t have access to Excel, you can download a free spreadsheet and Office replica that is completely compatible with Microsoft Office at OpenOffice.org .

After downloading the personal household budget worksheet template, proceed to fill in the cells by classifying all the money you currently spend into the appropriate categories. The budget should resemble your current personal or family spending patterns, so be sure not to overlook small or routine expenses. Be realistic and honest with yourself and try not underestimate your actual expenses. Think long and hard about how much money you have really been spending on these budget categories and fill in realistic amounts. Make sure you account for everything you spend, even if you don’t see a specific category on the budget worksheet, add those expenses to other or create a new category that fits your needs.

Change and improve your household budget to meet your goals

Now that you’ve quantified what your current family budget looks like, you’ll want to scrutinize it very closely and look for areas to improve. First, define the goal of your budget: Is it to save money. To understand where you are spending your money? To be able to pay down credit card debt? To be able to pace your spending so that you don’t get into trouble? To find out where all your money is going? Or perhaps the best reason of all, to stop wasteful spending. Regardless of your goal, there are always ways to improve your personal or household budget. Here are some tips on how to focus on changing and improving your budget:

There are really only two ways to improve your budget. Either increase your income or decrease your expenses. Since income is typically fixed in the short term, focus on reducing your expenses by finding ways to save money. We offer many ideas on how to save on everyday expenses.

Start with your biggest expenses like mortgage and insurance. When interest rates are lower than your current mortgage rate, you should look into refinancing. A refinanced mortgage can add a few hundred dollars a month to your budget. Also, those annoying insurance commercials aren’t kidding, you can actually save hundreds of dollars per year on insurance if you shop around and find the best rates.

Control your spending and cut spending to areas that are higher than you expected. Visit our section on how to manage your budget expenses to make sure you don’t miss adding any of these expenses to your budget spreadsheet.

If possible, find ways to make more money. Raising your income is more difficult than cutting your expenses because you have less control over your income, at least in the short term. There are always other ways to add income to your help your family budget. For example, you could get a second job, do freelance work, get a promotion at work or ask for a raise (if you deserve it).

Analyze your budget worksheet further

After you’ve completed the first draft of your budget, your work is not done. You must analyze your results and make sure that you make improvements. Also, make sure that your work was accurate. If your budget shows that you should be able to save $1,000 per month, but in reality you are barely scraping by, then you’ve missed some expenses on your spreadsheet. Look at your total income minus your non-discretionary spending. This is the most you should be able to save each month. Try to keep your spending in check and get as close to this goal as possible.

If you want to get even more detailed and get a better idea of your budget, here is some advice on how to modify our free budget spreadsheet to help you analyze your budget. First, start by making a copy of your budget from each month. The easiest way to do this is to add a column for each month. Then, fill in your actual expenses each month. Then, to the right of the budget, start calculating the monthly changes and percentage changes. Here’s an example of what your budget might look like.

In looking at this example budget, you can see how your actual expenses vary from month to month in both dollar terms and in percentage returns. In this case, the goal was to lower discretionary entertainment expenses. You can see that they succeeded in lowering their expenses incurred by dining out because they made a conscious effort. Also, as a way to lower their theater expenses, they didn’t stop going to the theater, but rather decided to stop buying food while a the theater. This lowered their theater budget by a third and saved them $20 per month.

By looking at an analysis in this way, you can easily see which expenses have improved and where further improvement is needed. You can also quantify how much money that your budgeting work has saved you each month. Looking at this type of analysis can help motivate you to stay on track and find more ways to help improve your bottom line.

Stick to your budget and don’t give up

The most important step in financial planning and budgeting is to both be realistic and to stick to your plan. If your goal is to save $100 each month and you aren’t able to save any money the first month, don’t give up! Repeat the steps outlined on this page and find out why you weren’t able to meet your savings goal (was it unrealistic? did something unaccounted for come up? did you misspend?). More importantly, adjust your expenses as you go and don’t give up on the process. The more you scrutinize and understand your household budget, the better luck you will have sticking to it and meeting your goals.

What to Do With the Money You Save From Budgeting

Once you’ve established a monthly budget and have maximized your monthly savings rate, it’s time to figure out what to do with all that money that you’ve worked so hard to save. To start with, you should set aside an emergency savings fund until you have about a month of expenses saved. Many financial planners recommend saving 6 months to a year’s worth of expenses, but we say only a month, and here’s why.

Keeping six months to a year’s worth of expenses in a savings account is a lot of money to sit in an account and earn almost nothing (as that’s what savings accounts pay during low interest rate periods). Instead, take all of the additional savings and put them in a stock account. Stock accounts automatically sweep the funds into money market accounts that pay more than savings accounts, so you’ll be earning something on the saved money instantly. Then, when you save up at least $1,000 in this stock account, buy a diversified mutual fund or ETF. We recommend ETFs because they have lower fees and there is no minimum required holding period. Plus, you purchase them on the open market and don’t have to wait until the day is over to sell them. In reality, the money in this account is still an emergency fund. If something does happen, it is easy to sell this stock and transfer the money back to your spending account. What it does do, is gets you started with your investing and wealth building, which is a habit that everyone should develop as soon as possible.

The next step is to continue what you’re doing. Stick to your budget. Try to improve it further so that you can save more each month. Change your lifestyle to be more frugal or maybe work toward getting a higher paying job. Now, as your investment account grows to around $10,000, you’ll want to start diversifying a little bit. Consider buying 2 to 4 mutual funds or ETFs that all hold different classes of stock. You may want to add a few thousand dollars worth of foreign stocks, pick a specialized or high growth fund, or even choose a stock or two to buy for your own pleasure. Continue adding the money saved by your household budget to this account and watch it grow until it reaches close to one hundred thousand dollars.

Once you’ve reached one hundred thousand dollars, it’s time to diversify a little more. At this level, you’ll want to make sure that you own stocks in many different countries, industries and stock categories (like value, growth, dividend and emerging stocks). You may also want to add in some funds or stocks that track real estate or commodities at this point, but there is no hurry. Anyway, at this point you can move beyond the simple budgeting tips that we’ve provided on this page and start learning about how to manage your money and continue building your wealth.

You may also wish to visit Budget Ways and read their reviews of some of the top household budget spreadsheets that are available for free.