FRB AssetBacked Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)

Post on: 8 Апрель, 2015 No Comment

Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)

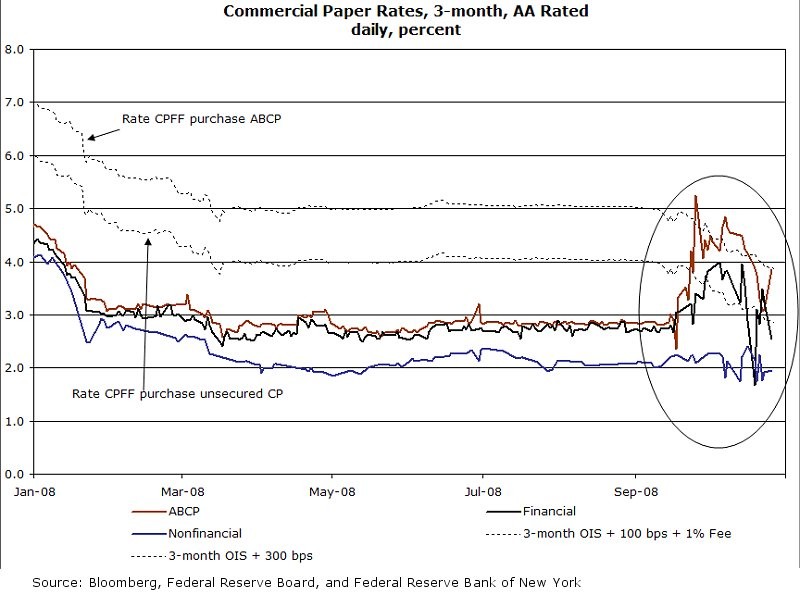

Money market mutual funds (MMMFs) are common investment vehicles that, in aggregate, hold trillions of dollars in funds on behalf of individuals, pension funds, municipalities, businesses, and others. During the financial crisis, MMMFs experienced significant withdrawals of funds by investors and were forced to meet the demand for withdrawals by selling assets in illiquid markets. The Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF) was introduced to help MMMFs that held asset-backed commercial paper (ABCP) meet investors’ demands for redemptions, and to foster liquidity in the ABCP market and money markets more generally. Without additional liquidity in the money markets, forced sales of ABCP could have depressed the price of ABCP and other short-term instruments, resulting in a cycle of losses to MMMFs and even higher levels of redemptions and a weakening of investor confidence in MMMFs and the financial markets.

The AMLF was designed to provide a market for ABCP that MMMFs sought to sell. Under the program, the Federal Reserve provided nonrecourse loans to U.S. depository institutions. U.S. bank holding companies, U.S. broker-dealer subsidiaries of such holding companies, and U.S. branches and agencies of foreign banks. These institutions used the funding to purchase eligible ABCP from MMMFs. Borrowers under the AMLF, therefore, served as conduits in providing liquidity to MMMFs, and the MMMFs were the primary beneficiaries of the AMLF.

AMLF loans were fully collateralized by the ABCP purchased by the AMLF borrower. The ABCP had to meet eligibility requirements outlined in the program’s terms and conditions. Further, to help ensure that the AMLF was used for its intended purpose, the Federal Reserve later required that an MMMF had to experience material outflows before the ABCP that it sold would be eligible collateral for AMLF loans.

The AMLF was created by the Federal Reserve under the authority of Section 13(3) of the Federal Reserve Act, which permitted the Board, in unusual and exigent circumstances, to authorize Reserve Banks to extend credit to individuals, partnerships, and corporations. The facility was administered by the Federal Reserve Bank of Boston, which was authorized to make AMLF loans to eligible borrowers in all 12 Federal Reserve Districts.

The facility was announced on September 19, 2008, and was closed on February 1, 2010. All loans made under the facility were repaid in full, with interest, in accordance with the terms of the facility.

Visit the Excel viewer for more information. Filter and sort features have been added to the column headers in the Excel spreadsheet to assist you with searching and to allow for the creation of custom datasets. Click on the arrow button in each column header to view and select the different filter and sort features.

Compressed (ZIP) files are available through 7-zip. Download the free 7-zip compression utility

The following information on AMLF transactions is provided:

Data Description