Four Different ETF Investing Styles and Strategies

Post on: 4 Июнь, 2015 No Comment

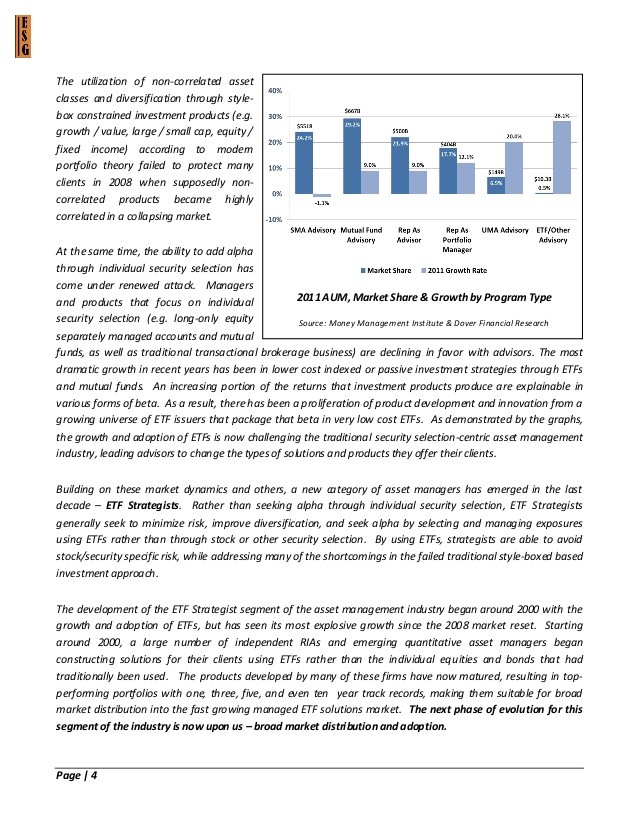

The total assets committed to mutual funds exceed 7.5 trillion dollars. ETFs, which are comprised of stock from many different companies much like a mutual fund, are invested with around 300 billion dollars. While the total investment in ETFs may be far lower than for mutual funds, they are continuing to grow in popularity and many retail investors are still unaware of their existence. ETFs have only been around since the early 90s and are expected to take on a bigger role in portfolios for many years to come.

ETFs are loved by investors because they are diversified like mutual funds, trade like stocks, and are even cheaper than index funds. ETFs were originally designed to mimic indexes like the S&P 500 and give investors a similar return on investment. ETFs have evolved so that they not only mirror indexes, but entire sectors and markets as well. But how can ETFs specifically be used in individual investment strategies?

Primary Investments

One strategy available to investors is to use ETFs as their primary financial investment. ETFs are designed so that

investors can have exposure to entire markets or sectors without the expense of having to acquire each stock, bond, or commodity individually. The investor can purchase an ETF in a market they are interested in (perhaps equities, so an ETF tracking the S&P 500 would be a good idea) and simply increase their position using a buy and hold strategy. This same strategy can be used with index funds but it is cheaper to implement with ETFs. An investor can purchase an ETF for equities and another for fixed-income investments and have overall market exposure with minimal expense and hassle.

Sector Rotation

There are many variations of sector rotation used with ETFs, but the basic idea is to find ETFs for specific sectors and rotate them in and out of the portfolio based upon analysis and market performance. The idea behind sector rotation is that the economy is cyclical and predictable. ETFs allow investors to obtain exposure to entire sectors without incurring the risks associated with individual stocks which are more volatile (ETFs are less risky because they are investment baskets with large numbers of companies from an entire sector even though some individual stocks will be down in the sector, others should be up resulting in the risks being spread more evenly).

Hedging

ETFs are very simple to trade and far more flexible than mutual or index funds. Because they trade like stocks, ETFs can be used to sell short as a means of hedging against a long position in an equity. For instance, if an investor is heavily invested in a particular automakers stock, he or she may want to sell short an ETF that tracks the entire automotive sector. In most cases, if the stock performed poorly and took a turn for the worse, chances are that the ETF tracking the auto industry would also lose valuethus making it profitable because it was sold short. Consequently, investors can hedge against losses for a long position in a particular companys stock by selling short an ETF that tracks the entire industry.

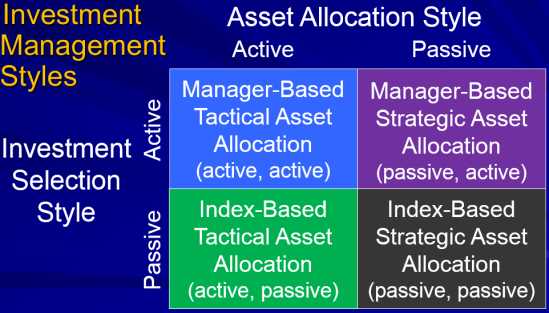

Asset Allocation

The asset allocation of an individual investors portfolio should change over time. In the beginning, an investor tends to take greater risks and therefore has a portfolio that is probably heavy in equities. But as the investor ages, the assets have hopefully matured and there is less need to take risks. However, there is an increased need for steady income as retirement looms, so that is why portfolios tend to reposition asset allocation over time so that more fixed-income investments are included. ETFs are useful investment tools that can help rebalance portfolios to reflect changing needs without the need for a lot of trades (and the commissions that go with them). If it is time to shift away from equities, an investor can buy a fixed income ETF after selling the appropriate percentage of stocks (vice versa if more equities are needed). By rebalancing with ETFs rather than mutual funds or bonds, an investor can save on expenses while having a more liquid and flexible portfolio to manage afterwards.