Forward P

Post on: 16 Март, 2015 No Comment

Q: If someone wants to buy a stock, should they consider the forward P/E or the current P/E?

A: The price-to-earnings ratio or P/E ratio must be the most frequently quoted, and abused, stock valuation tool.

Both investing amateurs and professionals like to toss out references to a stock’s P/E as a gauge of whether it’s cheap or expensive. But as you point out in your question, a stock’s P/E can be measured in many ways, and the method you choose dramatically changes the conclusion.

I won’t get into how many variations of the P/E there are. If you’re interested in learning more about forward and trailing P/Es, and the advantages and disadvantages of each, you can read that here:.

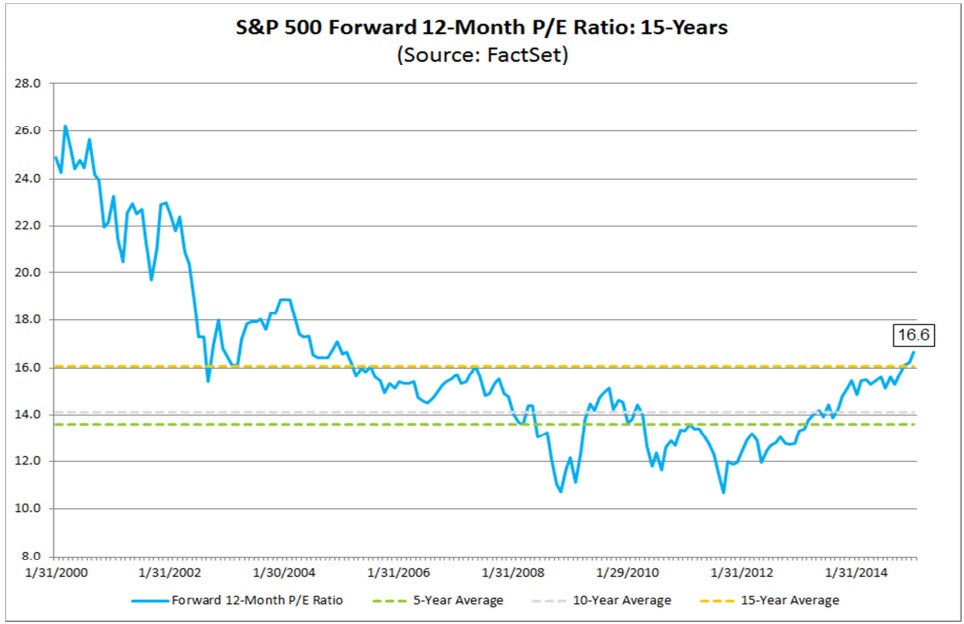

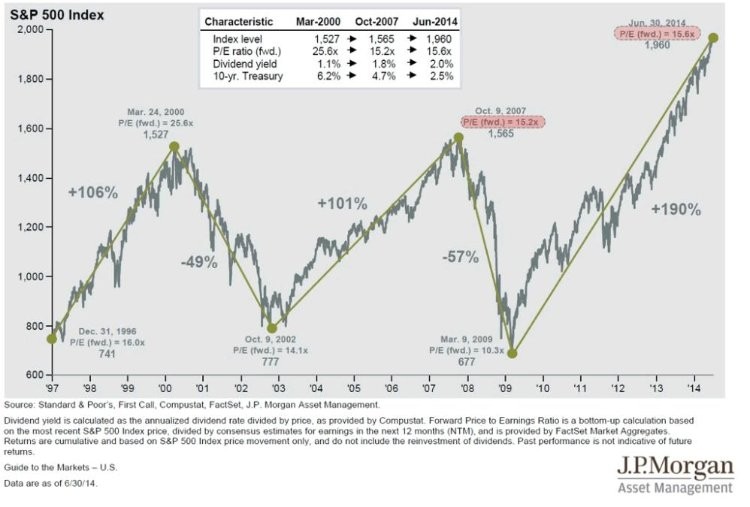

The forward P/E is based on what the company is expected to earn a year in the future. And the trailing P/E is based on what the company earned in the previous year. The difference between a trailing and forward P/E can be dramatic.

Which P/E should you pay attention to? The answer is, both. It’s especially important now to consider both because future earnings are so unpredictable.

Rather than trying to pick which P/E ratio to use, compare them with each other. If you see a big difference between the two, you might learn more about the company’s valuation if you find out why the forward and trailing P/E are so different.

For instance, if you notice that a stock has a high double-digit trailing P/E and a low forward P/E, you know that analysts are predicting earnings to recover sharply, but investors aren’t believing the estimates yet. In that situation, if the company delivers as analysts hope, there could be a nice upside for the stock.

Similarly, if a stock’s trailing P/E is low but the forward P/E is high, it might be a clue that analysts are being extremely bearish about the company’s future, which might be a warning to you. On the other hand, this situation might mean investors are being overly optimistic about a stock’s future, and they could be in for a rude awakening.

As you see, there’s great value in looking at both the trailing P/E and the forward P/E.

Matt Krantz is a financial markets reporter at USA TODAY and author of Investing Online for Dummies. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com. Click here to see previous Ask Matt columns. Follow Matt on Twitter at: twitter.com/mattkrantz