Folio Investing Brings Experience To Automated Financial Advisors

Post on: 10 Май, 2015 No Comment

Traditional investment advisors and brokerages firms, now more than ever, face increased competition from alternative services in particular, robo advisors. A robo advisor is an online wealth management service that provides an automated portfolio without the use of human financial planners. Notably, Wealthfront and Betterment are widely recognized as the face of online advisory with the largest number of assets under management.

Prior to the recent upsurge of robo advisors, however, Folio Investing established itself as an alternative investment service through its online service. Founded in 1998 by former SEC commissioner Steve Wallman, Folio Investing is predicated on 5 core principles, called the Folio Advantage. The Folio Advantage is comprised of diversification, cost reduction, customization, consistent investing, and tax minimization. With its wide array of features, an investor still must consider the inherent risks prior to investing with Folio or any investment service.

Diversification

Built on 5 principles, Folio Investing has established a fair alternative to traditional brokerage firms. At its core, diversification is the central focus of Folio’s platform. Diversification is not only purchasing multiple different assets but also varying the industries in which assets are owned. Concentrating assets to one industry does not maximize the benefits of diversification and may increase investor risk.

Customization

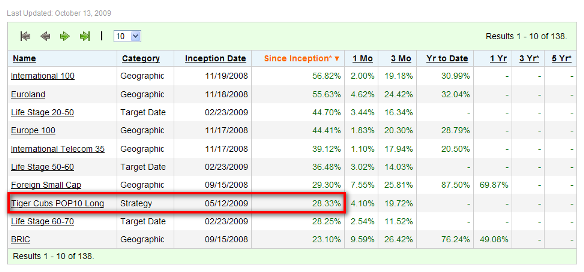

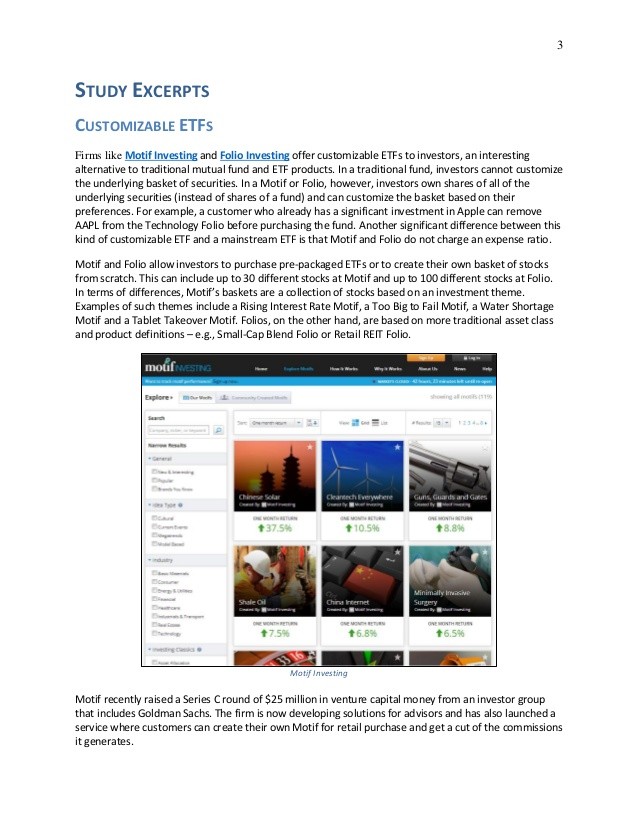

Folio offers a full range of investment products from stocks. bonds. ETF’s. and mutual funds to name a few. Unlike many newer companies, Folio has not built its investment service around low cost ETFs. However like Motif Investing, Folio offers customizable packages called Folios for investments mixed with stocks, mutual funds and ETFs.

Folios can be fully customized by the investor or chosen from over 100 ready to go packages. In particular Folio 30 is a ready-to-go Folio of 30 stocks in the Dow Jones Industrial Average (DJIA) .

Folio also offers investors the option of fractional investing. Fractional investments leverage upside and exposure to the market without purchasing 100 percent of the asset. Based on real time trading, assets and securities traded through Folio Investing reflect current prices.

Cost Reduction

Compared to similar platforms, Folio Investing has taken an alternative approach to commission and fees. A majority of brokerage firms or robo-advisors charge investors commission, management or transaction fees. Folio offers a pricing plan that gives investors’ unlimited transactions for $29 per month or $290 per year.

Folio’s Unlimited Plan allows investors 2,000 commission free trades each month. To maximize Folio’s flat fee, an investor would need to invest about 3 times per month. For passive investors, a more traditional commission based pricing model may be more beneficial.

Tax Minimization

While investing can have financial benefits, many investors fail to recognize the effect of taxes. Folio provides ten automated tax strategies to minimize tax liabilities when selling securities. As a result investors can easily maximize returns through capital gains taxes and tax harvesting. A graphical representation of different tax strategies is provided to investors in order to minimize tax liabilities. (For more, see: Does Tax Loss Harvesting Really Work? )

Private Investing

Recently, Folio Investing has ventured to offer investors securities in private companies. Prior to this, equity crowdfunding was the most widely recognized means to investing in private companies. However, illegal in nature, equity crowdfunding has been unable to gain ground in private investing.

As a clearing brokerage service, Folio has established the prospect of investing in startups as effortlessly as clicking a button. Investors will be able to add private securities to their portfolio in a cost efficient and seamless manner. In particular, crowdfunding and peer-to-peer lending companies will benefit most from Folio’s Private Placement Platform .

The Bottom Line

Despite the recent expansion of online advisory tools, the 15-year-old company Folio Investing has been on the cutting edge since the beginning. While technology and online advisory companies have made investment opportunities more accessible, the ultimate burden still lies on the investor to educate, strategize and understand the inherent risks involved with investing.