Florida Intangible Tax Individuals Q A

Post on: 31 Май, 2015 No Comment

Florida Intangible Personal Property Tax

(Individual and Joint)

What is Intangible Personal Property Tax?

Florida’s intangible personal property tax is an annual tax based on the current market value, as of January 1, of intangible personal property owned, managed, or controlled by Florida residents or persons doing business in Florida.

The tax applies to intangible assets such as:

- stocks

- mutual funds

- bonds

- loans

- money market funds

- notes

- accounts receivable

- interest in limited partnerships registered with the Securities and Exchange Commission.

Every Florida resident who (on January 1) owns, manages, or controls intangible personal property must file an Intangible Tax Return for Individual and Joint Filers (Form DR-601I). Florida residents whose intangible assets are held by security dealers and/or stock brokers are also required to file.

You are considered a Florida resident when your true, fixed or permanent home and/or principal establishment is in Florida. You can establish Florida residency by filing a declaration of domicile, qualifying for homestead exemption, or registering to vote. Other actions, such as obtaining a Florida driver’s license, can indicate an intent to establish residency.

Although everyone owning intangible personal property is subject to the tax, only those persons whose tax obligation is $60 or more must file a return and pay the tax.

- Money (including cash-on-hand and in checking or savings accounts), certificates of deposit (CDs), annuities, and cash values of insurance policies;

- All intangible property held in an individual retirement account (IRA) qualified under section 408, U.S.I.R.C. as amended;

- All intangible property held in an employee retirement plan qualified under section 401, of the U.S. Internal Revenue Code, (I.R.C.) as amended;

- Deferred compensation plans offered to government employees when qualified under section 457 of the Internal Revenue Code;

- Bonds, notes, and other obligations issued by Florida or its municipalities, counties, and other taxing districts, or the U. S. government and its agencies, territories, and possessions (if these investments are held in a fund they may be taxable);

- Interest in a limited partnership not registered with the Securities and Exchange Commission;

- Interest in a general partnership;

- Franchises;

- Notes and other obligations for payment, except bonds, to the extent secured by liens on real property;

- Two-thirds of accounts receivable arising out of trade or business; and

- A trust contributing 95% of its income to a federally exempt organization under section 501(c)3, I.R.C. as amended.

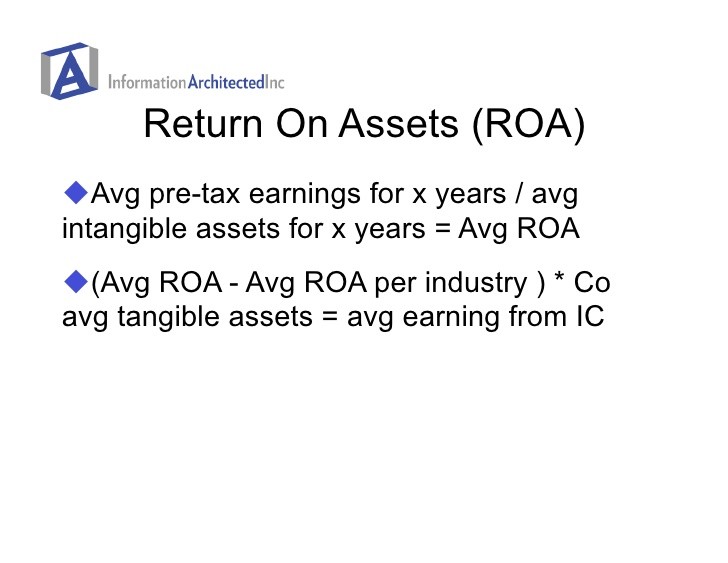

How Tax is Calculated

Individual Filers

The first $20,000 of total taxable assets are exempt. Total taxable assets valued between $20,000 and $100,000 are taxed at $1 per thousand dollars of value. Total taxable assets valued at more than $100,000 are taxed at $1.50 per thousand dollars of value.

Joint Filers

The first $40,000 of total taxable assets are exempt. Total taxable assets valued between $40,000 and $200,000 are taxed at $1 per thousand dollars of value. Total taxable assets valued at more than $200,000 are taxed at $1.50 per thousand dollars of value.

Discounts

If you file between January and the end of May, you qualify for a discount. The earlier you file, the greater the discount.

For More Information From the Florida Department of Revenue:

For forms and general information, call Taxpayer Services, Monday-Friday, 8 a.m. to 5 p.m. ET, at 1-800-352-3671 (in Florida only) or 904-488-6800.

Hearing and speech impaired citizens should call 1-800-DOR-TDD1 (1-800-367-8331) or 904-922-1115.

For detailed written responses to your questions, write Taxpayer Services, 1379 Blountstown Hwy. Tallahassee, FL 32304.

Can I get information from you, rather than from the government?

Yes, just contact us by e-mail or phone.