Five ETFs That Strategists Say Should Be Avoided

Post on: 16 Март, 2015 No Comment

Most ETFs fulfill the promise of low cost and all-day trade. But some are so rife with flaws, they should be handled with great care or avoided altogether. We asked several ETF strategists to tell us which they think are the worst ETFs and why.

• Ron Rowland, founder, All Star Investor and Capital Cities Asset Management, Austin, Texas.

Alerian MLP ETF (ARCA:AMLP ): Ever since Congress created the Investment Company Act of 1940, the investing public has come to associate mutual funds, and now ETFs, as investment vehicles that are pass-through structures from an income tax standpoint. In other words, investors believe that funds themselves do not incur or pay any taxes. Any and all tax obligations are passed through to the shareholders. AMLP changed that.

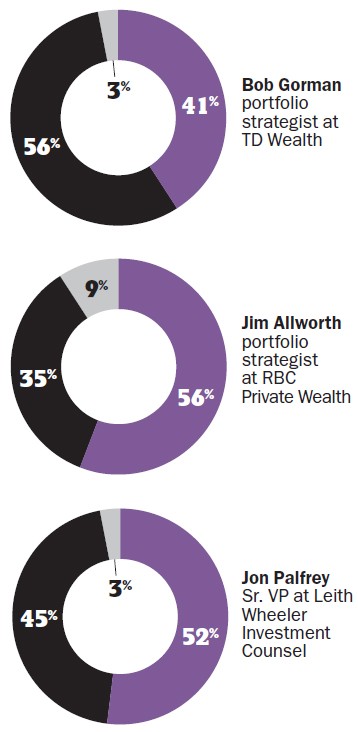

Naming their pet peeves among ETFs are, clockwise from left: Ron Rowland of All Star Investor, Michael Johnston of ETF Database, Matt Hougan of ETF. View Enlarged Image

There are more than 1,100 ETFs and ETNs listed for trading in the U.S. today. Of those, AMLP is the only one structured as a C-corporation. Because it is the first of its kind, investors are not aware of the outrageous expenses that come with this structure.

As a C-corp, it has to pay 35% federal income tax on all capital gains (price appreciation) as well as various state tax liabilities. This burden is of course ultimately borne by the shareholders.

Since AMLP does not know who or how many shareholders it will have when its tax bill becomes due, it must accrue this on a daily basis. AMLP accomplishes this by reducing the daily price change by 37.5%, leaving shareholders with the other 62.5%.

According to data from AMLP’s website, since its launch on Aug. 25, 2010, through the end of 2010, AMLP shareholders only received 65% of the total return generated by the underlying benchmark index (8.7% vs. 13.5%). That is the equivalent of a 35% expense ratio.

The 35% entity-level tax obligation is before and in addition to the shareholder’s tax obligations. If you bought AMLP in a taxable account when it was launched and sold on Dec. 31, you now owe taxes on your 8.7% return. Depending on your tax rate, this might reduce your return by another 20% to 40% of the remainder. It’s essentially the compounding of taxes, or double taxation.

AMLP likes to counter this argument, saying that their distributions are tax-deferred. However, tax-deferred is not the same as tax-free, and having the fund pay 35% corporate taxes seems to defeat the whole purpose. MLPs are one of the most tax-efficient vehicles available to investors. However, AMLP is the least tax-efficient ETF that I’m aware of.