Financial Planning Software and Personal Finance Software

Post on: 13 Август, 2015 No Comment

Free: Financial Planning Tips, Investment Advice, Tutorials, Primers, Financial Planner Training, and How to DIY

The overall themes are to calculate how money actually works in the Real World logically, have financial planning software that can be controlled to reflect that, have total control over what’s printed, and then having a money tool for almost every job in the financial planning and investment management process. So there’s a Tool For Money to:

• then decide what type of financial advisor you want to be,

• then what to say and do when they’re open to your products and services (this link is the best place to start if you’re a newbie financial adviser, and/or this site confuses you),

• then how to present their financial planning reports to them,

• With almost everything in between too (AKA practice management).

Non-advisors (consumers and investors) can also use these Tools For Money to Do It Themselves (AKA DIY), so they won’t have to go through all of the above, while saving all of the time, work, risk, and money financial advisors charge.

So it’s best to think about the financial jobs you need done. Then, like a financial toolbox, find the tools that do them using the text below, or the right-hand column.

Professional financial planners and investment managers working with individual clients: This site offers a large part of the software your financial planning practice needs. These money tools were created by folks that actually live and work in your world, not by folks living in an academic ivory tower that have never met and listened to an actual paying client in person. We’ve personally made financial plans and managed money for thousands of people in the Real World, so we know what you want, need, and we feel all of your ever-changing daily frustrations. See samples of what you’d get by downloading the free sample financial plan. The point of selling these financial tools is for you to run financial plan and investment reports for your prospects and clients.

Consumers and do-it-yourself investors: Do it all yourself, and make better financial plans than you’d get by hiring a sophisticated and expensive financial planner. Also you can create your own custom investment portfolios, for a fraction of the cost. There are detailed instructions for all financial planning software, so anyone with basic Microsoft Excel experience can use them.

Most of the financial plan software modules have a free fifteen-day trial period.

If you think the site is hard to navigate, then you’re probably trying to find a page meant for another audience. If so, then it’s easiest to use the site map or ask by sending an e-mail. Press Control F on any page. Then input the text you’re interested in (e.g. bond), and it may go to that page’s link. Also, using a search engine like this helps too — input with the quotes: toolsformoney.com what you are searching for

This is the Tools for Money home page. Control-D will put this site into your Favorites list

Market Chart Courtesy of Thomsoninvestortools.com

Brief Financial Planning Software Descriptions

Featuring Our Flagship Product:

Fully-Integrated Suite of Financial Planning Software: The Dual RWR retirement software, budget & cash flow projector, net worth projector, multiple-student college planner, life insurance needs software, and comprehensive asset allocation software are all hard-wired together for complete integration, just like the major competitors.

This allows the creation of full-blown financial plans with minimal duplication of input, similar user-friendliness, and complete control of most everything, including printing reports. The IFP excels in functionality, power, control, flexibility, accuracy, and transparency.

Retirement Planning Software: RWR is very powerful, flexible, and accurate retirement planning software. Create a retirement plan with the power to simulate any Real World scenario. It’s the same as doing a mini-financial plan because it will take college expenses, unequal cash flows, and everything that happens in the Real World into account.

This retirement savings software is for projecting detailed goals, incomes, expenses, and investment values before and after retirement, to estimate when your money may run out. It works great using the bucket approach to set up asset accounts according to how they pay out, so you can deplete one investment bucket before tapping another (e.g. non-qualified before qualified), and perform all of the retirement strategies you’re used to.

This is the cost-saving solution if you’re frustrated with other vendors’ lack of functionality, detail, flexibility, power, control, accuracy, and forecasting ability. With RWR, you’ll have total control of every dollar in every year, all of the variables, how everything flows, and printing reports.

Retirement Planner: RP is a basic and inexpensive retirement planning calculator that lets you quickly and easily run retirement projections. Even though RP is simple, it’s still capable of performing adequate retirement projections and analyses.

Simple Retirement Planner: SRP is a scaled-down version of RP.

Free 401(k) Calculator: Free retirement calculator for forecasting 401k, 403b, and similar captive retirement plan accounts.

Free Money eBook: An uncensored how-to money e-book to enlighten you the about the mysteries of the financial services, financial planning, estate planning, insurance, banking, and investment industries.

This will help you understand many financial myths that have been propagating erroneously for decades.

Learn how to choose a financial planner and/or money manager, and then if you should fire them to avoid their high costs and shenanigans. Then you’ll learn the basics of how to manage your own investment portfolios.

If you’re new to the financial businesses, or are thinking about getting in, this investment e-book could literally save your life. Learn what these businesses are really all about, from an insider’s point of view, so you can make informed decisions about your career and financial future. Learn how the industry is organized, motivated, and how to navigate it to help make it work in your favor.

Comprehensive Asset Allocation Software: Investment software for do-it-yourself investors and financial advisors working with high-net worth clients. Use this turnkey asset allocation software to calculate, compare, and implement, the mix of asset classes / investments you feel is best for yourself or your clients. It treats all of one’s investments in one pie, like they should be in the Real World; so you can control, evaluate, discuss, and implement the whole scenario without leaving anything out.

Get total control over asset allocation (and every dollar, and printing) instead of being locked into what a software company thinks you should do. Input contributions / withdrawals, and return assumptions for each investment (or asset class), and then see 75-years of estimated growth for all of the Current vs. Proposed allocation mixes.

Investment Model Portfolios : Turnkey money management system for small investors that will help take you from nothing to making trades with mutual fund ticker symbols, just by following the directions. Build and maintain your own long-term, low transaction, easy to understand, reduced risk, well-diversified and allocated investment portfolio that matches your investment risk-tolerance. There is a track record since 1/1/99 accounting for fees, rebalancings, and fund changes.

Financial advisors: This is a basic marketing must if you practice asset allocation, use portfolio models, or want to start. Everything is updated monthly.

FREE Mutual Fund and ETF Picks (Open-end mutual fund screening). These are the actual recommended mutual funds selected for 21 asset classes used with the above-mentioned asset allocator tools. Everything is updated monthly for professional money managers and do-it-yourself investors.

Read enlightening text and get free helpful advice and tips on mutual funds, picking mutual funds, and mutual fund screening.

Financial Planning Fact Finders: These are not for consumers. Just edit, print, and give to clients or prospects, and it comes back filled out so you can know them well, and then manually input their data into financial plan software. If your clients are computer literate, then they can follow simple directions and you can get them back and forth via e-mail or download.

You can edit them any way you want to fit your practice. They are refined continually to qualify, and get all of the important information needed for basic to advanced financial planning and investment management, and also for input into the highest level of any comprehensive financial planning software.

They’re also great for staying out of trouble and keeping BD compliance people happy, because you’ll have what they told you they wanted — their life’s goals, suitability and risk tolerance all covered, printed, and on record in their files.

Investment Policy Statement Template (IPS). Not for consumers, but a must-have for any investment portfolio manager working with individual clients.

Forget fancy-shmancy, hard-to-use, full of bugs and meaningless details, and way too expensive IPS tools. All you need to do is edit this Word document template, save, and print. It covers most everything other sophisticated programs produce for individual clients, for a fraction of the cost, in minutes.

Bond Calculators: The demo has a free bond yield to maturity calculator. The main features of this fixed income software are:

• Two 100-bond convexity and duration calculator sheets (the second is yield to call). Calculate all of the usual modified duration and convexity numbers, and then estimate how assumed future changes in interest rates will change the price of each bond, and the combined bond portfolio. Plus many more averages.

• Bond total return calculator using the most accurate method — Horizon Return.

• Calculate annual amortization of premiums and see basis totals on up to 100 coupon bonds for twenty years. It uses both the Constant Yield and Straight Line amortization methods.

• Multi-year bond calculator: Input up to 25 bonds and get an estimated overall portfolio yield for up to 50 years.

• Zero coupon bond accretion: Input up to 25 zero coupon bonds, and see the annual accretion, and inputted taxes due, on each bond and on all bonds.

• Calculate a zero coupon bond’s current fair market value, and yield to maturity (and/or yield to call).

• Portfolio Yield Calculator: This calculates a current snapshot of the combined average income / dividend yield of your total combined investment portfolios; then it estimates how much income, or paycheck, they’ll produce on a daily, weekly, monthly, semi-annual, and annual basis.

• Preferred stock yield to call and yield to maturity calculator. Will handle yields from 2% to 35%, and is accurate to the third decimal place.

College Savings Calculator: Calculate how much money is needed to put one, or up to five students at a time, through college. This will help you calculate how much money is needed to save, both lump sum, and/or monthly, to reach the goal of putting someone through college — both now, and in the future, while accounting for all of the details.

You have total control over every dollar in every year. It also does a side-by-side comparison of two different scenarios (like public vs. private college).

Basic Financial Planning Marketing Tools: Not for consumers, but these are something every professional in the fee-based investment management business should have. You’ll need a marketing / firm fact / bio package to either send to new prospects in the mail, or give them to take home after the first appointment. This page lists what you’ll need, has some freebies, and offers some inexpensive tools to help get your initial marketing binder up to speed.

Financial Seminar : Not for consumers. This is a

200-slide unprotected PowerPoint seminar covering financial planning, the money game, risk management, retirement planning, investment management, asset allocation, portfolio optimization, and more. It contains a script that suggests what to say for some slides. You can make any changes you want to it. Use it as a starting point to help build your own custom marketing seminars, so you can say what you want and not be stuck with canned expensive presentations you can’t customize.

Free Financial Tools (AKA TVM Calculators) . Financial tools for the little jobs that come up when building financial plans. The first seven sheets are a large array of financial calculators that perform most of the usual TVM (time value of money) functions: Present value, future value, interest rate, payments, IRR & NPV, loan amortizers, CD penalty, CPI inflation calculator, renting vs. own a home, underwater house calculator, cost of raising a child, life expectancy, wage breakdowns, final expenses, percentage change, long-term costs of a family-ruining monster, etc. Then it has:

• The financial planning practice valuation calculator covers most of the bases when you want to estimate how much you may be able to sell your financial advisory practice for today.

• 25-year time-weighted rate of return calculator that tells the rate of return each year, and averages for multiple years, considering all of the unequal monthly cash flows that happen with investment portfolios in the Real World: Dividends / capital gains / spent withdrawals and taxes on them, as well as contributions.

• Investment management fee calculator for investment advisors: If you have to calculate fees manually periodically to tell your custodian how much to deduct from clients’ cash accounts to pay you, and then this will pay for itself the first time.

• Portfolio Yield Calculator: This calculates the combined average income / dividend yield on your total combined investment portfolios; then estimates how much income, or paycheck, everything will produce over several time frames.

• Age 70Ѕ IRS Required IRA Minimum Distribution Calculator (MDIB / MRD calculators). It also has the same type of money calculator for inherited IRAs.

• All three versions of IRS 72(t) tax-qualified premature distribution calculators. Calculate how to retire as early as age 50 and avoid pre-age 59Ѕ penalties.

• Six Social Security calculators compare and help decide when to start collecting benefits. See the truth instead of what’s always touted in the media.

• Inflation Adjusted Income Stream Generator: This unique financial calculator estimates how much money you can withdraw annually, without running out, considering inflation.

• The Golden Handshake calculator will calculate the present value of an employee buyout offer from your employer, so you can see if it’s worth it or not.

Life Insurance Calculator: This life insurance calculator will tell you how much life insurance you and your family really need, by letting you input in detail only what you want to insure for. It calculates both current needs, and how much life insurance is needed every year, up to 75 years into the future.

It also allows you to input exact figures into manual override columns, to account for estimated future changes in incomes, expenses, Social Security, declining debts like mortgages, etc.

Input all lump sum needs (it tells you what these are), and then input data to replace the breadwinner’s lost income. It then calculates everything taking into account Social Security benefits and all other sources of survivor’s income. You can control every dollar in every year to calculate your exact needs, so you can minimize the expense of maintaining costly life insurance.

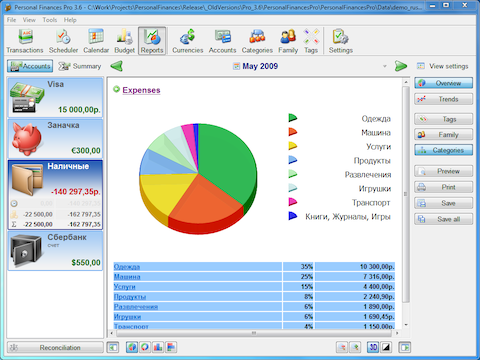

Net Worth Calculator (Balance sheet software). It displays a detailed current snapshot of overall net worth by listing everyone’s assets and liabilities, with tables, graphs, and pie charts.

Input up to five accounts for each of the following: Client, spouse, jointly held / community property, and children’s assets (for a total of 20 separate financial accounts). Each account can then hold up to 25 assets (with one liability).

Calculate current snapshots of assets and liabilities held by everyone; net worth, balance sheet, asset allocations, and after-capital gains tax investment values, using up to 500 assets and 20 liabilities.

75-Year Net Worth Projector : You can control every dollar in every year, and integrate the results with other financial and retirement planners. It takes the data entered into the net worth calculator (above), and then automatically forecasts everything into the future.

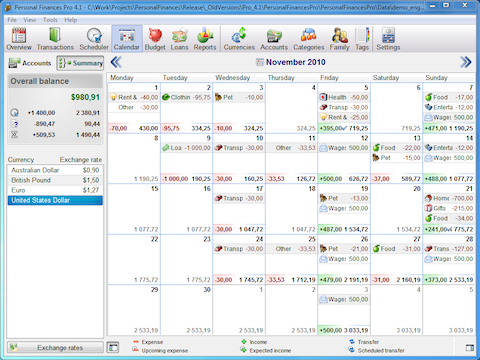

Personal Budget Software and 75-Year Cash Flow Projector: The family budget part of the spreadsheet is a free personal finance download.

This money calculator is used for tracking family expenses in normal times, and can also be used to estimate expenses and income needs during disability and retirement. It has many uses, such as categorizing expenses and calculating how much you’re really spending, comparing that to incomes (to show surpluses / deficits); it also calculates gas mileage and average / effective tax brackets.

The cash flow projector then takes each expense in three categories — fixed, variable, and debt service; and then adds the inflation rate you input (globally or on each expense). Then it displays the next year’s numbers. Then everything is summed up in a logical fashion, so you can use and make sense out of it.

You have total control over every income and expense item in every year, so you can project your household budget 75-years into the future down to the dollar (and then use these future numbers as inputs into your retirement plan).

Rental Real Estate Software: This calculates how a rental property (or a portfolio of up to five properties) has really done over its life; or estimate what it probably will do. With just a few minutes of input, this program will estimate IRR and NPV, for all properties — separately, combined, unweighted and weighted. It considers all cash flows, income taxes, depreciation, basis, purchases, sales, improvements, commissions, will handle one refinancing, it has an underwater rental calculator, and more.

Estimate a property’s internal rate of return and net present value both pre- and post-capital gains tax, to see if it’s currently over- or under-priced. Control most every dollar in every year for unprecedented control and accuracy.

Investment Comparator: Investment software that properly compares the long-term details of the 27 most-common methods of investing side-by-side apples-to-apples with each other for simple bottom-line evaluation. For example, it performs buy term and invest the difference comparisons (BTID).

Read about The Lifetime Subscription Deals .

Use the custom deal ordering forms

Financial Planning Software Modules For Sale