Financial Physics Understanding the Stock Market

Post on: 16 Март, 2015 No Comment

Financial Physics Model

Forecasting Future Returns

Looking ahead, stock market return will continue to depend on prospects for earning growth, dividend yield, and valuation change. Thus separating fundamental return and speculative return would be a valuable tool for considering reasonable expectation for future stock market return.

Future Fundamental Return:

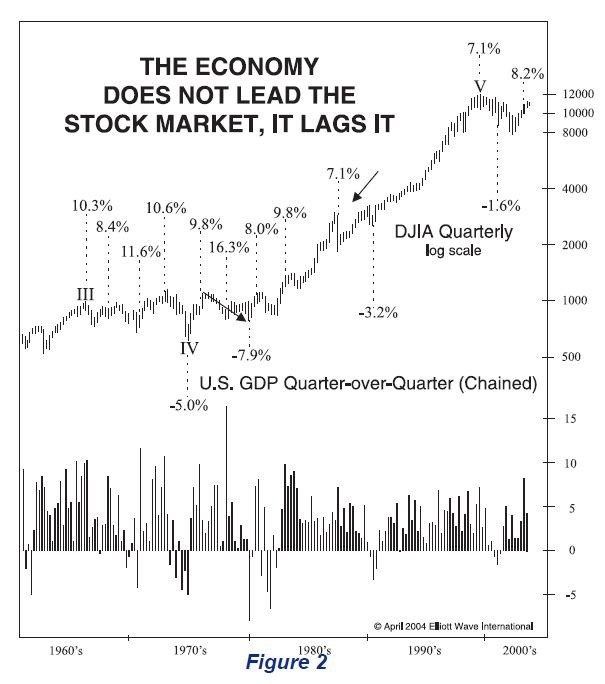

As we have seen previously, fundamental return is a sum of two factors earning growth and dividend yield. As profit increases, the stock portfolio appreciates in price. As one earns dividend yield, portfolio increases its value even more. As we analyzed the earning growth and dividend payout, we will find that in the long run, both items are logically connected to the GDP (Gross Domestic Product).

Earning Growth:

If one assumes that the S&P 500 index is an excellent proxy for the market as a whole — there is a historic and permanent relationship between S&P 500 index earning growth and real economy growth — GDP growth. The business factors that drive earning growth are the same factors that drive GDP growth. GDP at its heart, after all, is the sum of the revenues of all U.S. businesses. As business revenues grow, business earnings grow, and GDP grows.

On a macro-economics sense, over the long run, GDP growth depends on two main factors the population growth, and the productivity growth rate. Population growth plus productivity growth produce GDP growth. As population growth, the workforce grows and more people working, produces more output. Productivity is defined by output per person per hour. As the world is becoming more and more digitize, and as we automate more and more of our activities, it is raising the productivity more rapidly than we once thought possible.

Over the last seven decades, real GDP (not adjusted for inflation) has grown around at 3.5%. Past GDP growth of 3.5% a year has been driven by population growth of about 1.0% and productivity growth averaging about 2.5%. In future population growth is likely to slow down, perhaps by a little. However, in our view, this will be compensated by increase in the productivity growth due to the globalization and digitization of our new world.

If we assume that in future also, GDP will maintain its present growth rate of 3.5% a year and if we add to that an annual inflation rate of about 2.5%, one gets about 6% growth in the nominal GDP. This essentially represents the real and nominal (real + inflation) sales growth of 3.5% and 6% respectively for S&P 500 index in the future.