Financial Iceberg

Post on: 25 Апрель, 2015 No Comment

Bubble Territory Approaching ?

​​Another one of the more prominent themes among bond ETFs last year was growing speculation that high-yield bonds were approaching bubble territory. Calls for asset bubbles is an old investing avocation, and since the global financial crisis, it seems that every time an asset class’s popularity rises too quick for the comfort of some, a bubble must be right around the corner.

Talk of a junk bond bubble seemed to start in earnest in the second quarter of 2012, prompting a spate of coverage of the topic. Later in the year, there were reports of redemptions from popular junk bond ETFs such as the iShares iBoxx $ High Yield Corporate Bond Fund.

Those reports may have fueled the fire of the junk bond bubble prediction, but most mainstream media coverage of the issue ignored the fact that while HYG saw some modest outflows here and there, some other new high-yield bond ETFs became home to soaring inflows.

In other words, some important points about the efficacy of a junk bond bubble in the current environment are being missed, according to Market Vectors Portfolio Manager Fran Rodilosso.

I think there is a difference so far between what we are seeing at the beginning of 2013 and the types of credit bubbles we have seen historically, said Rodilosso. A bubble is built on excessive leverage, and modern bubbles have been fueled by leveraged buyouts, real estate speculation, and structured products with a high degree of embedded leverage.

While 2013 is still young, investors to this point, have scoffed at talk of junk bond bubble, sending major high-yield bond ETFs modestly higher to start the new year. HYG, the largest junk bond ETF by assets, is 1.6 percent to start the new year.

Clearly, quantitative easing, which has depressed yields on U.S. Treasuries, has contributed to a yield chase. However, as Rodilosso notes, credit spreads between junk bonds and Treasuries are not at concerning levels.

Yields have been pushed down by a highly aggressive central bank policy, with the result that yield-oriented investors have been pushed into owning lower-rated credits, said Rodilosso. As a result, the yields on riskier debt are as low as they have been. But the credit spreads, the difference between the yield on high yield bond and a Treasury security, are actually closer to their historic average.

One issue that may be fueling the junk bubble chatter is new issuance, which rose to an all-time high of $306 billion through the end of October.

In years past, that might have implied increased leveraged buyout activity or companies using debt to fund dividends, but Rodilosso highlights a different possibility.

Whereas during a more classic’ bubble a vast majority of debut issuance has historically funded takeovers, dividends, and massive capital spending, 2012’s record issuance was still, for the most part done for the purpose of refinancing. That refinancing was done at lower interest rates, reducing the cost of debt for many borrowers, while reducing the amount to be paid back over the next two years.

Not so Fun Damentals

​​ Esther George, the president of the Kansas City Fed and this year a voting member on the Feds rate-setting committee, the FOMC, delivered a speech last week in Kansas City in which she specifically addressed the Feds role in skewing investor attitudes, and the possible consequences:

​​ A long period of unusually low interest rates is changing investors behavior and is reshaping the products and the asset mix of financial institutions. Investors of all profiles are driven to reach for yield, which can create financial distortions if risk is masked or imperfectly measured, and can encourage risks to concentrate in unexpected corners of the economy and financial system. Companies and financial institutions, such as insurance companies and pension funds, and individual savers who traditionally invest in long-term safe assets, are facing challenges earning reasonable returns, and so they may reach for yield by taking on more risk and reallocating resources to earn higher returns. The push toward increased risk-taking is the intention of such policy, but the longer-term consequences are not well understood.

Of course, identifying financial imbalances, asset bubbles or looming crises is inherently difficult, as policymakers were painfully reminded during the financial crisis in 2008. Public transcripts of the FOMCs discussions from as early as 2006 show participants were clearly focused on issues in the housing market and yet did not fully appreciate the risk to the economy from the financial sectors exposure to risky mortgages.

Accordingly, I approach policy decisions with a healthy dose of humility when considering the long-run effects of monetary policy. We must not ignore the possibility that the low-interest rate policy may be creating incentives that lead to future financial imbalances. Prices of assets such as bonds, agricultural land, and high-yield and leveraged loans are at historically high levels. A sharp correction in asset prices could be destabilizing and cause employment to swing away from its full-employment level and inflation to decline to uncomfortably low levels.

Simply stated, financial stability is an essential component in achieving our longer-run goals for employment and stable growth in the economy and warrants our most serious attention.

So the FED had UnJunked the Junk Bond Market. ​

If you would like to receive our free daily markets updates, please Sign-up

But others are seeing the danger zone within the credit market.

​​The credit markets this week already look very different to how they ended last year. As BofAML’s Barnaby Martin notes, beta-compression, flatter curves and credit outperformance versus equity have all been abundant themes of late. Relative value is still there, when one looks closely, but is unfortunately not what it used to be.

​​ He adds that things in credit have started to feel a lot like 2007 again, and while he believes the trend is set to continue (though slower) and the liquidity-flooded fundamentals in the high-yield bond market have been holding up well, it is trends in the leveraged loan market, that continue to deteriorate, that are perhaps the only canary in the coal-mine worth watching as global central bank liquidity merely slooshes to the highest spread product in developed markets (until that is exhausted).

​​The rolling 12m bond default rate among European high-yield issuers fell to 1.8% in December, whereas loan default rates rose to 8.5%. With leverage rising, the hope for ever more greater fools continues, even as everyone is forced into the risky assets.

Investment Grade bond spreads are now through post-Lehman tights

The monthly graph below show us a support at 93.00 ( low of June 2008 ). We have to respect price action but remember the momentum is fading in a declining volume environment.

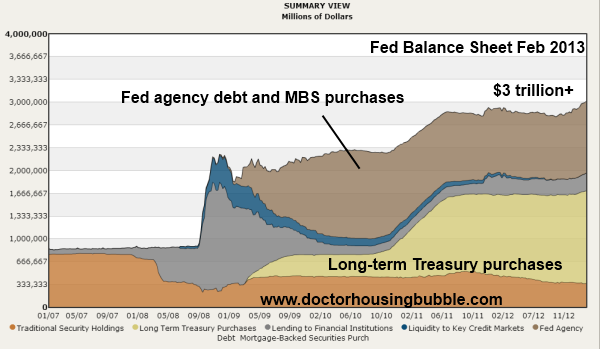

FED Induced liquidity buying

​

​Junk bonds have boomed following the Feds decision to continue with its loose monetary policy with $85 billion in monthly asset purchases. In fact, quantitative easing, accompanied by rock-bottom interest rates, has been accused of creating asset bubbles in places such as the treasury bond and the junk bond markets.

With investors chasing higher yield in the wake of low returns on other assets, high yield issuers raised a record quantum of debt in 2012. Fund raising companies have frequently used the proceeds to refinance higher interest-bearing loans. Some of the money ended up with private equity firms, such as Bain Capital, who borrow for leveraged buyouts and then burden the company with debt. In any case, there is no doubt that the boom in junk bonds has ensured access to capital markets for even those companies with the lowest credit ratings.

The chase for yield has driven down the yield on junk bonds to record lows. In fact, the interest in such bonds has been so great that some mutual funds have even refused to take new investors. Junk bond yields recently fell below 6% for the first time (giving them about 500 basis points spread over U.S. Treasury bills). From a historical perspective, junk bond issuers have paid about 10% in interest charges. (It is noteworthy that while yields may currently be low, spreads are nowhere near their historical bottom.)

After several years of tidy returns, returns from junk bonds came to over 15% in 2012. The sharpest appreciation has been in the lowly CCC rated paper. With good returns in the period following the financial crisis in 2008, market mavens wonder if there is much room left for capital appreciation or whether these bonds are to be held as a coupon play only.

Risks to the high yield market include a cyclical rotation into equities, firmer interest rates or a weaker economy, which would increase corporate default. Even without any recession, there is risk in the sense that should earnings take off again, then investors may bail out of debt to enter the stock market. Furthermore, investors face potential losses in case of callable bonds.

Yields have been pushed down by a highly aggressive central bank policy, with the result that yield-oriented investors have been pushed into owning lower-rated credits. As a result, the yields on riskier debt are as low as they have ever been, says Fran Rodilosso, fixed income portfolio manager at Market Vectors ETFs. But the credit spreads, the difference between the yield on a high yield bond and a Treasury security, are actually closer to their historic average.

Early Warning Signs. Correction on Huge Volume

​

​The largest ETF tracking high-yield corporate bonds was down last week from a multiyear high, unnerving bullish stock investors and those who have piled into junk debt funds recently.

The $16.3 billion iShares iBoxx High Yield Corporate Bond slipped 1.6 % from the peak on very strong volume.

Many analysts keep a close on high-yield bonds to gauge risk appetite and the health of credit markets. Weakness in junk debt often presages downdrafts in stocks.

Some investors and advisors are using high-yield bonds as an equity proxy after the financial crisis, said Josh Brown at The Reformed Broker blog in a post earlier this month. [I]ts also something Ive seen other financial advisors doing as a half-way measure toward coaxing their risk-averse clients off the sidelines without putting them into a higher equity weighting, he wrote. [Are High-Yield Bond ETFs Overvalued After Big Run?]

Investors piling into junk bonds have pushed yields to all-time lows. Every time junk bonds look like they have no more room to gain, they gain some more, reports Michael Aneiro at Barrons.

Yet effective yields in junk bonds are at multiyear lows, Kimble Charting Solutions points out. The effective yield measures a bonds yield when interest payments are reinvested. Also, high-yield funds and the S&P 500 are hitting key technical resistance levels at the same time, according to Kimble.

The bottom line is that investors should keep a close eye on high-yield bond ETFs for any additional warning signs.

Another Warning Signs.

​

​Illiquid credit bonds are vulnerable to huge outflows as we saw last week. it was the largest HYG ETF outflow on record. Furthermore, HYG’s shares outstanding have plunged over 11% in the last 90 days. The rotation appears to be up-in-quality and up-in-capital structure as loan funds saw inflows — but with stocks and credit linked inexorably via the balance sheet, the divergence cannot last forever (and never has). Until very recently this has not spilled over into the cash bond market, but the last few days have seen selling pressure picking up into this illiquid market. ( See graphs below )

The HYG bond market is very illiquid and thus more sensitive to huge flows. But what we do observe since the end of january is the complete disconnect between the credit bond market and the stock market risk behavior. ( See graph below )