Financial Advisor Compensation Fees and Commission

Post on: 16 Март, 2015 No Comment

Financial advisors provide their clients with an objective view of their financial situation and thus offer them valuable advices on the type of investment strategies they should follow in order to achieve their financial goals. Additionally, they compensate for the time or knowledge that some investors lack.

Financial advisors can be categorized by the professional designations they possess and the types of reward structures they require in return to their services.

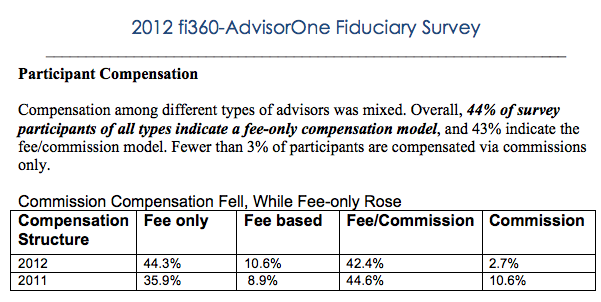

Commission Structure

Financial advisors may be compensated by one of the following ways:

- Fee Only Financial Advisor

A financial advisor that charges you only a fee will leave the constructed by him plan to be executed by you. The only product that such financial advisors offer is the plans for achievement of financial goals.

Some of the advantages of hiring such a financial advisor include the construction of a comprehensive plan, which is the major product they offer to clients. Additionally, they provide you with objective recommendations that are driven by the commission you will pay to him/her. Finally, by hiring a financial advisor, who is on fee only, you gain the advantage of personal interactions in which you will get thorough understanding of the constructed plan.

On the other hand, fee only financial advisors have their drawbacks. The fee you will be charged will greatly exceed the one you will be charged by the other types of advisors. The fact that the client should execute the plan on their own may be viewed as a difficulty by many inexperienced investors. Finally, since in the course of time both market conditions and needs of investors change, adjustments on the plan should be made, which may represent an additional expense.

This second method of compensating a financial advisor includes not only the construction of the plan, but also its execution. So, the fee is paid for the construction of the plan, whereas the commission for its execution.

Additionally, the fee may be replaced by a percentage of the assets that are under the management of the financial advisor.

Some of the advantages of the fee plus compensation advisor include the fact that not only a plan is provided but also it is executed by the advisor. Additionally, the latter provides other products in addition to the plan’s development and execution, such as different types of insurances.

On the other hand, the objectivity of the financial advisor is under question. Additionally, since advisors with this compensation structure provide house products, they may not be very suitable for your financial situation. Finally, the financial advisor may be lured by the higher commission offered by some products and in his/her attempt to get that commission may overlook equally good products with lower commissions.

Under this model, the financial advisor’s compensation constitutes only of the commission s/he gets from the products you have purchased through him/her. As a result it is suitable to qualify such a financial advisor as a salesperson since his main activity is the selling of different products to his/her clients.