Fidelity Learning Center Types of ETFs Actively Managed

Post on: 10 Апрель, 2015 No Comment

Your e-mail has been sent.

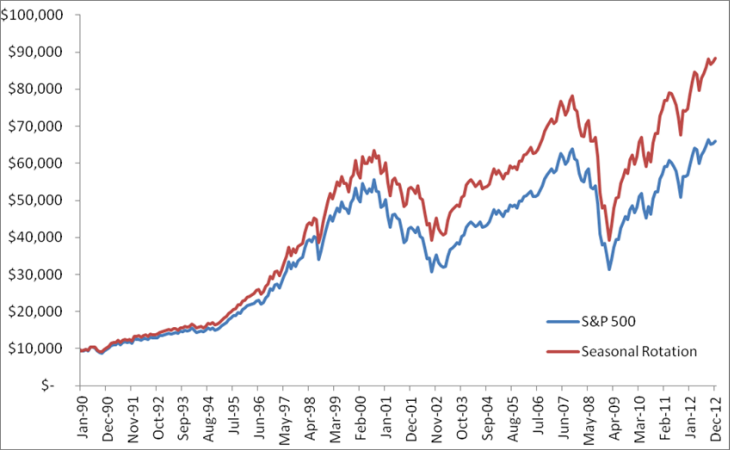

For nearly 20 years, all exchange-traded funds (ETFs) brought to the market replicated well-known benchmark indexes. In 2003, Powershares introduced the first ETFs that followed quantitative indexes based on active management strategies. Actively-managed ETFs invest in a portfolio of securities that is subjectively chosen by a fund manager on their own rather than follow a rules-based index. The idea is to perform better than a benchmark index through flexible active management.

Actively managed ETFs are registered with the Securities and Exchange Commission (SEC) as an investment company. The actively managed ETF would list its shares on a national securities exchange, and investors would trade the ETF shares throughout the day at various prices in the secondary market. The problem with active ETFs is in the daily reporting of positions and reporting the intraday price without giving away exactly what the fund manager is doing.

Every active ETF on the market today must disclose holdings daily. The underlying concept behind an actively managed ETF is that the portfolio manager will be able to adjust the portfolio as needed or desired while not being subject to the set rules of an index. The active manager aims to beat a benchmark and has to devise trading models and strategies to do so. Because very few portfolio managers are willing to divulge their next portfolio move for fear of front-running by other investors, ETFs with active portfolio managers have been slow to gain a foothold.

Advantages to Actively-Managed ETFs:

- The most talked-about benefit of actively managed ETFs is the opportunity to outperform indexes that other ETFs follow.

- The biggest benefit in actively managed ETFs will go to investors who would otherwise invest in a comparable actively managed open-end fund. An actively managed ETF would likely charge less than its open-end counterpart because the structure allows ETF companies to eliminate many client services and to reduce the cost of some administrative services.

- If a fund company introduced an actively managed ETF that closely tracked the performance of actively managed open-end funds, investors who frequently trade the open-end fund might choose to use the ETF because there would be no minimum required hold time (currently 30 days on most open-end fund purchases).

- Like index ETFs, the share creation and redemption process would make the actively managed ETF more tax-efficient than a traditional active open-end structure. This could be the biggest selling point of the funds.

- Flexibility is another key benefit. Like index ETFs, actively managed ETFs allow investors to trade throughout the day, including short sales and buying on margin.

Disadvantages to Actively-Managed ETFs:

- Fund companies are required to disclose their holdings on a daily basis for actively managed ETFs to function properly. The authorized participants need a fund composition file each day that lists the securities to turn in for a creation unit.

- Disclosure could be a problem for larger funds and funds that hold illiquid securities. In an open-end fund, active managers go to great lengths to conceal their holdings and camouflage trades so that competitors do not take advantage of their activity. Full disclosure hinders an active manager’s ability to implement a fund’s strategy since other investors figure out the manager’s intent and front-run trades, thus diluting potential profit opportunities for ETF shareholders and escalating losses. In addition, investors could free-ride and exploit a skilled manager’s research at no cost. The public would have access to daily fund information without purchasing ETF shares. Active manager skill is rare and highly valued in the investment management industry. If an actively managed ETF manager had skill, it would not be long before free-riders would tag along and dilute returns. Actively managed ETF managers may be reluctant to make adjustments in the portfolio for fear of front-runners and other traders in the marketplace. That reluctance could hurt ETF shareholders. All of these issues would reduce the competitive advantage of actively managed ETFs and reduce investors’ incentive to use actively managed ETFs over less-exposed traditional open-end mutual funds.

- Actively managed ETFs may develop large premiums or discounts to NAV on volatile trading days. With index ETFs, authorized participants (APs) have been able to minimize the possibility of arbitrage by releasing or redeeming shares as a way of controlling inventory and, therefore, prices. Any time a price disparity becomes apparent in an index ETF, it immediately gets traded away. Actively managed ETFs are a concern because the APs may not be able to maintain the same kind of control. It is difficult to hedge positions without knowing exactly what the underlying securities in an actively managed ETF are during the day, and that may lead to wide price disparities.

- Large price disparities are particularly likely to happen if an ETF’s last trade occurs well before the market close. At that, the underlying securities in the ETF might have already moved the fund’s intraday value away from its last trade price. The media will pick up on the large disparities, and the investing public will become outraged.

It’s important to note that expense ratios are different for actively-managed funds as opposed to index-tracking ETFs. Investors should expect costs to be higher.