Fidelity halts bitcoin investments from IRAs The Tell

Post on: 16 Март, 2015 No Comment

[This post was updated Thursday afternoon to include a new comment from SecondMarket.]

Fidelity Investments is no longer allowing clients to invest in the virtual currency bitcoin through SecondMarkets Bitcoin Investment Trust, a representative for Fidelity told MarketWatch on Thursday.

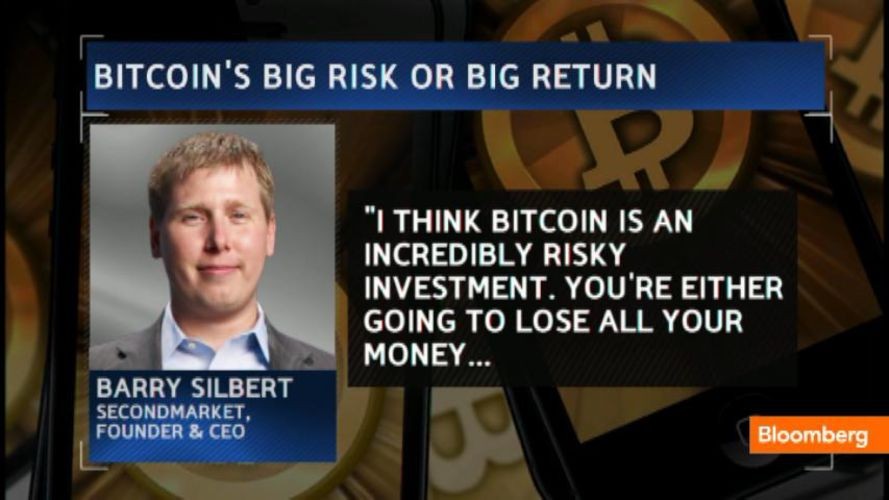

MarketWatch reported Wednesday that certain Fidelity clients could invest in the Bitcoin Investment Trust through their IRAs. That information was based on an interview with Barry Silbert, chief executive of SecondMarket. Read Wednesdays post here.

On Thursday, a Fidelity spokesman told MarketWatch that such investments are no longer allowed. The spokesman couldnt confirm when or why the policy was changed.

On an individual basis, we allowed an investor to invest in that Bitcoin Investment Trust, said Rob Beauregard, director of public relations at Fidelity, in a telephone interview Thursday morning. We are no longer allowing that.

He continued: We’re not commenting right now on why that was first allowed. There are reviews going on, and we’ll make a decision at a later date. At this time, it is not available on our retail platform.

SecondMarkets Silbert provided the following statement Thursday afternoon: The Bitcoin Investment Trust was previously approved by Fidelity as an eligible investment for accredited clients in their self-directed IRA accounts and investments began closing last week. We understand that Fidelity has decided to reevaluate this decision.

SecondMarket had said earlier that certain Fidelity clients could invest in bitcoin through the Bitcoin Investment Trust.

The Bitcoin Investment Trust, which launched in late September. is only open to accredited and institutional investors and has a minimum investment of $25,000. There are a few ways for a natural person to qualify as an accredited investor, according to the Securities and Exchange Commission. The first way is for an investor to have an individual or joint net worth of more than $1 million, not including the value of the primary residence. The second way is for the investor to have earned more than $200,000 in each of the last two years or for the investor to have a joint income with a spouse of more than $300,000.

Chamath Palihapitiya, a venture capitalist who is on SecondMarkets board of directors and is a part owner of the Golden State Warriors, tweeted this last week:

According to my family office, I am the first person to have bought BTC thru my Fidelity IRA. Long live tax free compounding!

— Chamath Palihapitiya (@chamath) December 6, 2013

Fidelitys website describes the company as the No. 1 provider of IRAs in the U.S. and one of the largest mutual-fund companies. Fidelity had $4.2 trillion in assets under administration as of Aug. 31, according to the firms website.

Saumya Vaishampayan

Follow Saumya @saumvaish

Follow The Tell @thetellblog