Fee Based Vs Commissioned Based Financial Planners

Post on: 6 Май, 2015 No Comment

by Guest Contributer

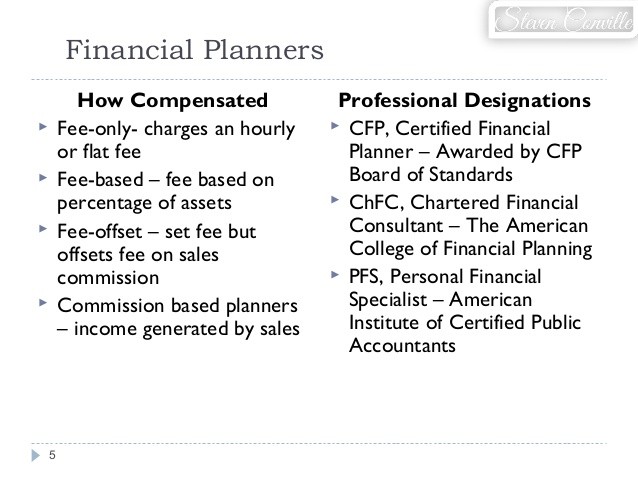

There are two main types of financial planners – fee based and commission based. Both types of financial planners provide financial advice on how to best manage most aspects of your financial life. This can include managing accounts, saving for goals, dealing with investments, ensuring that you have enough insurance, and even looking at estate planning.

Fee Based Financial Planners

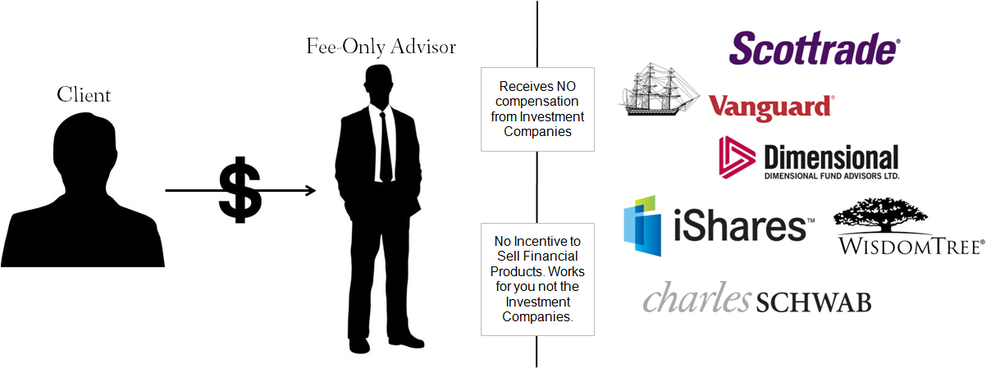

Fee only financial planners provide advice to their clients for a set fee. This fee varies, but it usually includes an initial consultation and a final deliverable of the financial plan. These financial planners are not reimbursed for the products they recommend and receive no commission from them if you sign up to use a certain product.

The big advantage of using this type of financial planner is that you can be more certain that the advice given to you is unbiased and does not contain a potential sales pitch or product pitch. However, the trade-off is that their services can be more expensive and even be prohibitive for on-going needs.

Fee based financial planners are good to get a financial plan started, since you only pay for the fee once. You may even consider going back and checking in every 5 years or so in order to make sure you and your financial plan are still on track. Fee based financial planners usually work independently or with a group of other fee based financial planners.

Commission Based Financial Planners

Commission based financial planners provide financial advice to their clients, but they also sell products and services that generate a commission. This is how commission based financial planners earn an income for themselves. They usually present this product in the form of recommended investments or services that fit the need of the individual.

By law, they must choose products that meet the individual’s need, but that does not necessarily have to be the best product. Some examples of products they may recommend include annuities, mutual funds, life insurance policies, and other investments.

The big disadvantage of using a commission based financial planner is the conflict of interest that often occurs from both providing advice to clients seeking help and the need to sell products in order to earn a commission. Commission-only planner usually work for companies for which their recommended products are affiliated such as banks, investment brokerages, and insurance companies.

Everyones Needs Are Different

There are times when either fee based or commissioned based financial planners are needed. One may not be better than the other in certain circumstances. Everyones circumstances are different, and it is very important that you pick a financial planning and his or her fee structure that is best for your situation. The most important thing is understanding exactly how your financial planner is compensated and reconciling that with what is best for you and your familys financial plan and future.