Federal Reserve s Policy Actions during the Financial Crisis and Lessons for the Future

Post on: 25 Июль, 2015 No Comment

Federal Reserves Policy Actions during the Financial Crisis and Lessons for the Future

Vice Chairman Donald L. Kohn

At the Carleton University, Ottawa, Canada

May 13, 2010

The financial and economic crisis that started in 2007 tested central banks as they had not been tested for many decades. We needed to take swift and decisive action to limit the damage to the economy from the spreading distress in financial markets. Because the financial distress was so deep and pervasive and because it took place in financial markets whose structure had evolved dramatically, our actions also needed to be innovative if they were to have a chance of being effective. Many central banks made substantial changes to traditional policy tools as the crisis unfolded. But the epicenter of the financial shock was in U.S. mortgage markets, with severe effects on many of our financial institutions, and our financial markets had perhaps evolved more than many others. As a consequence, no central bank innovated more dramatically than the Federal Reserve

We traditionally have provided backup liquidity to sound depository institutions. But in the crisis, to support financial markets, we had to provide liquidity to nonbank financial institutions as well. Just as we were forced to adapt and innovate in meeting our liquidity provision responsibilities, we also needed to adapt and innovate in the conduct of monetary policy. Very early in the crisis, it became evident that lowering short-term policy rates alone would not be sufficient to counter the adverse shock to the U.S. economy and financial system. We needed to go furthermuch further, in factto ease financial conditions and thus encourage spending and support employment. We took steps to reinforce public understanding of our inflation objective to prevent the development of deflationary expectations; we provided guidance on the possible future course of our policy interest rate; and we purchased large amounts of longer-term securities, and in the process created unprecedented volumes of bank reserves. Now, careful planning is under way to remove that stimulus at the appropriate time. My discussion today will focus on innovations in both our role as liquidity provider and in our monetary policy tools: their motivation, their effectiveness, and their lessons for the future. 1

The Federal Reserves Liquidity Tools

Before the crisis, the implementation of monetary policy was fairly straightforward, and our approach minimized its footprint on financial markets. The Federal Reserve adjusted the liquidity it provided to the banking system through daily operations with a relatively small set of broker-dealers against a very narrow set of collateralTreasury and agency securities. These transactions had the effect of changing the aggregate quantity of reserve balances that banks held at the Federal Reserve, and that liquidity was distributed by interbank funding markets through the banking system in the United States and around the world. In addition, the Federal Reserve stood ready to lend directly to commercial banks and other depository institutions at the discount window, where, at their discretion, banks could borrow overnight at an above-market rate against a broad range of collateral when they had a need for very short-term funding. Ordinarily, however, little credit was extended through the discount window. Banks were able to obtain their funding and reserves in the open market and generally turned to the window only to cover very short-term liquidity shortfalls arising from operational glitches or transitory marketwide supply shortfalls, as opposed to more fundamental funding problems.

During the financial crisis, however, market participants became highly uncertain about the financial strength of their counterparties, the future value of assets (including any collateral they might be lending against), and how their own needs for capital and liquidity might evolve. They fled to the safest and most liquid assets, and as a result, interbank markets stopped functioning as an effective means to distribute liquidity, increasing the importance of direct lending through the discount window. At the same time, however, banks became extremely reluctant to borrow from the Federal Reserve for fear that their borrowing would become known and thus cast doubt on their financial condition. Importantly, the crisis also involved major disruptions of important funding markets for other institutions. Commercial paper markets no longer channeled funds to lenders or to nonfinancial businesses, investment banks encountered difficulties borrowing even on a short-term and secured basis as lenders began to have doubts about some of the underlying collateral, banks overseas could not rely on the foreign currency swap market to fund their dollar assets beyond the very shortest terms, investors pulled out from money market mutual funds, and most securitization markets shut down. These disruptions to financing markets posed the same threats to the availability of credit to households and businesses that runs on banks created in the more bank-centric financial system of the 1800s and most of the 1900s. As a result, intermediaries unable to fund themselves were forced to sell assets, driving down prices and exacerbating the crisis; moreover, they were unwilling to assume the risks necessary to make markets in the debt and securitization instruments that were critical channels supporting household and business borrowingand households and businesses unable to borrow were thus unable to spend, thereby deepening the recession.

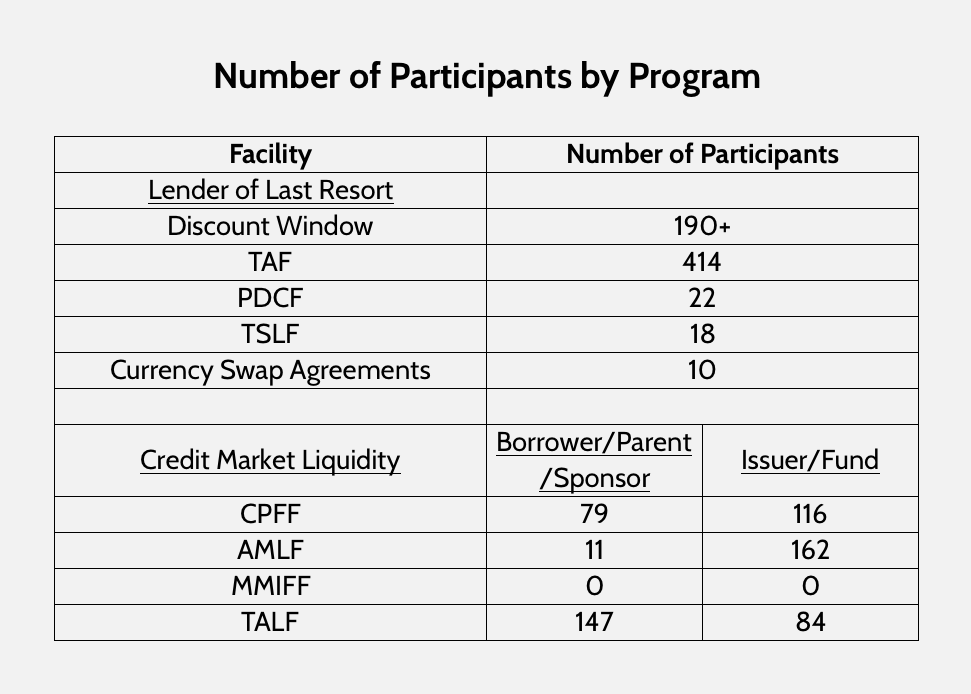

These liquidity pressures were evident in nearly every major country, and every central bank had to adapt its liquidity facilities to some degree in addressing these strains. At the Federal Reserve, we had to adapt somewhat more than most, partly because the scope of our activities prior to the crisis was fairly narrowparticularly relative to the expanding scope of intermediation outside the banking sectorand partly because the effect of the crisis was heaviest on dollar funding markets. Initially, to make credit more available to banks, we reduced the spread of the discount rate over the target federal funds rate, lengthened the maximum maturity of loans to banks from overnight to 90 days, and provided discount window credit through regular auctions in an effort to overcome banks reluctance to borrow at the window due to concerns about the stigma of borrowing from the Federal Reserve. We also lent dollars to other central banks so that they could provide dollar liquidity to banks in their jurisdictions, thus easing pressures on U.S. money markets. As the crisis intensified, however, the Federal Reserve recognized that lending to banks alone would not be sufficient to address the severe strains affecting many participants in short-term financing markets. Ultimately, the Federal Reserve responded to the crisis by creating a range of emergency liquidity facilities to meet the funding needs of key nonbank market participants, including primary securities dealers, money market mutual funds, and other users of short-term funding markets, including purchasers of securitized loans. 2

Why couldnt the Federal Reserve maintain its routine lending practices and rely on lending to commercial banks, which in turn lend to nonbank firms? The reason is that financial markets have evolved substantially in recent decadesand, in retrospect, by more than we had recognized prior to the crisis. The task of intermediating between investors and borrowers has shifted over time from bankswhich take deposits and make loansto securities marketswhere borrowers and savers meet more directly, albeit with the assistance of investment banks that help borrowers issue securities and then make markets in those securities. An important aspect of the shift has been the growth of securitization, in which loans that might in the past have remained on the books of banks are instead converted into securities and sold to investors in global capital markets. Serious deficiencies with these securitizations, the associated derivative instruments, and the structures that evolved to hold securitized debt were at the heart of the financial crisis. Among other things, the structures exposed the banking system to risks that neither participants in financial markets nor regulators fully appreciated. Banks became dependent on liquid markets to distribute the loans they had originated. And some parts of the securitized loans were sold to off-balance-sheet entities in which long-term assets were funded by short-term borrowing with implicit or explicit liquidity guarantees provided by the banks. Securitization markets essentially collapsed when banks became unwilling to increase their exposure to such risks during the crisis, when the liquidity guarantees were invoked, and when other lenders in securitization markets became unwilling to supply credit.

Although the Federal Reserves lending actions during the crisis were innovative and to some degree unprecedented, they were based on sound legal and economic foundations. Our lending to nonbank institutions was grounded in clear authority found in section 13(3) of the Federal Reserve Act permitting a five-member majority of the Federal Reserve Board to authorize a Reserve Bank to lend to individuals, partnerships, or corporations in unusual and exigent circumstances. These actions also generally adhered to Walter Bagehots dictum, a time-honored central banking principle for countering a financial panic: Lend early and freely to solvent institutions at a penalty rate and against good collateral. 3 Central banks are uniquely equipped to carry out this mission. They regularly lend to commercial banks against a wide variety of collateral and have the infrastructure to value and perfect their interest in the underlying collateral. During a panic, market functioning is typically severely impaired, with investors fleeing toward the safest and most liquid assets, and the resulting lack of liquidity, even for sound banks with sound assets, can result in funding pressures for financial institutions and others. By lending to solvent institutions against illiquid collateral, central banks effectively step in to assume the liquidity risk of such assetsthat is, the risk that assets can only be sold in the near term at fire sale prices. And their ability to substitute for private-sector intermediation in a panic is unlimited since they create reserves. For the most part, the Federal Reserve priced these facilities to be attractive when markets were disrupted but not economical to potential borrowers as market functioning improved.

Importantly, lending against good collateral to solvent institutions supplies liquidity, not capital, to the financial system. To be sure, limiting a panic mitigates the erosion of asset prices and hence capital, but central banks are not the appropriate authorities to supply capital directly; if government capital is necessary to promote financial stability, then that is a fiscal function. This division of responsibilities presented challenges in the crisis. The securitization markets were impaired by both a lack of liquid funding and by concerns about the value of the underlying loans, and broad-based concerns about the integrity of the securitization process. To restart these markets, the Federal Reserve worked with the Treasury in establishing the Term Asset-Backed Securities Loan Facility (TALF): The Federal Reserve supplied the liquid funding, while the Treasury assumed the credit risk. The issue of the appropriate role of the central bank and fiscal authority was present in other contexts as well. We were well aware that we were possibly assuming a risk of loss when we lent to stabilize the systemically important firms of Bear Stearns and American International Group (AIG). Unfortunately, at the time, alternative mechanisms were not available and we lent with the explicit support of the Secretary of the Treasury, including a letter from him acknowledging the risks.

An important task before us now is to assess the effectiveness of these actions. Not surprisingly, rigorous studies that evaluate the extent to which the emergency liquidity facilities contributed to improved financial conditions are just beginning to emerge. Nonetheless, market reactions to the announcement of the emergency facilities, anecdotal evidence, and a number of the studies we do have suggest that the facilities forestalled potentially much worse outcomes and encouraged improvements. For example, some asset-backed securities (ABS) spreads, such as those for consumer ABS and commercial mortgage-backed securities, narrowed significantly following the creation of the TALF, and activity in ABS markets has picked up. While the overall improvement in the economic outlook has no doubt contributed to the improvement in ABS markets, it does appear that the TALF helped to buoy the availability of credit to firms and households and thus supported economic activity. Indeed, following the kick-start from the TALF, a number of these markets are now operating without any governmental backing. Another example is the reduction in pressures in U.S. dollar funding markets (as evidenced by the sharp narrowing of spreads between Libor (London interbank offered rates) and OIS (overnight index swap) rates and the decline in premiums paid for U.S. dollars in foreign exchange swap markets). These developments followed the establishment of the Term Auction Facility (which auctioned discount window credit to depository institutions) and also of liquidity swaps between the Federal Reserve and foreign central banks, which enabled those banks to lend dollars to commercial banks in their jurisdictions. Our willingness to lend in support of the commercial paper and asset-backed commercial paper markets helped to stem the runs on money market funds and other nonbank providers of short-term credit. Of note, usage of these emergency liquidity facilities declined markedly as conditions in financial markets improved, indicating that they were indeed priced at a penalty to more normal market conditions. They were successfully closed, suggesting that market participants had not become overly reliant on these programs and were able to regain access to funding markets. Except for the TALF and the special Bear Stearns and AIG loans, all were repaid without any losses to the Federal Reserve. The funding markets evidently remain somewhat vulnerable, however. Just this week, with the reemergence of strains in U.S. dollar short-term funding markets in Europe, the Federal Reserve reestablished temporary U.S. dollar liquidity swap facilities with the Bank of Canada, the Bank of England, the European Central Bank, the Bank of Japan, and the Swiss National Bank. 4

Lessons for Handling Future Liquidity Disruptions

What lessons can be drawn from the Federal Reserves experience in the financial crisis when designing a toolbox for dealing with future systemic liquidity disruptions? First, the crisis has demonstrated that, in a financial system so dependent on securities markets and not just banks for the distribution of credit, our ability to preserve financial stability may be enhanced by making sure the Federal Reserve has authority to lend against good collateral to other classes of sound, regulated financial institutions that are central to our financial marketsnot on a routine basis, but when the absence of such lending would threaten market functioning and economic stability. Thus, it would seem that authority similar to that provided by section 13(3) will continue to be necessary.

Second, we recognize that holding open this possibility is not without cost. With credit potentially available from the Federal Reserve, institutions would have insufficient incentives to manage their liquidity to protect against unusual market events. Hence, emergency credit should generally be available only to groups of institutions that are tightly regulated and closely supervised to limit the moral hazard of permitting access to the discount window, even when such access is not routinely granted. If the Federal Reserve did not directly supervise the institutions that would potentially receive emergency discount window credit, it would need an ongoing and collaborative relationship with the supervisor. The supervisor should ensure that any institution with potential access to emergency discount window credit maintained conservative liquidity policies. The supervisor would also provide critical insight into the financial condition of the borrower and the quality of the available collateral and, more generally, whether lending was necessary and appropriate. Most importantly, no such institution should be considered too big or too interconnected to fail, and any losses should be shouldered by shareholders and other providers of capital, by management, and, where consistent with financial stability, by creditors as well.

Third, the United States needs a resolution facility for systemically important institutions that meets the criteria I just enunciated. That authority must have access to liquidity to stabilize situations where necessary, but the fiscal authorities, not the central bank, should be the ones deciding whether to take on the credit risk of lending to troubled institutions in order to forestall financial instability.

Fourth, transparency about unusual liquidity facilities is critical. The public appropriately expects that when a central bank takes innovative actionsespecially actions that might appear to involve more risk than normal lending operationsthen it will receive enough information to judge whether the central bank has carried out the policy safely and fairly. The required degree of transparency might well involve more-detailed types of reporting than for normal, ongoing, lending facilities.

Finally, the problem of discount window stigma is real and serious. The intense caution that banks displayed in managing their liquidity beginning in early August 2007 was partly a result of their extreme reluctance to rely on standard discount mechanisms. Absent such reluctance, conditions in interbank funding markets might have been significantly less stressed, with less contagion to financial markets more generally. Central banks eventually were able to partially circumvent this stigma by designing additional lending facilities for depository institutions; but analyzing the problem, developing these programs, and gathering the evidence to support a conclusion that they were necessary took valuable time. Going forward, if measures are adopted that could further exacerbate the stigma of using central bank lending facilities, the ability of central banks to perform their traditional functions to stabilize the financial system in a panic may well be impaired.

Monetary Policy and the Zero Bound

The Federal Reserve and other central banks reacted to the deepening crisis in the fall of 2008 not only by opening new emergency liquidity facilities, but also by reducing policy interest rates to close to zero and taking other steps to ease financial conditions. Such rapid and aggressive responses were expected to cushion the shock to the economy by reducing the cost of borrowing for households and businesses, thereby encouraging them to keep spending.

After short-term rates reached the effective zero bound in December 2008, the Federal Reserve also acted to shape interest rate and inflation expectations through various communications. At the March 2009 meeting, the Federal Open Market Committee (FOMC) indicated that it viewed economic conditions as likely to warrant exceptionally low levels of the federal funds rate for an extended period. This language was intended to provide more guidance than usual about the likely path of interest rates and to help financial markets form more accurate expectations about policy in a highly uncertain economic and financial environment. By noting that the federal funds rate was likely to remain at exceptionally low levels for an extended period, the FOMC likely was able to keep long-term interest rates lower than would otherwise have been the case.

To provide the public with more context for understanding monetary policy decisions, Board members and Reserve Bank presidents agreed in late 2007 to prepare more frequent forecasts covering longer time spans and explain those forecasts. In January 2009, the policymakers also added information about their views of the long-run levels to which economic growth, inflation, and the unemployment rate were likely to converge over time. The additional clarity about the long-run level for inflation, in particular, likely helped keep inflation expectations anchored during the crisis. Had expectations followed inflation down, real interest rates would have increased, restraining spending further. Had expectations risen because of concern about the Federal Reserves ability to unwind the unusual actions it was taking, we might have needed to limit those actions and the resulting boost to spending.

Given the severity of the downturn, however, it soon became clear that lowering short-term policy rates and attempting to shape expectations would not be sufficient alone to counter the macroeconomic effects of the financial shocks. Indeed, once the Federal Reserve reduced the federal funds rate to zero, no further conventional policy easing was possible. The Federal Reserve needed to use alternative methods to ease financial conditions and encourage spending. Thus, to reduce longer-term interest rates, like those on mortgages, the Federal Reserve initiated large-scale purchases of longer-term securities, specifically Treasury securities, agency mortgage-backed securities (MBS), and agency debt. All told, the Federal Reserve purchased $300 billion of Treasury securities, about $175 billion of agency debt obligations, and $1.25 trillion of agency MBS. In the process, we ended up supplying about $1.2 trillion of reserve balances to the banking systema huge increase from the normal level of about $15 billion over the few years just prior to the crisis.

How effective have these various steps been in reducing the cost of borrowing for households and businesses while maintaining price stability? Central banks have lots of experience guiding the economy by adjusting short-term policy rates and influencing expectations about future policy rates, and the underlying theory and practice behind those actions are well understood. The reduction of the policy interest rate to close to zero led to a sharp decline in the cost of funds in money marketsespecially when combined with the creation of emergency liquidity facilities and the establishment of liquidity swaps with foreign central banks that greatly narrowed spreads in short-term funding markets. Event studies at the time of the release of the March 2009 FOMC statement (when the extended period language was first introduced) indicate that the expected path of policy rates moved down substantially. Market participants reportedly interpreted the characterization of the federal funds rate as likely to remain low for an extended period as stronger than the for some time language included in the previous statement. 5 Nonetheless, the extended period language has not prevented interest rates and market participants expectations about the timing of exit from the zero interest rate policy from reacting to incoming economic information, though each repetition of the extended period language has appeared to affect those expectations a little.

By contrast, the economic effects of purchasing large volumes of longer-term assets, and the accompanying expansion of the reserve base in the banking system, are much less well understood. One question involves the direct effects of the large-scale asset purchases themselves. The theory behind the Federal Reserves actions was fairly clear: Arbitrage between short- and long-term markets is not perfect even when markets are functioning smoothly, and arbitrage is especially impaired during panics when investors are putting an unusually large premium on the liquidity and safety of short-term instruments. In these circumstances, purchasing longer-term assets (and thus taking interest rate risk from the market) pushes up the prices of the securities, thereby lowering their yields. But by how much and for how long? Good studies of these sorts of actions also are sparse. Currently, we are relying in large part on event studies analyzing how much interest rates declined when purchases were announced in the United States or abroad. According to these studies, spreads on mortgage-related assets fell sharply on November 25, 2008, when the Federal Reserve announced that it would initiate a program to purchase agency debt and agency MBS. A similar pattern for Treasury yields was observed following the release of the March 2009 FOMC statement, when purchases of longer-term Treasury securities were announced. 6 Effectiveness, however, is hard to quantify, partly because we are uncertain about how, exactly, the purchases put downward pressure on interest rates. My presumption has been that the effect comes mainly from the total amount we purchase relative to the total stock of debt outstanding. However, others have argued that the market effect derives importantly from the flow of our purchases relative to the amount of new issuance in the market. Some evidence for the primacy of the stock channel has accumulated recently, as the recent end of the MBS purchase program does not appear to have had significant adverse effects in mortgage markets.

A second issue involves the effects of the large volume of reserves created as we purchased assets. The Federal Reserve has funded its securities purchases by crediting the accounts that banks hold with us. In explanations of our actions during the crisis, we have focused on the effects of our purchases on the prices of the assets that we bought and on the spillover to the prices of related assets, as I have just done. The huge quantity of bank reserves that were created has been seen largely as a byproduct of the purchases that would be unlikely to have a significant independent effect on financial markets and the economy. This view, however, is not consistent with the simple models in many textbooks or the monetarist tradition in monetary policy, which emphasizes a line of causation from reserves to the money supply to economic activity and inflation. According to these theories, extra reserves should induce banks to diversify into additional lending and purchases of securities, reducing the cost of borrowing for households and businesses, and so should spark an increase in the money supply and spending. To date, this channel does not seem to have been effective: Interest rates on bank loans relative to the usual benchmarks remain elevated, the quantity of bank loans is still falling, and money supply growth has been subdued. Banks behavior appears more consistent with the standard Keynesian model of the liquidity trap, in which demand for reserves becomes perfectly elastic when short-term interest rates approach zero. But the portfolio behavior of banks might shift as the economy and confidence recover, and we will need to watch and study this channel carefully.

Another uncertainty deserving of additional examination involves the effect of large-scale purchases of longer-term assets on inflation expectations. The more we buy, the more reserves we will ultimately need to absorb, and the more assets we will ultimately need to dispose of before the conduct of monetary policy, the behavior of interbank markets, and the Federal Reserves balance sheet can return completely to normal. As a consequence, these types of purchases can increase inflation expectations among some observers who may see a risk that we will not reduce reserves and raise interest rates in a timely fashion. So far, longer-term inflation expectations have generally been well anchored over the past few years of unusual Federal Reserve actions. However, many unsettled issues remain regarding the linkage between central bank actions and inflation expectations, and concerns about the effect of the size of our balance sheet are often heard in financial market commentary.

Lesson from Conducting Monetary Policy in a Crisis

It is certainly too soon to fully assess all the lessons learned concerning the conduct of monetary policy during the crisis, but a few observations seem worth noting even at this early stage.

First, commitments to maintain interest rates at a given level must be properly conditioned on the evolution of the economy. If they are to achieve their objectives, central banks cannot make unconditional interest rate commitments based only on a time dimension. The Bank of Canada has recently illustrated that need by revising its time commitment based on changing circumstances. To further clarify that the extended period language is conditional on the evolution of the economy, the FOMC emphasized in the November 2009 statement that its expectation that the federal funds rate is likely to remain at an exceptionally low level for an extended period depended on the outlook for resource utilization, inflation, and inflation expectations following the anticipated trajectories.

Second, as I previously pointed out, firmly anchored inflation expectations are essential to successful monetary policy at any time. Thats why central banks have not followed the standard academic recommendation to set a higher inflation targeteither temporarily or, as has been recently suggested, over the longer runto reduce the likelihood of hitting the zero lower bound. Although I agree that hitting the zero bound presents challenges to monetary policy, I do not believe central banks should raise their inflation targets. Central banks around the world have been working for 30 years to get inflation down to levels where it can largely be ignored by businesses and households when making decisions about the future. Moreover, inflation expectations are well anchored at those low levels.

Increasing our inflation targets could result in more-variable inflation and worse economic outcomes over time. Inflation expectations would necessarily have to become unanchored as inflation moved up. I doubt households and businesses would immediately raise their expectations to the new targets and that expectations would then be well anchored at the new higher levels. Instead, I fear there could be a long learning process, just as when inflation trended down over recent decades. Moreover, a higher inflation target might also mean that inflation would be higher than can be ignored, and businesses and households may take inflation more into account when writing contracts and making investments, increasing the odds that otherwise transitory inflation would become more persistent.

For both these reasons, raising the longer-term objective for inflation could make expectations more sensitive to recent realized inflation, to central bank actions, and to other economic conditions. That greater sensitivity would reduce the ability of central banks to buffer the economy from bad shocks. It could also lead to more-volatile inflation over the longer run and therefore higher inflation risk premiums in nominal interest rates. It is notable that while the theoretical economic arguments for raising inflation targets are well understood, no major central bank has raised its target in response to the recent financial crisis.

Third, it appears that large-scale asset purchases at the zero bound do help to ease financial conditions. Our best judgment is that longer-term yields were reduced as a result of our asset purchases. The lower rates on mortgages helped households that could refinance and supported demand to help stabilize the housing market. Moreover, low rates on corporate bonds contributed to a wave of longer-term business financing that has strengthened the financial condition of firms that could access securities markets and contributed to the turnaround in business investment.

Fourth, central banks also need to be mindful of the potential effects on inflation expectations of the expansion of their balance sheet. Most policymakers do not tend to put too much stock in the very simple theories relating excess reserves to money and inflation that I mentioned earlier. But we are aware that the size of our balance sheet is a potential source of policy stimulus, and we need to be alert to the risk that households, businesses, and investors could begin to expect higher inflation based partly on an expanded central bank balance sheet. As always, the Federal Reserve monitors inflation developments and inflation expectations very closely and any signs of a significant deterioration in the inflation outlook would be a matter of concern to the FOMC.

Fifth, central banks need to have the tools to reverse unusual actionsto drain reserves and raise interest rateswhen the time comes. Confidence in those tools should help allay any fears by the public that unusual actions will necessarily lead to inflation. And having or developing those tools is essential to allow aggressive action to ease financial conditions as the economy heads into recession. In the case of the Federal Reserve, our ability to pay interest on excess reserves, which we received only in September 2008, is a very important tool that made us more comfortable taking extraordinary steps when they were needed; it allows us to put upward pressure on short-term interest rates even with very elevated levels of reserves. In addition, we are developing new tools, including reverse repurchase agreements and term deposits that will allow us to drain significant quantities of reserves when necessary.

Finally, let me close with some comments on a lesson learned that some observers have emphasizedthat long periods of low interest rates inevitably lead to financial imbalances, and that the Federal Reserve should adjust its policy setting to avoid the buildup of such imbalances. As I have indicated at other times, I dont think we know enough at this point to answer with any confidence the question of whether monetary policy should include financial stability along with price stability and high employment in its objectives. Given the bluntness of monetary policy as a tool for addressing developments that could lead to financial instability, given the side effects of using policy for this purpose (including the likely increase in variability of inflation and economic activity over the medium term), and given the need for timely policy action to realize greater benefits than costs in leaning against potential speculative excesses, my preference at this time is to use prudential regulation and supervision to strengthen the financial system and lean against developing financial imbalances. I dont minimize the difficulties of executing effective macroprudential supervision, nor do I rule out using interest rate policy in circumstances in which dangerous imbalances are building and prudential steps seem to be delayed or ineffective; but I do think regulation can be better targeted to the developing problem and the balance of costs and benefits from using these types of instruments are far more likely to be favorable than from using monetary policy to achieve financial stability.

Conclusion

The most severe financial crisis since the Great Depression has caused suffering around the world. It also has been a difficult learning experience for central bankers. Monetary policymakers must ask whether the strategies and tools at their disposal need to be adapted to fulfill their responsibilities for price and economic stability in modern financial markets. As with the most interesting questions, the answers arent at all clear. But we should use our experience to foster a constructive discussion of these critical questions, because addressing these issues will enable central banks to more effectively promote financial stability and reduce the odds of future crises.

1. The views expressed are my own and not necessarily those of my colleagues on the Federal Open Market Committee. James Clouse and Fabio Natalucci of the Boards staff contributed to these remarks.

2. Primary dealers are broker-dealers that trade in U.S. government securities with the Federal Reserve Bank of New York.

3. Walter Bagehot ([1873] 1897), Lombard Street: A Description of the Money Market (New York: Charles Scribners Sons).

5. A clear-cut assessment of the effects of the introduction of the extended period language, however, is complicated by the fact that the FOMC also decided at the March 2009 meeting to increase the size of the Federal Reserve balance sheet further by purchasing up to an additional $750 billion of agency MBS, bringing its total purchases of these securities to up to $1.25 trillion, and to increase its purchases of agency debt by up to $100 billion to a total of up to $200 billion.

6. Treasury yields also declined notably on December 1, 2008, following a speech by the Chairman noting that the Federal Reserve could purchase longer-term Treasury securities in substantial quantities. See Ben S. Bernanke (2008), Federal Reserve Policies in the Financial Crisis , speech delivered at the Greater Austin Chamber of Commerce, Austin, Tex. December 1.

Please use the comments to demonstrate your own ignorance, unfamiliarity with empirical data and lack of respect for scientific knowledge. Be sure to create straw men and argue against things I have neither said nor implied. If you could repeat previously discredited memes or steer the conversation into irrelevant, off topic discussions, it would be appreciated. Lastly, kindly forgo all civility in your discourse. you are, after all, anonymous.