Federal Banking and Financial Regulations

Post on: 16 Март, 2015 No Comment

How Bank Deregulation Caused the 2008 Financial Crisis

Federal financial regulations protect investors from financial risk and fraud. Since the 1980s, however, the trend has been deregulation to unfetter U.S. banks to compete globally. Foreign countries blame these lax U.S. banking regulations for the global financial crisis. In November 2008 the G-20 called on Washington to increase regulation of hedge funds and other financial firms. (See U.S. Resists G-20 Summit Call )

Dodd-Frank

to be under the Federal Reserve. It gives regulators the authority to split up large banks so they don’t become too big to fail . It eliminates loopholes for hedge funds, derivatives and mortgage brokers. Known as the Volcker Rule , it bans Wall Street banks from owning hedge funds. It gives states the right to regulate banks, overriding Federal regulations if needed to protect the public. It also suggests an independent agency that has the authority to review systematic risks that would affect the entire financial industry. It reduces executive pay by allowing shareholders a non-binding vote. For more, see Dodd-Frank Wall Street Reform Act.

Financial Regulations Proposed in 2009

The Consumer Financial Protection Agency was originally proposed in 2009. Banks lobbied against it, but may be mollified if it is under the Fed. The other proposals from 2009 are still in limbo:

- Bank regulations would be consolidated under a new National Bank Supervisor.

- Banks would have to increase their capital cushion.

- Issuers of products sold on the secondary market would have to keep at least 5% of the value of their products sold. They would have new reporting requirements, as well.

- Credit rating agencies, such as Standard & Poor’s and Moody’s, would face regulations designed to reduce conflict of interest. (Source: Reuters, Financial Initiatives. June 17, 2009)

Obama Pledged to Increase Financial Regulations

Obama promised tougher regulations on insider trading in his economic campaign platform. He wanted to streamline regulatory agencies, especially those that oversee banks that borrow from the government, establish a financial market advisory group, improve transparency for financial disclosure, and crack down on trading activities that could manipulate markets. These are also in limbo.

Once elected, Obama put together an economic team that is in favor of more federal regulations. Obama appointed Former Federal Reserve Chairman Paul Volcker to head his Economic Recovery Advisory Panel. Volcker blamed the economic crisis on poor regulation of the financial sector, and is a well-known advocate of tougher restrictions.

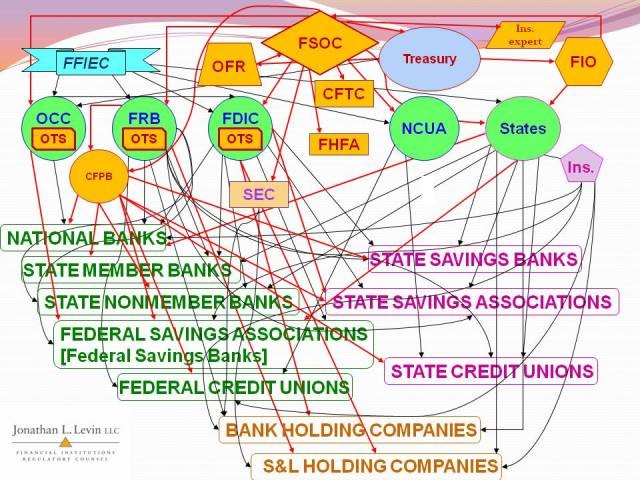

The Securities and Exchange Commission (SEC ) is at the center of Federal financial regulations. President Obama signaled his intent to increase regulation by appointing Mary Schapiro as the chair. One of the first things she did was to increase the regulations on the SEC itself.

The Federal Reserve took more control of companies, like AIG. that were too big to fail. The FDIC is in charge of winding down commercial banks before they go bankrupt. However, these existing agencies don’t cover hedge funds and mortgage brokers.

Will Regulations Prevent Another Crisis?

If all the measures suggested were enacted, they would prevent failures like AIG and Lehman Brothers from catching the economy, and the government, off-guard. They would offer some protection for consumers from unethical mortgage and credit card offers. However, regulations cannot prevent the kind of innovation that created products like credit default swaps. These products arise in unforeseen areas if a profit can be made. Innovation in the search for profit cannot be stopped. It is up to every individual to be informed and alert when making financial decisions. (The Economist, Financial Reform. June 17, 2009)

Sarbanes-Oxley

In 2002, financial regulation was increased with the Sarbanes-Oxley Act. It was a regulatory reaction to the corporate scandals at Enron, WorldCom and Arthur Anderson. Sarbanes-Oxley also required top executives to personally certify corporate accounts. If fraud was uncovered, these executives could face criminal penalties. At the time, many were afraid this regulation would deter qualified executives from seeking top positions.

Glass-Steagall Repeal

In 1999, the Glass-Steagall Act was repealed. This allowed commercial banks to invest in derivatives and hedge funds. It also allowed investment banks to take deposits. It signaled a shift towards allowing the market to regulate itself. This led to firms like Citigroup to invest in credit default swaps, and require billions in bailout funds in 2008. June 22, 2009