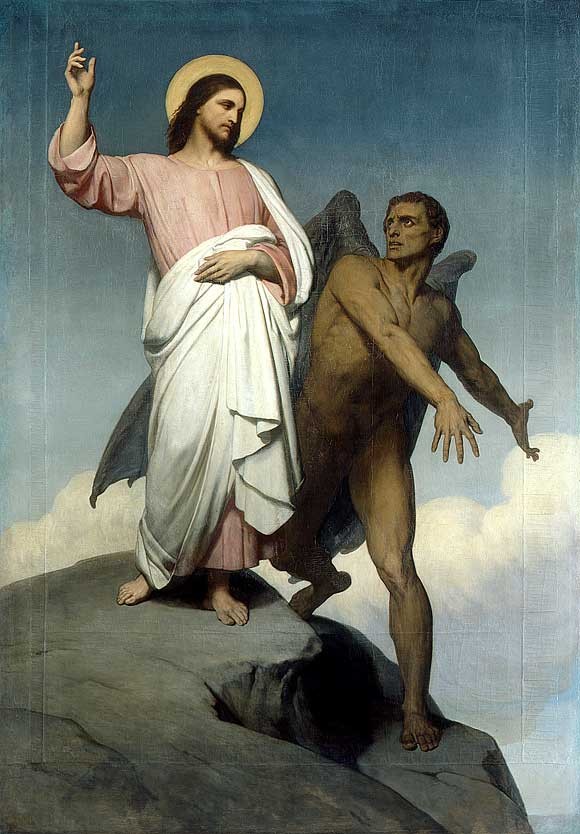

Fall 2008 The temptation of market timing

Post on: 25 Июль, 2015 No Comment

The desire to stay the course and focus on the long term has challenged investors over the past few months. Some investors have ignored their financial goals and moved funds out of equity markets and into perceived safer havens, such as money market funds to wait out the stormy market conditions — a practice known as “market-timing.” Increasing evidence suggests this harms portfolio performance.

Canadian investors unnerved by the recent market turmoil moved a record $18 billion into money market mutual funds. i A major Canadian financial institution estimates that Canadians have “parked” $45 billion to wait out the uncertainty. This strategy has several weaknesses, the greatest being the potential to accurately target a rebounding market. Clear demarcations are not readily apparent between the end of a market downturn and the start of a market recovery.

Bad investor behavior

Research by behavioral scientists has identified several investor responses that potentially impact their investment portfolios. These include investor “overconfidence” in predicting market events such as market upturns and downturns and “overreaction” in responding to a recent market event. Investors exhibiting overconfidence will take risks without gaining the corresponding reward; investors exhibiting overreaction are best illustrated as buying high and selling low. Ultimately, each response shifts investors away from their financial goals and diminishes the portfolio performance over time.

Volatility’s silver lining

Fund managers approach volatility, which is inherent in all markets, as an opportunity for purchasing equities at great prices. Their approach is devoid of the emotion uncovered by behavioural scientists. Relying on well-honed methodologies for building great investment portfolios, they are able to purchase investments at exceptional prices recognizing that when markets rebound their portfolios will benefit. Their process is continuous, the opposite of market timing, and ultimately rewards investors following this long-term strategy. Maintaining a personal commitment to financial goals and a long-term focus for investment portfolios can be challenging, but is the most reliable way to achieve wealth goals. To talk to a professional advisor call 1 800 229-1798, or visit the MD Financial website.

i Investor Economics, Insight Monthly Update. May 2008, page 15.

MD Financial includes CMA Holdings Incorporated companies offering financial planning and a banking referral service through MD Management Limited, mutual funds by MD Funds Management Inc. and MD Private Trust Company, investment counselling services by MD Private Investment Management Inc. estate and trust services by MD Private Trust Company and insurance products by MD Life Insurance Company and MD Insurance Agency Limited.