Expect More ETFs In 401(k)s

Post on: 25 Май, 2015 No Comment

Expect More ETFs In 401(k)s

June 20, 2014 FA Staff

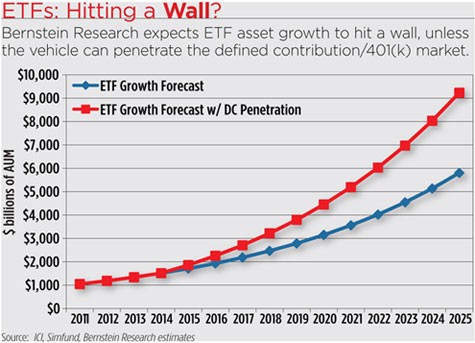

The exchange-traded fund revolution has yet to impact the 401(k) retirement plan space. According to Cerulli Associates, ETFs comprise less than 1 percent of the assets inside 401(k) plans versus roughly 54 percent of assets invested in mutual funds.

But that could change in the near future.

Were very confident that this gap will close because ETFs can offer plan sponsors and participants some unique advantages and benefits that mutual funds cant, Dave Gray, head of Schwab Retirement Plan Services client experience team, said Friday during a media call to discuss Schwabs efforts to bring ETFs into the 401(k) plan market.

Those advantages, Gray noted, include ETFs low operating expenses and their ability to let plan sponsors and participants access asset classes they might not otherwise via index mutual funds, such as a broader array of products in fixed income or commodities.

In February, Schwab launched an ETF-version of Schwab Index Advantage. a 401(k) retirement program employing index-based mutual funds it launched in 2012. The new version includes about 80 index-based ETFs in 26 asset categories from nearly a dozen firms, including Charles Schwab Investment Management

Its not an us versus them situation, said Gray, referring to mutual funds versus ETFs. Its really a matter of ETFs being the next evolution of 401(k) investing.

He added that plan sponsors are aware of the impact of investment expense on their participants and are looking for greater cost efficiencies. ETFs are a great solution for plan sponsors, Gray said. I think the missing piece has been access to ETFs in a core fund lineup. Were providing that access now.

Gray offered some reasons for the slow adoption of ETFs by retirement plan sponsors. First, the record-keeping systems at most major providers are built around end-of-day mutual fund trading technology, and they arent itching to change that business model to accommodate ETFs that trade on an intraday basis.

We built a patent pending process that integrates the 401(k) record keeping system, our bank, trust and custody services, and our broker-dealer so that intraday trading and valuation could be enabled within the 401(k) space, Gray said.

Another hurdle to overcome dealt with partial shares. Gray said mutual funds are built to handle dollar-based investments while ETFs trade only in whole shares, so Schwab had to make sure a 401(k) investor still got credit for a partial share when he or she made their contribution to ensure their money is invested at all times.

Regarding ETFs in 401(k)s, we recognize its a new concept for most employers and for the consultants who serve those employers, Gray said. Were happy to report that the market has been receptive to the this exchange-traded fund approach.

Gray said Schwabs target market in the retirement plan space is company plans with assets of $20 million to multiple billions of dollars. He noted that more than 90 clients have transitioned or are in the process of transitioning to either the index mutual fund or index ETF version of Schwab Index Advantage.

Were excited by the level of receptivity were receiving, Gray said.