Exchange Traded Portfolios

Post on: 16 Март, 2015 No Comment

Bold, beautiful, cheap, and sassy, exchange-traded funds make traditional mutual funds look as exciting as granny in her flowered print dress. Here’s why ETFs are the latest it equity.

By Motley Fool Staff | More Articles

September 14, 2009 | Comments (4)

Wouldn’t it be something to travel back in time and take a look at the seminal moments in investing history? Cave-men exchanging shiny rocks and pointed sticks for dinosaur steaks. traders swapping stocks under a Wall Street Buttonwood tree. John Bogle outlining his Master’s thesis on index investing and later turning the moldy old mutual-fund world on its head.

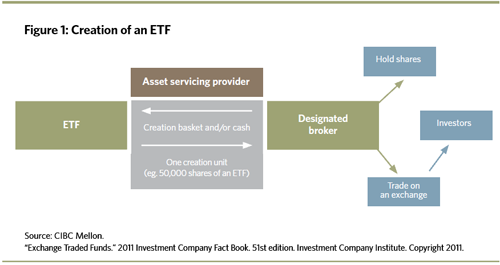

We’re a bit late to witness the birth of this century’s latest it equity — the Exchange Traded Fund (ETF) — but we’re in a good position to observe its meteoric rise. An ETF is similar to a mutual fund in that each share gives the holder a tiny piece of dozens, hundreds, or even thousands of companies that are held by the fund. Their cute-ish names — like VIPERs, Spiders, Diamonds, and iShares — belie the wallop that ETFs are giving investors and investment firms.

Why the breathless excitement? One reason is that they are simple vehicles for trading. Unlike mutual funds, ETFs trade all day long on the exchanges, just like stocks. While it’s not a strategy we Fools condone, many people enjoy putting frequent bets on particular industries, sectors, or geographical regions, and ETFs make it easy to do so. (We get into other ETF investing strategies a bit later .)

There’s certainly no shortage of investors looking to get a piece of the ETF action. These days, traders swap more than 95 million shares per day of The Nasdaq 100 Trust ( AMEX: QQQQ ). That’s way more attention than most issues get, even the most popular kids in school like Microsoft and Intel.

Another reason for their rise in popularity is that the flavor possibilities are endless. In the mid 1990s, there were barely two dozen ETFs traded on the Nasdaq. Now there are more than 300, controlling a quarter of a trillion dollars in assets

There can be ETFs to track any imaginable group of equities. Theoretically, if you were a money manager who owned millions of shares of stocks with a similar theme, you could start your own index ETF. How about tracking that new — and so far, fictitious — adolescent retailers’ index? You could call your fund Teenagers, Bane of Parents’ Pocketbooks (Ticker: TBOPP). (See what we mean about the cute-ish names?)

Itching for an ETF?

Can we interest you in a few shares of TBOPP? If you’ve perused the also-fictitious Trendy Teen Mutual Fund, you can begin to understand why investors are attracted to these fund siblings. ETFs share many of the same attractive qualities of mutual funds:

Broad exposure: Wider index ETFs make it easy to buy the whole market, the biggest companies, the smallest, or any particular sector. If you don’t feel like picking your own stocks, you can put your retirement money in an index that tracks the S&P 500, one of the most Foolish ways to save.

Easy diversity: ETFs also provide a simple method for you to fill in the blanks of your portfolio. As of this moment, there are more than 300 ETFs out there, with plans for at least another 40 to come soon. (Oops. spoke too soon. They just added another two as that last sentence was being typed out.) The majority of popular ETFs mirror the makeup of already-established indexes like the S&P 500 ( AMEX: SPY ). the Nasdaq 100 ( AMEX: QQQQ ). or ye olde Dow Jones Industrial Average ( AMEX: DIA ). Feel the need to own a piece of the tech industry? A Nasdaq-tracking ETF can get you what you need. Need to counterbalance your craving for fly-by-night biotechs? Get a piece of the Dow.

More specialized ETFs are coming along all the time, based on narrower indexes. If you hold mostly large-cap stocks, a small-cap ETF can get you a piece of the little guys. Big believer in the power of pasta, prosciutto, and pirelli? Then the iShares MSCI Italy Index ( AMEX: EWI ) might be for you. Convinced that raw industrial materials are the next big thing? Check out the iShares Dow Jones US Basic Materials Index ( AMEX: IYM ). If you love gold, there’s an Au ETF coming down the pike. Bonds, real estate investment trusts (REITs) — yup, there are ETFs for all these.

Keep in mind that while some ETFs contain shares of every stock in the underlying composite index, others include only a representative sample and may even invest 5% in other equities. (We explore other LINK P3[potential ETF pitfalls here].) But ETFs must make annual and semi-annual reports telling you about the fund’s holdings. And many individual funds report even more often, given you advance notice about upcoming changes. (Try getting that from a regular mutual fund!) In addition, all ETFs must provide investors with either a complete prospectus or a product description, which summarizes the prospectus and tells you how to obtain the real thing.

Cheap investments here!

One of the most attractive elements of ETFs is their cost structure. Because ETFs are based on indexes, there’s no need for a staff of two dozen Porsche-driving Harvard MBAs, so a minimum of your hard-earned money is consumed managing the indexes. Computers do most of the heavy lifting, and all they want is a little 110V and the occasional reboot.

That enables ETFs that track the major indexes to charge less than 0.20%. For instance, the Standard & Poor’s Depository Receipts S&P 500 tracking ETF has an expense ratio of 0.12%. The Dryden S&P 500 Mutual Fund offered in our Fool retirement plan charges 0.30%.

Does a point something percent difference seem like a hill of beans? Assuming a Fool employee can scrape together $500 per month, and both funds track the S&P 500 at 11% over 30 years, the difference between the mutual fund investment and the ETF one amounts to more than $52,000. If you could choose what to do with an extra 52 large, we’ll assume that you probably wouldn’t donate it to a mutual fund company.

For ETFs that track less popular stock groups, the expense ratio may creep closer to 1%, but that’s still much less than your average mutual fund. Some ETFs may also charge other fees, so, as with all investments, shop around and read carefully.

Investors shouldn’t be blinded by love based on low expense ratios. There’s still a price to pay — mainly brokerage fees. The most noticeable cost to the individual investor is the brokerage fee. ETF investors pay the same price to their broker as they would to buy or sell any stock. (Our Discount Broker Center can give you an idea of trading-related costs.)

Though both can be beautiful, there are other important differences between ETFs and index mutual funds. Take a closer look at the contestants, judge their talents, ask tough questions — there is, alas, no swimsuit competition — to see which one wins the tiara. Judges, get ready for round two: Mutual Funds v. ETFs