Exchange Traded Funds (ETFs)

Post on: 4 Май, 2015 No Comment

Exchange Traded Funds

Exchange Traded Funds (ETFs) are quite the rage in the investment industry right now. Its hard to visit a page on an investment-related website without seeing an article promoting 5 Hot ETFs or 3 ETFs Ready to Soar. But perhaps we should take a step back and answer two questions about ETFs:

- What are they?

- Why is it worthwhile for you to know about them?

ETFs: The Basics

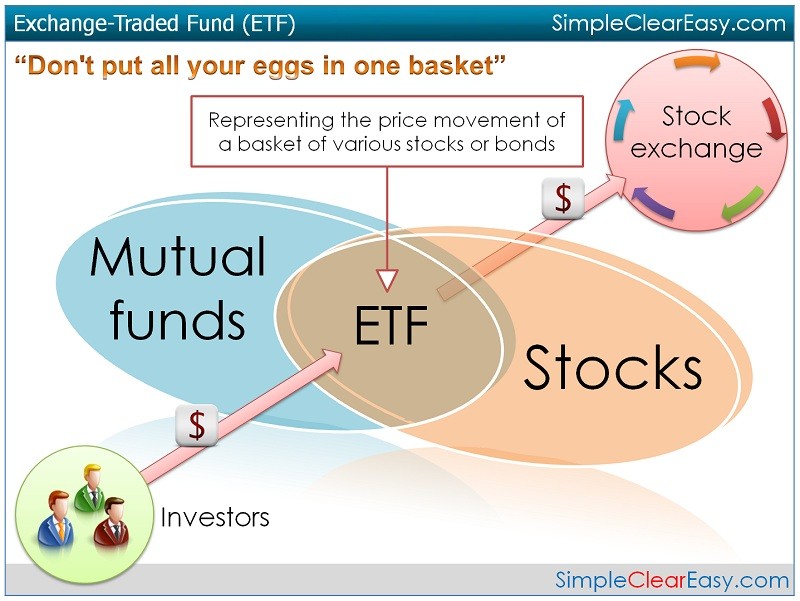

Exchange Traded Funds can be described as index funds that trade like individual stocks. (That said, some newer ETFs work more like actively managed mutual funds than index funds.) Like index funds, ETFs can be an excellent tool for constructing a low-maintenance, low-cost, diversified portfolio.

Diversification: Broad diversification has never been easier than it is with ETFs. For example, a simple 3-ETF portfolio (VTI, VEU, and ITE) would instantly spread your investment across:

- More than 3,000 U.S. stocks,

- More than 2,000 stocks from over 40 other countries, and

- A collection of U.S. Treasury bonds to help reduce overall volatility.

Low Costs: Most ETFs have very low expense ratios. As a result, they tend to outperform the majority of comparable actively managed mutual funds. (For example, a low-cost ETF that tracks a U.S. stock index is likely to outperform the majority of domestic stock mutual funds.)

Low-maintenance: When investing via actively managed mutual funds, you have to check up on your funds regularly to make sure the managers are still there and that their strategies are still working. When investing in individual stocks, you have to keep up-to-date on those companies to make sure theyre still worth owning. With ETFs, all you need to do is spend a few minutes each year (or each quarter) rebalancing your portfolio to make sure your asset allocation never gets too far out of whack.

ETFs vs. Index Funds

The fact that ETFs trade like individual stocks has several consequences, but the most significant for typical investors are that:

- You can get access to ETFs from any brokerage account, and

- You can buy ETFs in small increments.

To invest in index funds, you often need an account with the fund company in question. For example, to get access to Vanguards index funds, youd need an account with Vanguard. Vanguard ETFs, however, can be purchased through an account at any brokerage firm.

Another helpful feature of ETFs is that they can be used to get around the minimum investment requirements that many index funds have. For example, Vanguards Total Stock Market Index Fund requires a minimum investment of $3,000. In contrast, the ETF version of that same Vanguard fund can be purchased with an investment of under $60.

Be Sure to Do Your Homework

Of course, not every ETF is low-cost. Nor are all ETFs diversified investments. Before investing in an ETF, be sure to check that its expense ratio is reasonable (less than 0.50% in most cases) and that its portfolio fits well into your desired asset allocation.

About the Author. Mike Piper is the author of Investing Made Simple. He also blogs at The Oblivious Investor, where he explains topics like Roth IRA withdrawal rules .

Betterment is one of my two favorite ways to earn interest on my savings! They have an awesome program for the Average Joe to save and invest simply and effectively. There are no minimum balance requirements and no transaction fees. Read my Betterment Review or open an account to get started earning now.